| □ | Tracking Inventory as Assets, Liabilities, Sales and Expenses is a complex and tedious task - if performed manually. |

| • | If you are using the Inventory Tracking System (and the General Ledger System), this complexity (and tediousness) is almost completely automated - executed as a set of background procedures - as the User makes their normal Sales and Purchase entries, enters and completes Work Orders, and issues, checks-in and bills Purchase Orders. |

| • | The purpose of this chapter is to let you "look under the hood" to see what the system is actually doing in the background when Inventory related Transactions occur. |

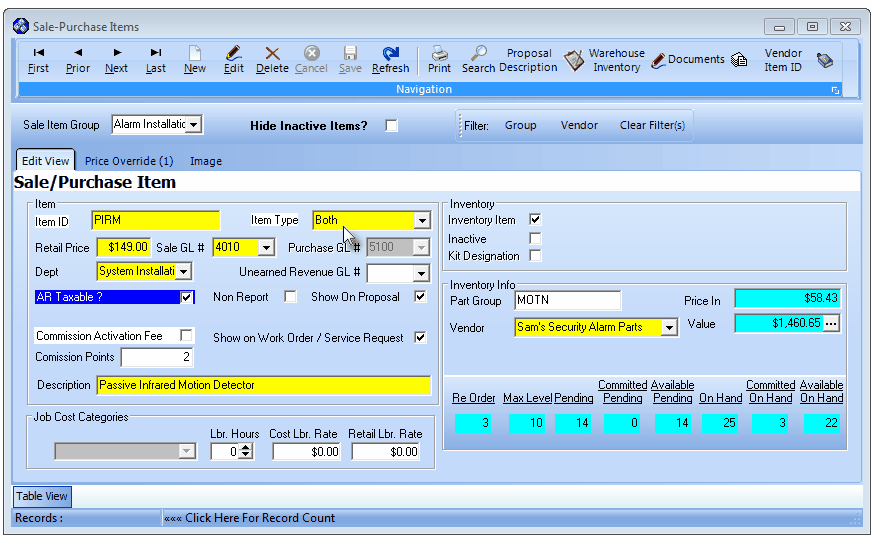

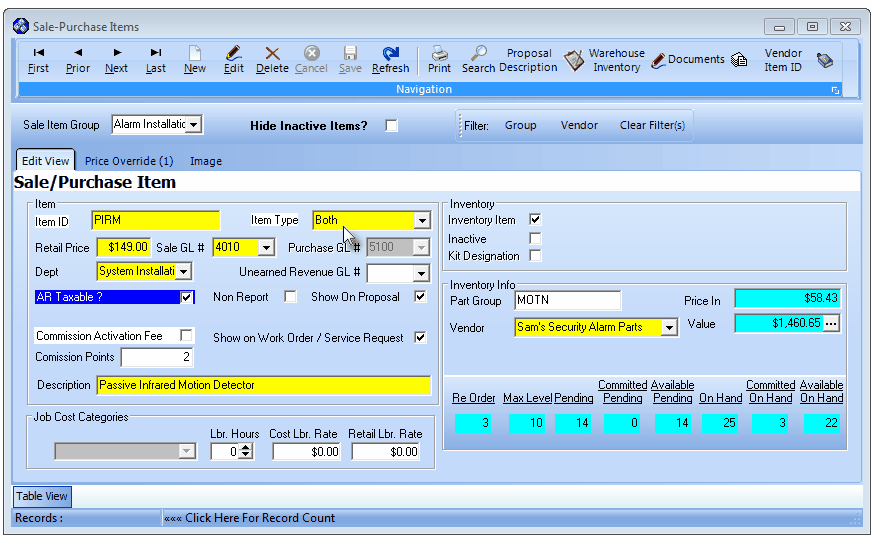

| 1. | Price In - The Value of each Inventory Item is the original Price In Value (the wholesale amount) assigned to that Inventory Item when it was initially entered in the Sale-Purchase Category Form. |

| a) | Purchases - Unless that Price is manually over-written while entering a Purchase, the Price In as originally entered, or subsequently manually modified on the Sale-Purchase Item Form for that Inventory Item will be the Value used and will be posted as follows: |

| ii. | The Accounts Payable Liability Account (one of the Mandatory Accounts) will be Credited (increased) by the Value of the Inventory that was Purchased based on the Price In currently in the Sale-Purchase Item Form (or adjusted Price manually entered on the Bill Form) for that Inventory Item (plus any Sales Tax or Shipping Expense charged on that Purchase). |

| b) | Sales - The Price In as originally entered (or subsequently manually modified) on the Sale-Purchase Item Form for that Inventory Item will be the Value used and will be posted as follows: |

| i. | The Inventory Asset Account will be Credited (reduced) by the Value of the Inventory that was Sold based on the Price In currently in the Sale-Purchase Item Form (or adjusted Price manually entered on the Invoice Form) for that Inventory Item |

| 2. | LIFO - The Price In Value is re-set, based on the most recent Cost entered on an Invoice for the Purchase of that Inventory Item. |

Purchases - Unless manually over-written while entering a Purchase, the Price In as originally entered (or subsequently manually modified) on the Sale-Purchase Item Form for that Inventory Item will be the Value used and will be posted as follows:

| a) | Purchases - The Price of the Inventory Item being Purchased - which will then become the re-set Price In on the Sale-Purchase Item Form for that Inventory Item - will be the Value used and will be posted as follows: |

| ii. | The Accounts Payable Liability Account (one of the Mandatory Accounts) will be Credited (increased) by that same Value (plus any Sales Tax or Shipping Expense charged on that Purchase). |

| b) | Sales - The Price In maintained by the LIFO re-set process on the Sale-Purchase Item Form for that Inventory Item will be the Value used and will be posted as follows: |

| 3. | Average Inventory Cost - The periodically recalculated Average Inventory Cost stored in the Price In field on the Sale-Purchase Item Form |

| i. | The Inventory Asset Account will be Debited (increased) by that Price In (Value) of the Inventory Item being Purchased |

| ii. | The Accounts Payable Liability Account (one of the Mandatory Accounts) will be Credited (increased) by that same Value (plus any Sales Tax or Shipping Expense charged on that Purchase). |

| • | However, within MKMS, it is managed as an automatic, background process. |

| • | To take advantage of this automated process, you must first: |

| □ | An Analysis of the various Inventory Tracking System Processes (Everything you's ever want to know about Inventory related Transaction): |

Inventory Item record on the Sale-Purchase items Form

| • | Inventory is Ordered - When Inventory Items are ordered through the use of the Purchase Order Form, the Inventory Item's Pending and Available Pending counts will both be increased by the Quantity that was Ordered (as shown on the Sale Purchase Item Form above as 3). |

| • | Inventory is Received - When Inventory Items, ordered using a Purchase Order, are actually Received, they are Checked In. |

| ▪ | Those Inventory Item's Pending and Available Pending counts will not be changed (the change occurs when these received Inventory Items are actually Billed by the Vendor (see below) and that Bill is recorded as a Purchase. |

| ▪ | The Received column on the Purchase Order will be updated by the system to reflect the Quantity that had been previously Checked In and has now been Billed. |

| ▪ | The Inventory Item's Pending and Available Pending counts (displayed on the Sale Purchase Item Form) will both be decreased by the Quantity that was Billed. |

| ▪ | The On Hand count and Available On Hand count will be increased by the Quantity that was Billed. |

| ▪ | Within the General Ledger System the Value of the Inventory Items that are Billed will be Debited (subtracted) from the Inventory Purchases Account (one of the Mandatory Accounts) and that same Value will be Credited (added) to the Accounts Payable Account (one of the Mandatory Accounts). |

| ▪ | Within the General Ledger System, if any of these Inventory Items were charged Sales Tax, that Sales Tax amount that was charged will also be Credited to (added to and included with) the Accounts Payable Account transaction amount and that Sales Tax amount separately Debited (added) to the appropriate Sales Tax Expense Account(s) (one of the Mandatory Accounts). |

| ▪ | The On Hand count and Available On Hand count will be increased by the Quantity that was Billed. |

| ▪ | The Inventory Item's Pending and Available Pending counts (displayed on the Sale Purchase Item Form) will not be changed because these Inventory Items were never "Pending" before they were entered as a Purchase. |

| ▪ | Within the General Ledger System the Value of the Inventory Items that are Billed will be Debited (added) to the Inventory Asset Account and that same Value will be Credited (added) to the Accounts Payable Account. |

| ▪ | If any of these Inventory Items were charged Sales Tax, that Sales Tax amount that was charged will also be Credited (added to) the Accounts Payable account and Debited (added) to the Sales Tax Expense account. |

| ▪ | The Available On Hand count will be decreased, and the Committed On Hand will be increased, by the Quantity that was recorded as Inventory Items Used on the Inventory\Material tab of the Service Request Form. |

| • | The On Hand count and Available On Hand count will be decreased by the Quantity that was Invoiced. |

| ▪ | The General Ledger System will Credit (add to) a Sales Account for the amount of the Retail Price (using the GL Account Number assigned in the Sale Purchase Items Form), Credit (subtract) the net Cost (see the "Inventory Valuation Methods" section below) of the Inventory Items from the Inventory Asset Account, and Debit (add) the net Cost of the Inventory Items to the Cost of Goods Sold Account. |

| ▪ | If any of the Inventory Items that were sold had to be Taxed, the Sales Tax amount that was charged to the Sale will also be Debited (added to) in the Accounts Receivable Account (as part of the General Ledger System Sales transaction), and Credited (added) to the Sales Tax Liability Account. |

| • | When Inventory is directly Sold - When a Subscriber is Invoiced directly for an Inventory Item as part of a "stand-alone" Sale (and the Inventory Items included in the Sale were not Invoiced or accounted for as Inventory Used elsewhere in a Service Request or as part of a Job Costing entry): |

| • | The On Hand count and Available On Hand count will be decreased by the Quantity that was Invoiced. |

| ▪ | A Credit (add to) a Sales Account for the amount of the Retail Price (using the GL Account Number assigned in the Sale Purchase Items Form), Credit (subtract) the net Cost (see the "Inventory Valuation Methods" section below) of the Inventory Items from the Inventory Asset Account, and Debit (add) the net Cost of the Inventory Items to the Cost of Goods Sold Account. |

| ▪ | If any of the Inventory Items that were sold had to be Taxed, the Sales Tax amount that was charged to the Sale will also be Debited (added to) in the Accounts Receivable Account (as part of the Sales transaction), and Credited (added) to the appropriate Sales Tax Liability Account(s). |

| □ | How Inventory Adjustments are managed: |

| • | When a Credit Memo from a Vendor is Received - From time to time you will need to return unused or inoperative Inventory Items and so will receive a Credit for the Cost of these items from that Vendor for those returned items. |

| ▪ | The On Hand count and Available On Hand count will be decreased by the Quantity that was Credited. |

| ▪ | The Inventory Item's Available Pending count, and the Total Pending count (as shown on the Sale Purchase Item Form) will not be changed. |

| ▪ | The Value (see the "Inventory Valuation Methods" section below) of the Inventory Items that are Billed will be Credited (subtracted) from the Inventory Asset Account and that same Value will be Debited (subtracted) from the Accounts Payable Account. |

| ▪ | If any of these Inventory Items were charged Sales Tax, the Sales Tax amount that was charged will also be Debited (subtracted) from the Accounts Payable account and Credited (subtracted) from the Sales Tax Expense Account. |

| • | When a Credit Memo to a Subscriber is Issued - From time to time you may accept the return of unused or inoperative Inventory Items from a Subscriber and will therefore issue them a Credit for those. By doing so: |

| • | The Total On Hand count and Available On Hand count will be increased by the Quantity that was returned. |

| • | The Inventory Item's Available Pending count, and the Total Pending count (as shown on the Sale Purchase Item Form) will not be changed. |

| ▪ | A Credit (subtraction) to the Retail Price of the Inventory Items of this Credit from the Accounts Receivable account, and a Debit (subtraction) of the Retail Price of this Credit from the Sales account assigned to the Inventory Items in the Sale Purchase Item Form. |

| ▪ | In the General Ledger, the Value of the Inventory Items that were returned will be Debited (added) to the Inventory Asset Account and that same Value will be Credited (subtracted) from the Cost of Goods Sold account. |

| ▪ | If any of these Inventory Items were charged Sales Tax, the Sales Tax amount on the Credit will also be Credited (subtracted) from the Accounts Receivable account and Debited (subtracted) from the Sales Taxes Payable account. |

| • | Inventory Transfers - From time to time you may relocate Inventory Items from one Warehouse location to another. |

| • | These Transfers do no affect the overall Quantity of any On Hand count shown on the Sale Purchase Item Form. |

| • | Inventory Adjustments - From time to time you may perform a physical Inventory Count. As a result of this Counting Procedure, the On Hand Quantity of certain Inventory Items may need to be changed. |

| • | These Inventory Adjustments will change the Quantity of certain On Hand counts shown on the Sale Purchase Item Form. |

| ▪ | When Inventory Counts are increased using the Edit Warehouse Inventory Values Form, the Inventory Asset account is Debited (added to) by the Value (i.e., the Quantity increased is multiplied by the Price In of that Inventory Item - as defined on the Sale Purchase Item Form) of that increase, and the Inventory Adjustments Expense account is Credited (increased) by that increase. |

| ▪ | When Inventory Counts are decreased, the opposite occurs. |

| • | LIFO - Used to initiate the Last In - First Out Inventory Valuation Method. |

| • | Average Cost Inventory - Another approach to Inventory Valuation is to use the Average Inventory Cost as the Value used in the associated General Ledger System Inventory related Transactions. |

| • | This will establish and maintain the Value of the Inventory and continuously Average the Cost of Inventory so that all Price (cost) changes are taken into consideration whenever the Value of the Inventory is reported. |

| • | If the Average Cost Inventory Valuation Method is selected, the total Value field is computed by multiplying the Price In Amount by the On Hand Quantity. |