| 2. | LIFO - Last In / First Out - The cost as determined by the most recent price paid for this item as recorded on a Bill. |

| □ | Price In - By default, the Value of each Inventory Item is the original Price In Value (Cost) assigned to that Inventory Item as it was entered in the Sale-Purchase Category Form. |

| • | However, from an accounting standpoint, you may want to alter this default behavior by having that Price In Value re-set, based on the most recent Cost paid on an Invoice from a Vendor for the Re-Purchase of each Inventory Item. |

| • | This automatic Price In Value (Cost) re-set - based on the most recent price (Cost) paid - is referred to as Last In - First Out, or LIFO for short. |

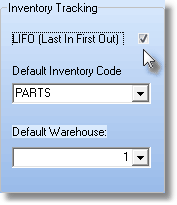

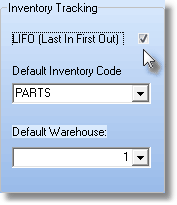

Check LIFO (Last In First Out)

| • | Thereafter, whenever an Inventory Item is Purchased or Sold, this continuously updated (LIFO) Value is the Value that is used in the associated General Ledger System transactions. |

| • | This valuation drift occurs over time as Costs are reset, and /or purchases are made but the previous history and timing of those Cost resets is unclear. |

| • | A different approach in establishing and maintaining the Value of the Inventory is to continuously Average the Cost of Inventory so that all Price (Cost) changes are taken into consideration whenever the Value of an Inventory Item is reported. |

| • | Once implemented, the Inventory Cost Averaging Calculation Records: |

| • | The specific Price (Cost) paid for that item, and |

| • | The Inventory Cost Averaging Calculation of each Inventory Item that is currently "in stock" is calculated by adding the Quantity of new Inventory Purchases and subtracting the Quantity of new Inventory Sales. |

| • | An Average Inventory Cost table is internally maintained by the system for each Sale-Purchase Item that has been specifically identified as an Inventory Item (i.e., there is a Check in its Inventory Item box). |

| ▪ | This Average Inventory Cost table contains the following information: |

| e) | Total Cost Paid for all of the Inventory Items that are currently On-Hand |

| • | This example of the Average Inventory Cost table shows how it is accessed and updated as Inventory is Purchased and Sold: |

|

Quantity

|

Unit Price

|

Total Price

|

Count

|

Total Cost

|

Avg. Cost

|

1st Purchase

|

1

|

$3.00

|

$3.00

|

1

|

$3.00

|

$3.00

|

2nd Purchase

|

2

|

$3.00

|

$6.00

|

3

|

$9.00

|

$3.00

|

3rd Purchase

|

3

|

$1.00

|

$3.00

|

6

|

$12.00

|

$2.00

|

1st Sale

|

-1

|

|

|

5

|

$10.00

|

$2.00

|

4th Purchase

|

1

|

$4.00

|

$4.00

|

6

|

$14.00

|

$2.33

|

2nd Sale

|

-1

|

|

|

5

|

$11.67

|

$2.33

|

Sample Average Cost Valuation Calculations

| • | When a Detail Line Item is added to an Invoice for the Purchase of an Inventory Item, a corresponding entry is made in this Average Inventory Cost table with: |

| d) | A new Count is calculated by adding the Quantity that was just Purchased to the previous Count. |

| e) | The new Total Cost Paid is calculated by adding the Total Price Paid to the previous Total Cost |

| f) | The Average Cost is re-calculated by dividing the new Total Cost be the new Count |

| • | When a Detail Line Item is added to an Invoice for the Sale of an Inventory Item, an entry is made in this Average Inventory Cost table with: |

| a) | The Quantity that was Sold |

| b) | The Count is re-calculated by subtracting the Quantity Sold from the previous Count. |

| c) | The Total Cost Paid is re-calculated by subtracting the result of the Quantity Sold multiplied by the previously calculated Average Cost. |

| d) | The Average Cost is re-calculated by dividing the new Total Cost be the new Count |

| 1. | If the AverageCostInventory option set to True ("T"), Inventory Valuation will be set based on the Average Cost paid for an Inventory Item versus (whatever was) the previously selected Inventory Valuation method. |

| ▪ | When AverageCostInventory is set to True ("T"), setting the Inventory Valuation to the Average Cost paid for an Inventory Item, if LIFO (Last In/First Out) was the selected Inventory Valuation Method, it will be turned off (LIFO will be Un-Checked) automatically. |

| 2. | Once the AverageCostInventory option set to True ("T"), from the Main Menu Select the Maintenance Menu and Choose the Inventory Tracking sub-menu, then Select the Calculate Inventory Item Average Cost option. |

| □ | Summary of the effects on the Sale-Purchase Item Form as they relate to these Inventory Valuation Methods: |

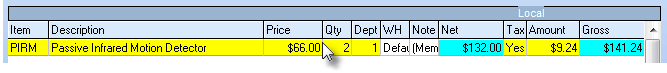

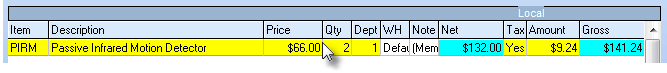

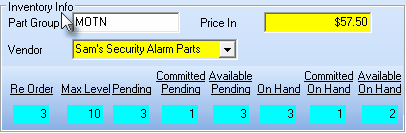

| • | The Price In for an Inventory Item - regardless of whether it is used as Both a Purchase and a Sale, or just a Purchase - will be the default Price inserted for the Inventory Item when entering a Bill. |

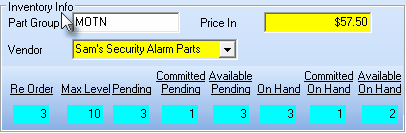

| • | How and whether the Price In and/or Value fields will be displayed within the Inventory Info box on the Sale-Purchase Item Form is based on which Inventory Valuation Method has been elected. The differences in how these Price In and/or Value fields are displayed are as follows: |

| • | Price In - This will be displayed as a normal mandatory field on the Sale-Purchase Item Form if this is an Inventory Item and the Average Inventory Cost Inventory Valuation Method has not be elected. |

| ▪ | When the Price In Inventory Valuation Method is in effect, the contents of the Price In field will remain unchanged unless that field is modified manually. |

Inventory Info box - LIFO or Price In Inventory Valuation Method selected

| • | LIFO - If the LIFO Inventory Valuation Method is in effect, the contents of this Price In field will be updated each time another Inventory Item of this type is Purchased with the Cost re-set to the most current Price that was Paid. |

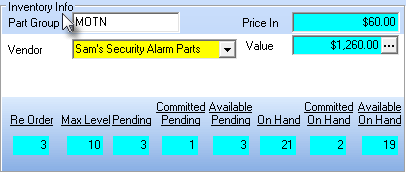

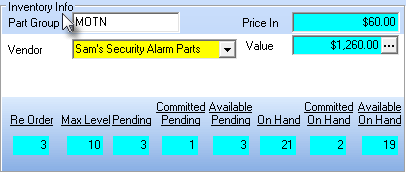

| • | Price In (Average Cost of this Item) - If the Average Inventory Cost Inventory Valuation Method is in effect, this is a system maintained field which is updated, as needed, using the Calculate Average Inventory procedure. |

Inventory Info box - Average Cost Inventory Valuation Method selected

| • | Value (total value of what is actually 'in-stock' On Hand for this Inventory Item) - If the Average Inventory Cost Inventory Valuation Method is in effect, this will be a system maintained field which is also updated, as needed, using the Calculate Average Inventory process. |

| □ | Summary of the Value used for Inventory Items in the General Ledger System as they relate to Purchases of and Sales for Inventory Items when each of these Inventory Valuation Methods are being used. |

| • | The Value used for the Price (cost) of an Inventory Item when posting a General Ledger System Inventory related Transaction is based on the currently selected Inventory Valuation Method and how each Valuation Method's Transaction is posted is described below: |

| a) | Purchases - Unless manually over-written while entering a Purchase, the Price In as originally entered (or subsequently manually modified) on the Sale-Purchase Item Form for that Inventory Item will be the Value used and will be posted as follows: |

| ii. | The Accounts Payable Account with be Credited (increased) by the Value of the Inventory that was Purchased based on the Price In currently in the Sale-Purchase Item Form for that Inventory Item (plus any Sales Tax or Shipping Expense charged on that Purchase). |

| b) | Sales - The Price In as originally entered (or subsequently manually modified) on the Sale-Purchase Item Form for that Inventory Item will be the Value used and will be posted as follows: |

| 2. | LIFO - The Price In Value is re-set, based on the most recent Cost entered on an Invoice for the Purchase of that Inventory Item. |

Purchases - Unless manually over-written while entering a Purchase, the Price In as originally entered (or subsequently manually modified) on the Sale-Purchase Item Form for that Inventory Item will be the Value used and will be posted as follows:

| a) | Purchases - The Price of the Inventory Item being Purchased - which will then become the re-set Price In on the Sale-Purchase Item Form for that Inventory Item - will be the Value used and will be posted as follows: |

| i. | The Inventory Asset Account will be Debited (increased) by the Price (Value) of the Inventory Item being Purchased |

| ii. | The Accounts Payable Account with be Credited (increased) by that same Value (plus any Sales Tax or Shipping Expense charged on that Purchase). |

| b) | Sales - The Price In maintained by the LIFO re-set process on the Sale-Purchase Item Form for that Inventory Item will be the Value used and will be posted as follows: |

| 3. | Average Inventory Cost - The periodically recalculated Average Inventory Cost stored in the Price In field on the Sale-Purchase Item Form |

| i. | The Inventory Asset Account will be Debited (increased) by that Price In (Value) of the Inventory Item being Purchased |

| ii. | The Accounts Payable Account with be Credited (increased) by that same Value (plus any Sales Tax or Shipping Expense charged on that Purchase). |

| i. | The Inventory Asset Account will be Credited (reduced) by the calculated Price In Value of the Inventory Item that was Sold |