Inventory Items, Job Costing Considerations, and Warehouse Locations

| □ | Inventory Tracking and Job Costing System Users: |

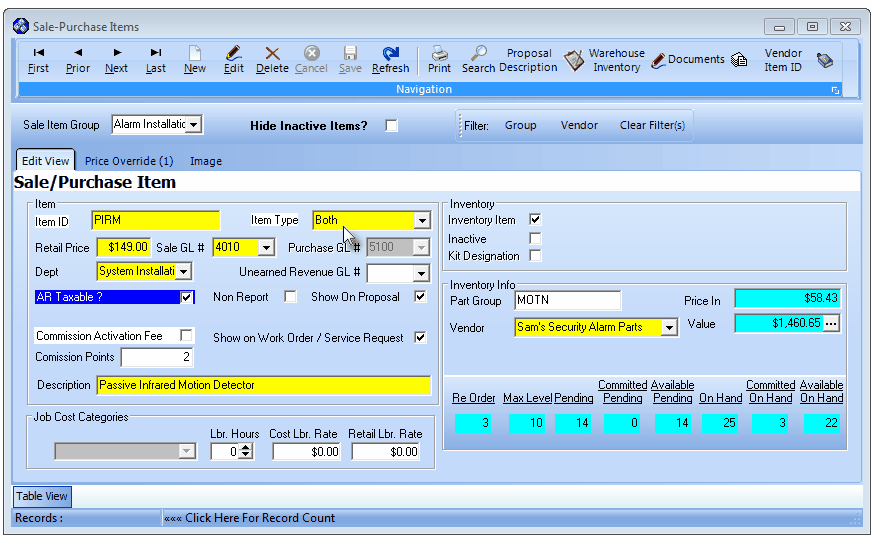

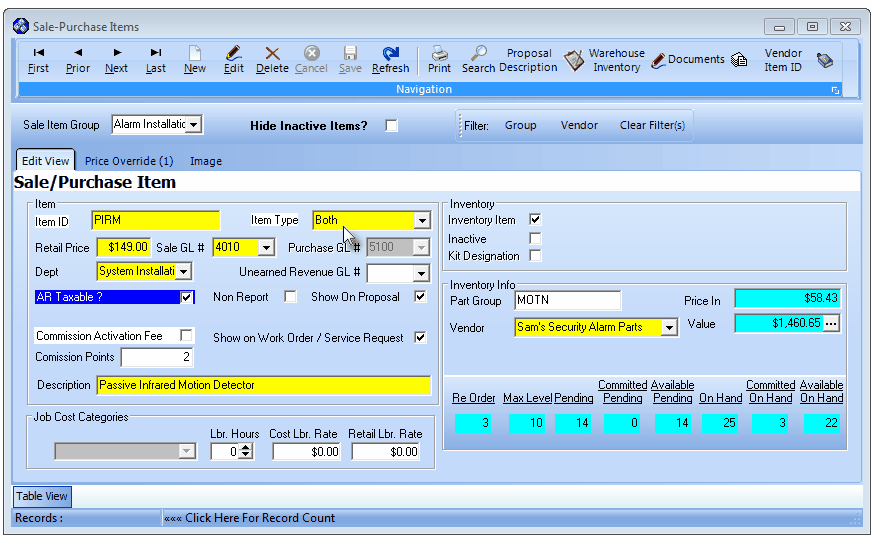

| • | To define an Inventory Item, from the Main Menu Select the Maintenance Menu and Choose Sales-Purchase Items. |

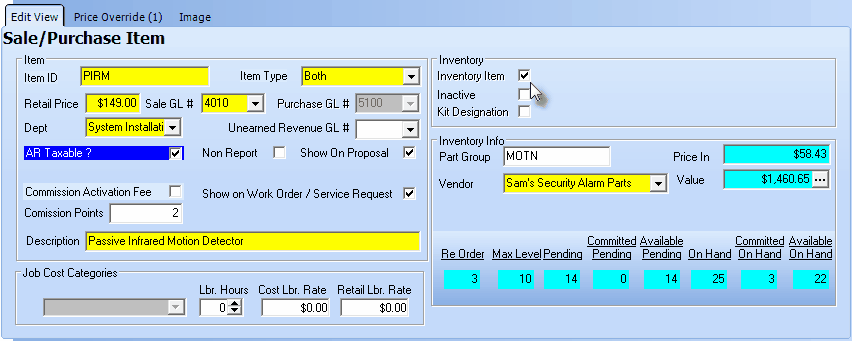

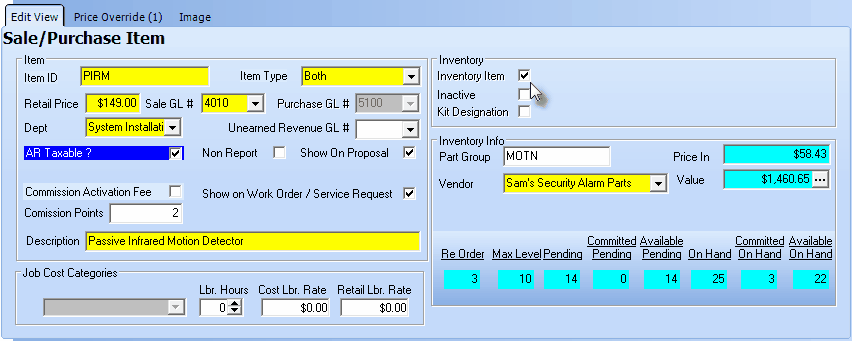

Sale-Purchase Items Form - Inventory entry

| • | This Sale-Purchase Items Form may be Re-sized by Dragging the Top and/or Bottom up or down, and/or the Right side in or out. |

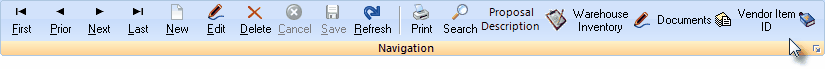

| • | This Navigation Menu provides the normal Record Movement, New, Edit, Delete, Cancel, Save, and Refresh options; as well as Print, Search, Proposal Description, Warehouse Inventory, Documents and Vendor Item ID functions. |

| • | Completing the Basic Inventory Item information - Click the  Icon on the Navigation Menu to start the Inventory (Sale-Purchase) Item entry. Icon on the Navigation Menu to start the Inventory (Sale-Purchase) Item entry. |

| • | Sale Item Group - Optionally, you may enter a Sale Item Group using the Drop-Down Selection List provided. |

| ▪ | If you have a large quantity of Sale-Purchase Items, this Sale Item Grouping feature allows you to Select the desired Sale-Purchase Item from a filtered list (based on the Sale Item Group assigned to it). |

| ▪ | The Advanced Sale Item Lookup function (accessed with Alt+F2 from within the Sale-Purchase Item Drop-Down Selection List on Sales, Proposal, Purchase Order and Purchases forms) lets you Select from a list of items limited to a specific group - thereby presenting a much shorter list from which to choose. |

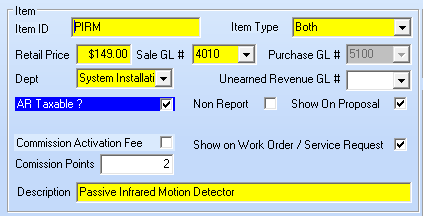

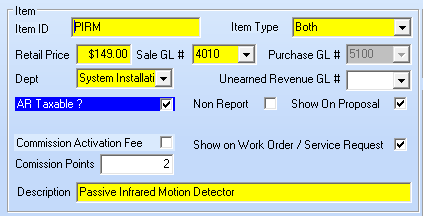

Sale Purchase Item Form - Item data box

| • | Item ID - Enter a unique code of up to 40 alpha-numeric characters (most punctuation marks are also permitted) for this Inventory Item. |

| ▪ | All letters will be capitalized automatically. |

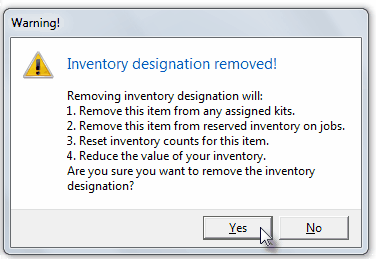

| ▪ | Once an Inventory record is saved, if a User changes the Item Type field of an Inventory related Sale-Purchase Item to Sale rather than Both, the record cannot be saved without Un-Checking the Inventory Item box on the Sale-Purchase Item Form, |

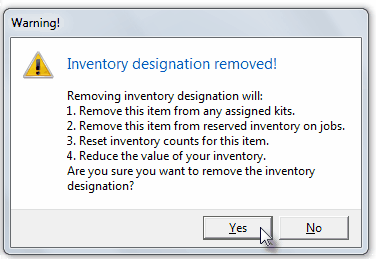

| ▪ | This action (Un-Checking the Inventory Item box) also requires confirmation because the Sale-Purchase Item will no longer be considered (or tracked as) an Inventory Item. |

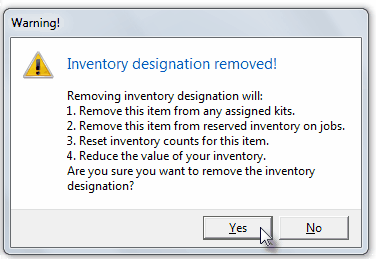

Inventory designation removed!

| • | Item Type - Enter the Item Type as Both (you must Purchase the Inventory Item before you Sell the Inventory Item). |

This Default Inventory Code is assigned within the Inventory Options tab of the User Options Form.

| • | Retail Price - Enter the usual Retail Price for this Inventory Item (if this is an Inventory Item that will be part of the Company's Inventory and the Inventory Tracking & Job Costing System is being used, the Retail Price is mandatory. |

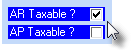

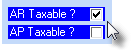

| • | AR Taxable? - Check this box if this Sale-Purchase Item is normally Taxable when making a Sale. |

| ▪ | When entering a Sales Invoice: |

| a) | If AR Taxable? is Checked, whenever this Sale-Purchase Item is entered on a Sales Invoice, the appropriate Tax Code & Tax Percentage Rate will be inserted automatically, based on the Sales Tax information entered in the Accounting Info Tab for that Subscriber. |

| b) | If Not Checked, whenever this Sale-Purchase Item is entered on a Sales Invoice, the Tax Code will be entered as N (Non) and the Tax Percentage Rate set set at 0%, regardless of the Sales Tax information entered in the Accounting Info Tab for that Subscriber. |

| • | AP Taxable? - Under Development - If present, Check this box if this Sale-Purchase Item is normally Taxable when making a Purchase. |

| ▪ | When entering a Bill (Purchase Invoice) Under Development: |

| a) | If AP Taxable? is Checked, whenever this Sale-Purchase Item is entered for a Bill (Purchase Invoice), the appropriate Tax Code will be inserted, and the Tax Percentage Rate will be used to calculate the Sales Tax Amount based on the Sales Tax information entered in the Vendor Tax Information tab for that Vendor. |

| b) | If Not Checked, whenever this Sale-Purchase Item is entered for a Bill (Purchase Invoice), the Tax Code will be entered as No and the Tax Amount set at 0%, regardless of the Sales Tax information entered in the Vendor Tax Information tab for that Vendor. |

| • | Commission Points - Enter a Point Value (representing its approximate cost) if this Sale-Purchase Item earns Commissions Points for the Salesperson when it is sold. |

| ▪ | The Commission Points assigned to a Sale-Purchase Item should represent an approximate Cost for the acquisition and installation of the component. |

| ▪ | Commission Points are assigned a Point Value - on an Employee by Employee basis - in the Personal tab of the Employee Form. |

| • | Other Check boxes - There are several other Check Boxes that may, or may not be needed based on the specific Purpose of this Inventory Item: |

| ▪ | Non Report - Check Non Report if this Inventory Item should not be included in certain Sales Analysis Reports. |

| ▪ | Show on Work Order / Service Request - Check the Show on Work Order / Service Request box if this Sale-Purchase Item has been assigned an Item Type of Sale or Both and might be needed when recording the use of Inventory and/or Materials on a Service Request. |

| o | By Not Checking this box, this Inventory Item will not be included in the Drop-Down Selection List lists that are provided to a Technician working in the field using the Web Tech Service or to any User recording information within the Inventory and/or Materials tab on a Service Request Form. |

| o | The result is that any Sale-Purchase Items that are defined to identify Purchases or Sales that are unrelated to providing Service to Subscribers will be eliminated from the list - making that Selection process easier and faster, thus reducing the Drop-Down Selection List list to a manageable size, and more importantly, with a definable content. |

| ▪ | Show on Proposal - Check the Show on Proposal box if this is coded as a Sale item (or Both) and it may be used on a Proposal (also see Proposal Description below). |

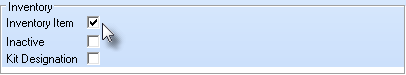

| ▪ | Inactive - Located within the Inventory section of the Sale-Purchase Item Form, this Check box identifies an Inventory Item as Inactive and therefore no longer in use. |

| o | The Inactive Check box is provided because, once entered and used, a Inventory Item cannot be deleted because it has become part of the Transaction "History" of the system. |

| o | Checking this box will remove this item from the Drop-Down Selection Listes normally used to Choose a specific Inventory Item for a Sale or Purchase. |

| • | Description - Enter a clear, concise description of this Inventory (Sale-Purchase) Item entry. |

| ▪ | Up to 70 alpha-numeric characters may be entered, upper and lower case letters are allowed, most punctuation marks, with spaces also permitted. |

| ▪ | For Sale-Purchase Items defined with an Item Type of either Both or Sale, a more detailed Description using the Proposal Description Icon on the Navigation Menu at the top of the Form may be defined. |

| • | Other Job Cost Categories - The Job Cost Category Drop-Down Selection List is unavailable (it's Gray) because this is an Inventory Item Expense. |

| ► | Note: If using the Commission Tracking System and charging an Activation Fee (defined as part of a Proposal Package), the individual Inventory Items - which will be included in a Proposal Package - should have Commission Points assigned but should not have Labor related information defined (because Labor is included in the Activation Fee). |

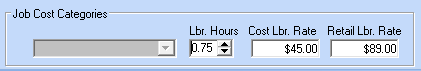

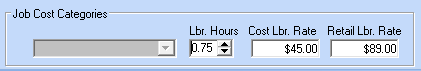

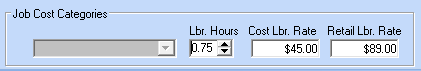

Job Cost Categories section for Inventory Items

| ▪ | Labor Hours - ("Lbr. Hours") - Define the number of Hours this Inventory (Sale-Purchase) Item takes to install. |

| ▪ | Cost Labor Rate - ("Cost Lbr. Rate") - Define the internal Cost for each hour this Inventory (Sale-Purchase) Item takes to install. |

| ▪ | Retail Labor Rate - ("Retail Lbr. Rate") - Define the average Retail Charge for each Labor Hour required. |

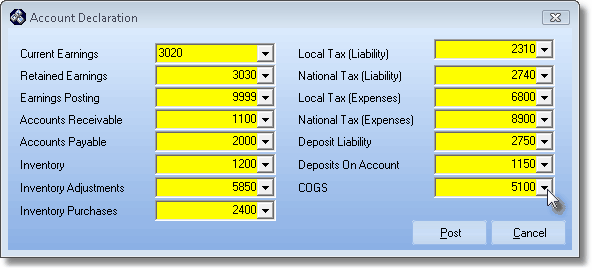

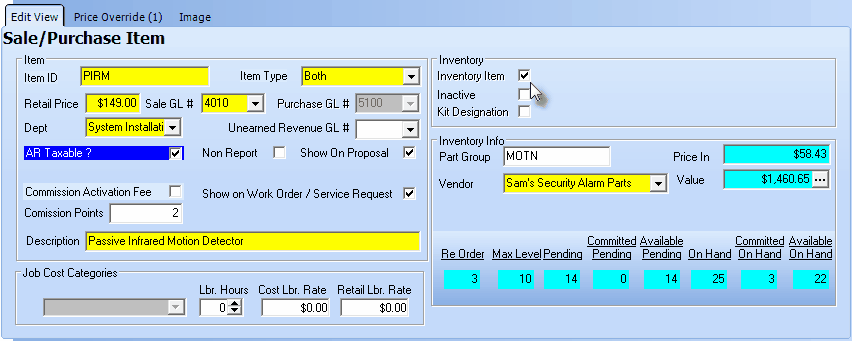

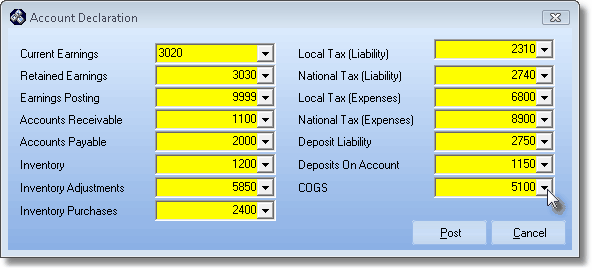

Inventory Item on the Sale-Purchase Items Form with Active General Ledger

Mandatory Account Declaration entries

| o | Once this record is saved, the Purchase GL # will be locked and shown in Gray. |

| o | This is because changing it later would cause an incorrect Inventory Valuation in the General Ledger. |

| ▪ | Dept - If you are a General Ledger System User and have initiated the use of multiple Departments, enter the appropriate Department number using the Drop-Down Selection List provided. |

| • | Completing the Inventory information: |

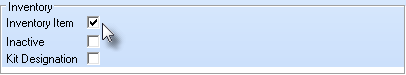

| • | Inventory Item - Check the Inventory Item box. |

| ▪ | When you Check Inventory Item, the Form will require additional information needed to properly track Parts as actual Inventory. |

| ▪ | If an Inventory Item is entered, and saved, and subsequently a User attempts to Remove this Check mark, a Warning will be displayed. |

| ▪ | This action (Un-Checking the Inventory Item box) requires confirmation because the Sale-Purchase Item will no longer be considered (or tracked as) an Inventory Item with those ramifications itemized in the Warning dialog. |

Inventory designation removed!

| ▪ | Answer appropriately using special care. |

| • | Never Check the Inactive box unless this part is no long used. |

| ▪ | Do not Delete a Part item once it has been used in an Invoice (either for Sales or Purchases). |

| ▪ | If you will no longer order or sell the part, just mark it as Inactive. |

| • | Kit Designation - Check the Kit Designation box if this is a Part that actually consists of several individually ordered and sold parts that you have designed as an internal "Kit". |

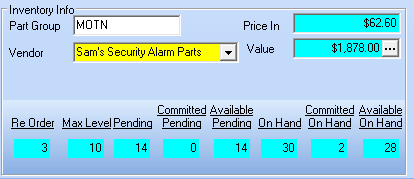

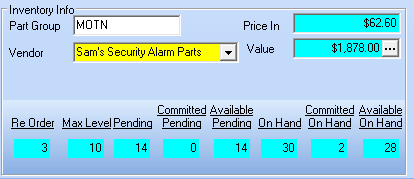

| • | Completing the Inventory Info information: |

Inventory Info section - Average Inventory Valuation Method

| • | Part Group - Enter a Part Group code. |

| ▪ | This is a user definable code that has no predefined data set. |

| ▪ | It is for your use as you see fit. |

| • | Price In -Enter the Price In which should be the Price you pay for this Part (see the Inventory Valuation Method chapter for an explanation of the available Inventory Pricing options). |

| ▪ | If Average Inventory Costing is selected as the Inventory Valuation Method, the system maintained Price In field is the Average Price Paid for this Inventory Item, and the system maintained total Value field is computed by multiplying that Price In Amount by the On Hand Quantity. |

| • | Vendor - Enter the preferred Vendor from whom this Part is generally purchased using the Drop-Down Selection List provided. |

| ▪ | Right-Click the Vendor field to open the Search By dialog to Set the List Order of the Vendor choices (by Vendor ID or Vendor Name). |

| • | Sale Item Group - Optionally, you may also enter a Sale Item Group using the Drop-Down Selection List provided. |

| ▪ | The Advanced Sale Item Lookup function (accessed with Alt+F2 from with the Sale-Purchase Item Drop-Down Selection List on Sales, Proposal and Purchases Forms) lets you pick from items only in a specific group - thereby presenting a much shorter list. |

| • | The Inventory Quantities and Status information at the bottom of the Form is presented for information, but cannot be changed here. |

| ▪ | If the actual On Hand level is less than the established Re-Order level for this Inventory Item, an 'On Hand' Low message will be flashed. |

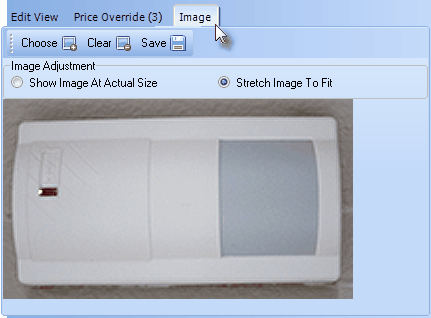

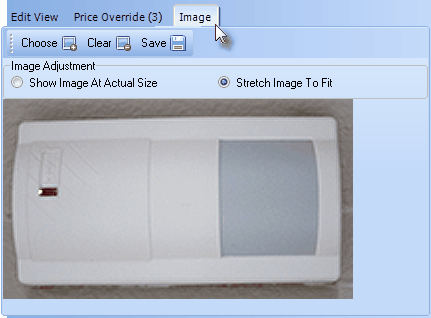

| • | Image - As shown in the illustration below, the Image tab is used to enter a picture of the Sale-Purchase Item, when appropriate. |

| ▪ | By using this Image tab to identify an Inventory Item or Kit, it provides the User access to an actual picture of that Part. |

Sale Purchase Items Image tab

| a. | Choose - Click the Choose button and, using the standard Windows® dialogue box provided, locate the desired file. |

| b. | Image Adjustment - Once the Sale-Purchase Item's BMP or JPG file is selected, Choose the Image Adjustment method that best displays your Sale-Purchase Item in the display box by alternately Clicking Show Image At Actual Size and Stretch Image To Fit. |

| • | Providing additional Information about this Inventory Item: |

| • | Click the Proposal Description on the Navigation Menu at the top of the Form to create a longer and more detailed description of this Sale-Purchase Item. |

| ▪ | The expanded description entered here will be printed in addition to the Description field information entered above, on all Proposals containing this Sale-Purchase Item. |

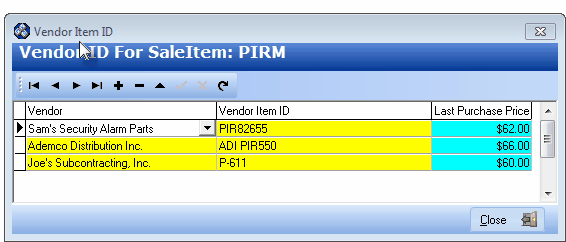

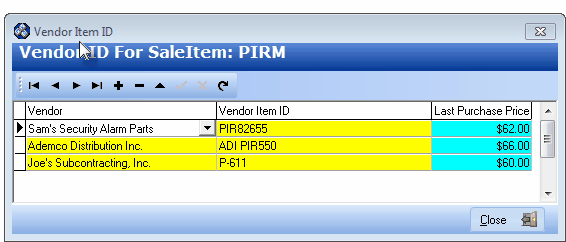

| ▪ | Click the Vendor Item ID on the Navigation Menu to open the Vendor Item ID Form. |

Vendor Item ID entry

| ▪ | This Vendor Item ID Form is used to identify the Part Numbers (Vendor Item IDs) that various Vendors, from whom this Inventory Item is Purchased, use internally to identify this Inventory Item (i.e., their Part Number). |

| ▪ | Click Add ("+") to start a new entry. |

| o | Vendor - Use the Drop-Down Selection List to Choose the appropriate Vendor. |

| o | Vendor Item ID - Enter the actual Part Number used by the selected Vendor. |

| o | Last Purchase Price - System maintained field. |

| ▪ | Save - Click the Save ("ü") to save this Vendor Item ID record. |

| □ | Other Job Costing and Service Department related considerations: |

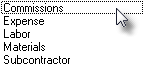

| • | These type of Non-Inventory Expenses are identified with a Job Cost Category |

| • | As you define your Sale-Purchase Items, if your Job Costing System is active, you will - as needed - enter the Job Cost Category for the item by using the Drop-Down Selection List provided. |

| • | The Job Cost Category field is not available when you are defining an actual Inventory Item or Kit. |

| • | The field is Gray - as in the example Inventory Item in the illustration below - because Inventory usage is tracked separately and automatically. |

Job Cost Categories section for Purchase Categories which are Inventory Items

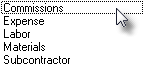

| • | The Non-Inventoried Job Cost Categories are: |

Job Cost Categories List

| • | Job Cost Category options and their purpose are: |

| o | This Commissions Job Cost Category will usually not have Labor component defined. |

| o | This Expenses Job Cost Category will usually not - but may - have a Labor component defined. |

| o | This Labor Job Cost Category will almost always have a Labor component defined |

| d) | Materials - Identifies this Purchase Category as charges for various Material used for a Job (such as wire, batteries, other electrical supplies, conduit, clamps, etc.). |

| o | This Materials Job Cost Category will usually not - but may - have a Labor component defined |

| e) | Subcontractor - Identifies charges of Subcontractor bills that will be charged against a Job (such as telephone line installations, pre-wiring, CCTV, independent alarm installer, etc.). |

| o | This Subcontractor Job Cost Category will usually not - but may - have a Labor component defined. |

| • | Where appropriate, enter Labor information: |

| o | Labor Hours - ("Lbr. Hours") - This field is used to define - when this is an Inventory Item - the average number of Labor hours that are required to install this Part. |

| o | Cost Labor Rate - ("Cost Lbr. Rate") - This field is used to define - when this is an Inventory Item - the average internal Cost for each hour required to install this Part. |

| o | Retail Labor Rate - ("Retail Lbr. Rate") - This field is used to define - when this is an Inventory Item - the average Retail Charge for each hour required to install this Part. |

| ► | Note: When this Inventory (Sale-Purchase) Item is included in a Proposal and subsequently converted to a Job, the Retail Labor Rate information is included in the Job Estimate tab. |

| o | Labor Hours - ("Lbr. Hours") - This field is used to define the average number of Labor hours that are required for completing the designated Job Cost. |

| o | Cost Labor Rate - ("Cost Lbr. Rate") - This field is used to define the average internal Cost for each hour required for the designated Job Cost. |

| o | Retail Labor Rate - ("Retail Lbr. Rate") - This field is used to define the average Retail Charge for each hour required for the designated Job Cost. |

| □ | Warehousing your Inventory: |

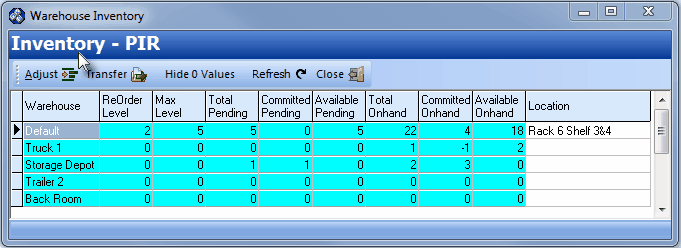

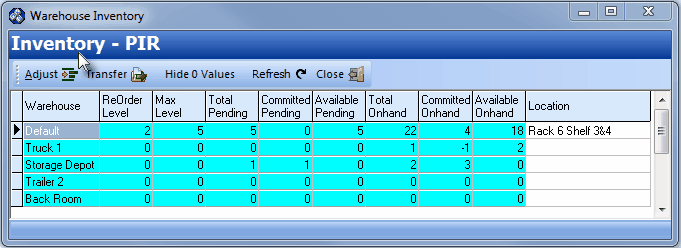

| • | Warehouse Inventory Form: |

| • | To see the current status of an Inventory Item by Warehouse, Click the Warehouse Inventory on the Navigation Menu of the Sale-Purchase Items Form. |

Warehouse Inventory Form

| • | Warehouse - The far left column lists the places defined as Warehouses. |

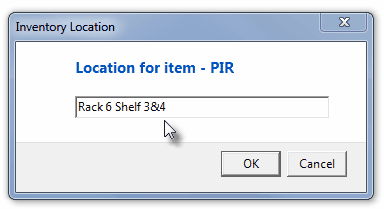

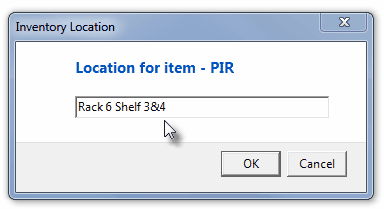

| • | Location - The far right column is used to enter the specific Location within this Warehouse |

| ▪ | Click the Ellipse button  (on the right of the Location field). (on the right of the Location field). |

| ▪ | Enter a specific Location where this Inventory item is stored within the selected Warehouse. |

| ▪ | Click OK to record this entry. |

| • | Status Line - row (between the Warehouse and the Location columns) displays a series of columns with the current status (counts) of this Inventory Item. |

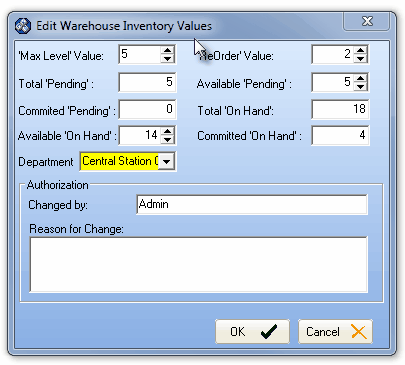

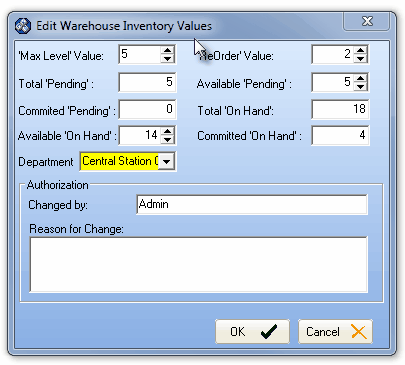

| • | Adjust - Edit Warehouse Inventory Values - Allows you to (Re-)Set the rules for Reordering Inventory items, and to adjust actual Inventory Item counts based on the results of a physical Inventory Counting process. |

Edit Warehouse Inventory Values

| • | Click on the Inventory Count field(s) to be revised. |

| ▪ | 'Max Level' Value: - The maximum Quantity of this Inventory Item that should be in-stock (Available 'On Hand') at any time. |

| ▪ | 'ReOrder' Value: - The Quantity of this Inventory Item which is in-stock (Available 'On Hand') that triggers a Re-Order Request (documented in the Inventory Reorder Report). |

| ▪ | Available 'On Hand': - The Quantity of this Inventory Item that is in-stock at any time. |

| o | Right-Click this Available 'On Hand' field to (re-)set the Increment in which the Up/Down Arrows will change the current Quantity and display the resultant Quantity. |

| o | The choices are 1, .5, and .1 |

| o | Once the field is (re-)set, this Increment setting will become the default. |

| ▪ | Available 'Pending': - The number of this of this Inventory Item which has been ordered but is not already committed to a Job, but has not be received (Also see Reserved Inventory and Purchase Orders). |

| • | Adjust these numbers, as required. |

| ▪ | Department - Use the Drop-Down Selection List to Choose the Department that normally uses this Inventory Item. |

| • | Authorization - Enter the Reason for Change |

| • | Click OK to save the change or Cancel to abort the revisions. |

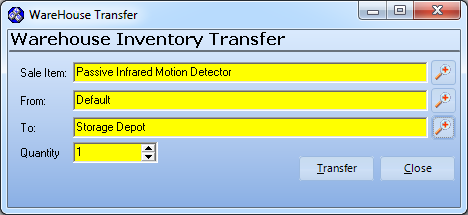

| • | Transfer - Move Inventory Item(s) from one Warehouse to another. |

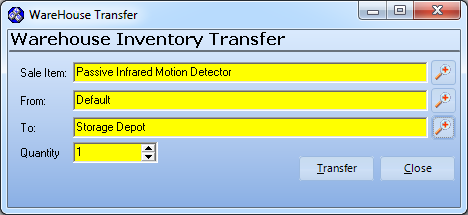

Warehouse Inventory Transform Form

| • | Sale Item - The Inventory Item you want to relocate. |

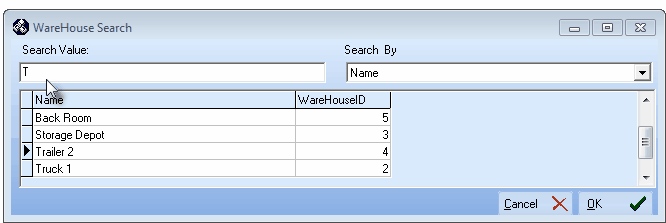

| • | From - Click the Warehouse Search Icon to locate the appropriate Warehouse Location FROM which to move this item from. |

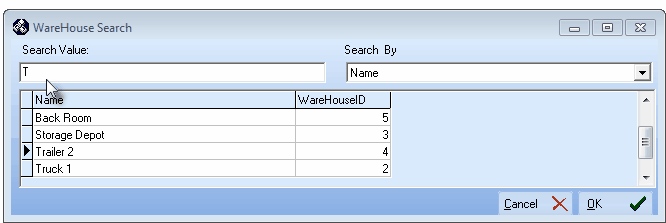

| ▪ | Search By - Use the Drop-Down Selection List to Choose the search method which may be by Name or by Warehouse ID number. |

| ▪ | Search Value - Enter the characters with which to perform the search. |

| ▪ | Click the OK button to close the Warehouse Search Form which will also insert the selected record into the From field. |

Warehouse Search Form

| • | To - Click the Warehouse Search to locate the appropriate Warehouse Location TO which to move this item. |

| ▪ | Search By - Use the Drop-Down Selection List to choose the search method which may be by Name or by Warehouse ID number. |

| ▪ | Search Value - Enter the characters with which to perform the search. |

| ▪ | Click the OK button to close the Warehouse Search Form which will also insert the selected record into the TO field. |

| • | Quantity - Enter the Quantity to be Transferred. The default value will be 1. |

| • | Transfer - Click the Transfer button to execute the move. |

| • | Close - Click the Close button to exit the Form. |

| • | Hide 0 Vaues - Click the Hide 0 Values button to eliminate all Inventory Items, with no values in any columns, from the Warehouse Inventory display. |

| • | Show All Values - If the Hide 0 Vaues has been Clicked, the button name changes to Show All Values, which may be Clicked to do just that. |

| • | Refresh - Updates the Form with the most current information in case another User made a change since the Form was opened. |

| • | Close - Closes the Warehouse Inventory Form |