| • | However, the other side of these Financial Transactions, the other Debit or Credit entry required with Double Entry Bookkeeping has not been specifically identified. |

| • | Pre-defining these "other side of the transaction" Accounts allows the General Ledger System to complete the double entry accounting entry automatically - without asking the User to identify any Account number information at that time. |

| □ | Purpose for the Mandatory Accounts |

| ◆ | In the examples below, "post" means "to add to an Account's balance", and "subtract" means "to take away from an Account's balance". |

| • | These Mandatory Accounts (highlighted in Yellow) are required for the following situations |

| • | Closing a Month - Your Profit (or Loss) is posted to the Current Earnings Account, which is an Equity Account Type numbered between 3000 and 3999, and to your Earnings Posted Account which should be numbered 9999. |

| • | Closing a Year - Your Year-end Profit (or Loss) is posted (manually by making the appropriate General Journal Entry) to the Retained Earnings Account, which is an Equity Account Type numbered between 3000 and 3999; and to your Earnings Posted Account which should be numbered 9999 (see Close the Year). |

| • | Posting a Sale to a Subscriber - A Sale (e.g., each detail line item entered on a Sales Invoice) is posted to the General Ledger Account Number identified on the Sale-Purchases Items Form for the Sales Category sold, and the Accounts Receivable Account which represents the other half of that Financial Transaction. |

| • | Posting an Invoice from a Vendor - The Purchase (e.g., each detail line item entered on a Bill) is posted to the General Ledger Account Number identified for that item in the Purchases Items Form, and the Accounts Payable Account represents the other half of that Financial Transaction. |

| • | Charging Sales Taxes - When you charge a Subscriber for Sales Tax (local and/or national), you are simply holding those funds until you file the Department of Revenue's Sales Tax Return and actually send those funds to the State (or who ever is the appropriate governmental authority). |

| ▪ | Internally, the Sales Tax entry is posted to the appropriate Sales Tax Liability Account because you are liable for the payment of those funds to someone else in the near future. |

| ▪ | So, you must define a Local Tax (Liability) Account, and a National Tax (Liability) Account - even of you don't use it - to accept this Sales Tax entry. |

| ▪ | Your Accounts Receivable Account represents the other half of the transaction because you have Invoiced the Subscriber for the Sales Tax, but have not yet received it. |

| • | Paying Sales Taxes - When you are being charged Sales Tax (local or national) by a Vendor, you are incurring an Expense. |

| ▪ | So the transaction is posted to a Sales Tax Expense Account. |

| ▪ | Remember, even if you don't need to separate Local and National Sales Tax, you must define both. |

| ▪ | The Accounts Payable Account represents the other half of the transaction because you must eventually pay the Vendor for the Sales Tax - as well as your Purchases. |

| • | Accepting Deposits - All monies received are initially posted as Deposits when entered on the Receipts, or Post Receipts Form. |

| ▪ | When you post a Deposit, you may not have an Invoice to which you can apply it. |

| o | If a Subscriber pays a Salesperson a Deposit for future work, that Deposit is a Liability (you owe them something for that deposit - typically an installation - but you have not yet completed it, nor have you actually invoiced them for it). |

| ▪ | But, usually you do have an Invoice to which you can Allocate that Receipt. |

| o | Then, when you Allocate the money - either manually from the Receipts Form, or as part of a more automatic process on the Post Receipts Form - internally the transaction subtracts the Deposit from a Deposit Liability Account, and subtracts it from the Accounts Receivable Account which represents the other half of the transaction. |

| • | Giving Deposits - All monies paid are posted as Payments. |

| ▪ | If a Vendor requires the advance Payment of a Deposit for future service (Electric or Telephone Company deposits are typical), that Deposit is an Asset - they owe that deposit to you and must eventually return it to you or provide a service for it. |

| o | So, that Deposit is still your money. |

| o | The Vendor is just holding it for a while, and eventually will give it back. |

| ▪ | When you record that Deposit to that Vendor, you do not have an Invoice from them to which you can apply it. |

| • | Upgrade Revisions to the Mandatory Account Declarations. |

| ▪ | From time to time, as Upgrades are provided, changes to module requirements may also include additions to the Mandatory Account Declarations. |

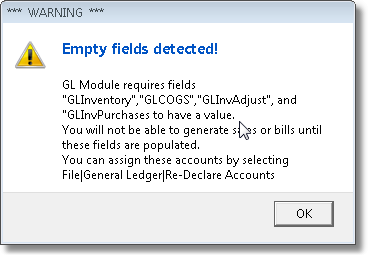

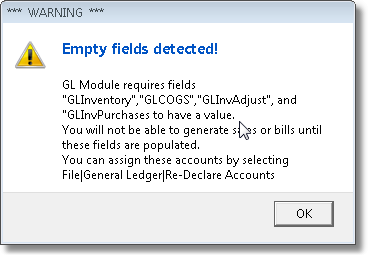

| ▪ | These requirements will usually be "announced" with a *** WARNING *** Message specifically describing the changes and providing the solution. |

Warning message declaring the additional Mandatory Accounts

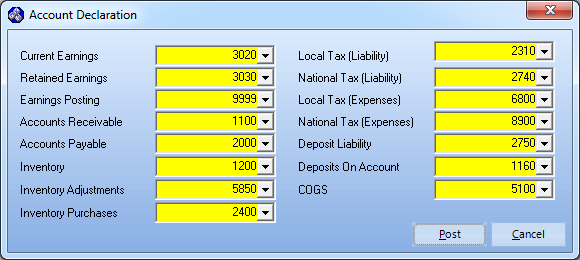

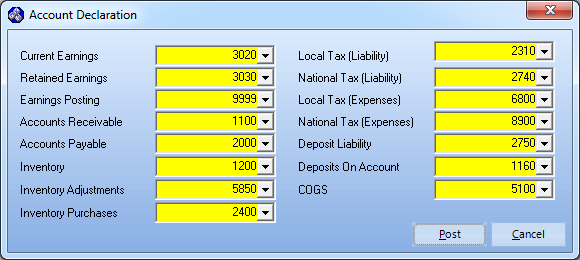

| □ | Example of the Mandatory Account Declarations |

The General Ledger Setup Wizard - Mandatory Account Declaration entries

| • | Current Earnings - An Equity Account Type numbered between 3000 and 3999. |

| • | Retained Earnings - An Equity Account Type numbered between 3000 and 3999. |

| • | Earnings Posted - An Expense Account Type numbered 9999. |

| • | Accounts Receivable - An Asset Account Type numbered between 1000 and 1999. |

| • | Accounts Payable - A Liability Account Type numbered between 2000 and 2999. |

| • | Inventory - An Asset Account Type numbered between 1000 and 1999. |

| • | Inventory Adjustments - An Expense Account Type numbered between 5000 and 9998 |

| • | Inventory Purchases - A Liability Account Type numbered between 2000 and 2999. |

| • | Local Tax (Liability) - A Liability Account Type numbered between 2000 and 2999. |

| • | National Tax (Liability) - A Liability Account Type numbered between 2000 and 2999 (it may not be the same as the one above, and must be defined). |

| • | Local Tax (Expenses) - An Expense Account Type numbered between 5000 and 9998. |

| • | National Tax Expenses) - An Expense Account Type numbered between 5000 and 9998 (it may not be the same as the one above, and must be defined). |

| • | Deposit Liability - A Liability Account Type numbered between 2000 and 2999. |

| • | Deposit On Account - An Asset Account Type numbered between 1000 and 1999. |

| • | COGS (Cost of Goods Sold) - An Expense Account Type numbered between 5000 and 9998 (it may not be the same as Inventory Adjustments, and must be defined). |