| • | There are five different Types of Accounts to which Financial Transactions may be posted. |

| • | Each Type of Account has a number range that is pre-set based on generally accepted accounting practices. |

| • | The five Account Types and their Numbering Ranges are listed below: |

| 1. | Assets - 1000 - 1999 - Actual Cash Assets (like real money in a desk drawer, or the money you have in a bank or money market account); and other Assets (things of value that the Company owns or is entitled to) like monies other people or businesses owe your Company, and your Company's furniture, computers, vehicles or properties. |

| 2. | Liabilities - 2000 - 2999 - What you owe others. This would include Accounts Payable balances owed to Vendors, Payroll Taxes and Credit Card debt; and Long Term Liabilities such as business loans and mortgages. |

| 3. | Equity - 3000 - 3999 - Your Start Up Capital investment and the business's Retained Earnings - which are Profits you have not yet paid out to someone. |

| 4. | Revenue - 4000 - 4999 - Revenue (Income) from Sales, Interest earned from savings, and any other miscellaneous Income. |

| 5. | Expenses - 5000 - 9989 - General Expenses, such as rent, utilities, payroll, health insurance, shipping expenses, postage, office, supplies, interest for loans, and taxes, and Sales Related Expenses such as Cost of Goods Sold, Commissions, Advertising, etc. |

| ◆ | The General Ledger Account Numbers 9990 - 9998 are used (internally) by the system and therefore should not be defined by the User. |

| • | General Ledger Group IDs - General Ledger Groups (Groups) are used to sub-divide the five basic Types of Accounts (see above) of Financial Transactions into sub-groups. |

| • | General Ledger Group Header Descriptions will appear as sub-headers - and are shown with their own Footer Description and individual sub-totals - when any of the General Ledger Financial Reports are printed. |

| • | Assigning a Group to a specific General Ledger Account ensures the Account will be included within that Group, and the Balance of each assigned Account within that Group will be included in the sub-total for that Group. |

| • | To enter your General Ledger Accounts, on the Main Menu Select Maintenance and Choose the General Ledger sub menu, then Click Accounts. |

| □ | Defining a General Ledger Account: |

| • | This chapter assumes that an accountant has previously designed a Chart of Accounts for your Company, and that you are currently using, or plan to use this set of General Ledger Accounts within this General Ledger System. |

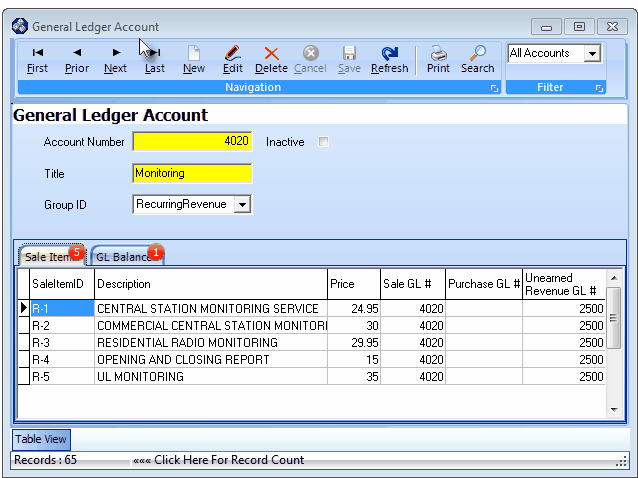

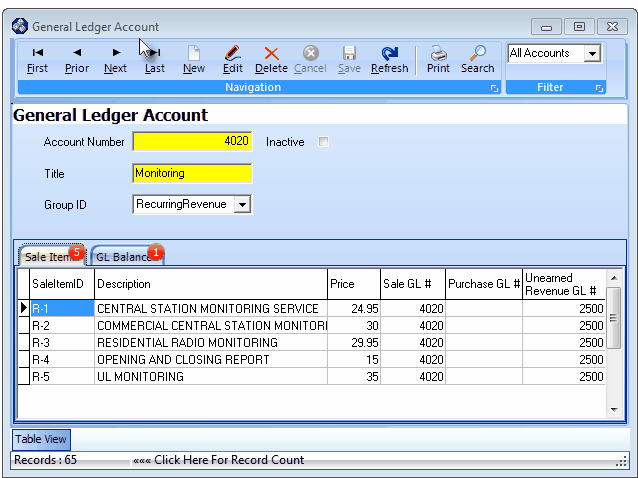

General Ledger Account Form

| • | This General Ledger Account Form may be Re-sized by Dragging the Top and/or Bottom up or down, and/or the Right side in or out. |

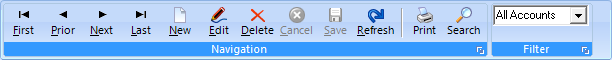

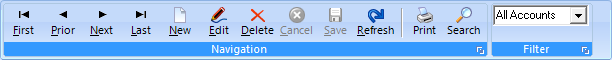

| • | Navigation Menu - The Navigation Menu is located at the top of the General Ledger Account Form. |

| • | This Navigation Menu provides the normal Record Movement, New, Edit, Delete, Cancel, Save, and Refresh options; as well as special Print, Search and Filter functions. |

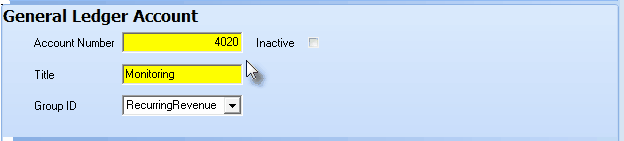

| • | Record Editing section - The details of the currently selected record are displayed below the Navigation Menu at the center (Main Body) of the General Ledger Account Form. |

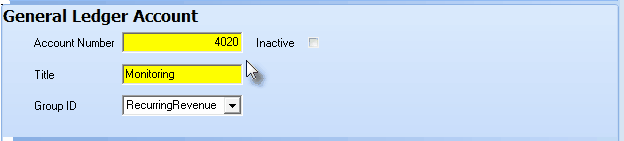

General Ledger Account Form - Record Editing section

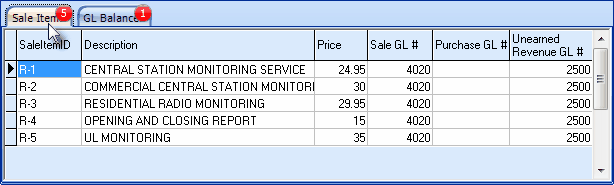

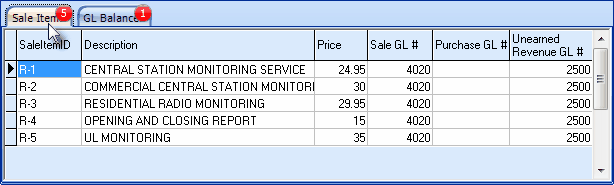

| • | Sale Items tab - Lists each Sale-Purchase Item which has been assigned the currently selected General Ledger Account |

General Ledger Account Form - Sale Items tab

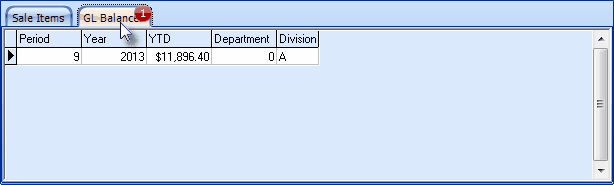

| • | GL Balances tab - Lists the YTD Account Balance - for the currently selected General Ledger Account |

General Ledger Account Form - GL Balance tab

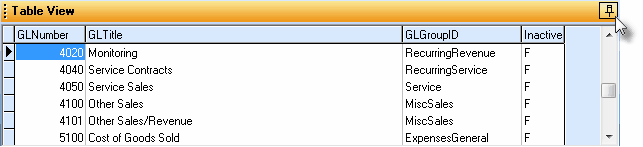

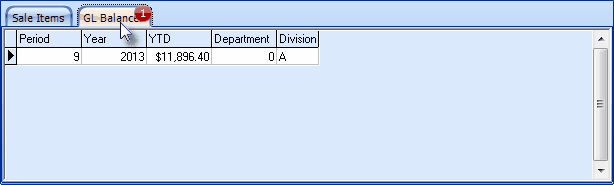

| • | Table View tab - A tabular (spreadsheet style) Table View of the currently defined General Ledger Accounts is accessible by Clicking the Table View tab at the bottom of the General Ledger Account Form. |

| • | To display a specific General Ledger Account record in the Record Editing section, Click on that record within the Table View section, or use the Search Icon (see the "Using the Special Functions" section later in this chapter). |

| • | This Table View information may be Pinned in Place by Clicking the Pin Icon on the right. |

General Ledger Accounts Form - with Table View tab Pinned Open

| ▪ | You may Un-Pin this Table View by Clicking the Pin Icon again. |

| ▪ | Click on any listed record to display that information in the center (Main Body) of the Form. |

| • | There are four columns of data in this General Ledger Account Record Listing: |

| 1) | GL Number - The Account Number (from 1000 to 9999) for this General Ledger Account. |

| 2) | GL Title - The the Account Title for this General Ledger Account. |

| 4) | Inactive - A True/False column indicating whether this is an Inactive (True), or an Active (False) General Ledger Account record. |

| • | Each column's Header Name describes the data contained in that column. |

| ▪ | Clicking on a Header Name will set the order in which the General Ledger Accounts will be listed. |

| ▪ | Clicking on the same Header Name will set the order in the opposite direction (ascending vs. descending). |

| ▪ | The Header Name that is determining the Order of the list will have an Icon indicating the Order displayed next to that Header Name. |

| • | To define a General Ledger Account: |

| • | Click the  Icon to start the General Ledger Account entry in the Record Editing section. Icon to start the General Ledger Account entry in the Record Editing section. |

| • | Account Number - Enter the Account Number (from 1000 to 9999) for this General Ledger Account. |

| ▪ | This General Ledger System assumes that the numbering system being used is the same as the one outlined above. |

| ▪ | See "The five Account Types and their Numbering Ranges" section above. |

| ▪ | All internal calculations that are made are based on this numbering system as are the Financial Statements that are produced. |

| • | Title - Enter the Account Title for this General Ledger Account. |

| ▪ | Although it's best to keep these Titles a brief as possible, up to 50 characters, upper & lower case letters, numbers punctuation and spaces are permitted. |

| • | Group ID - If this General Ledger Account is to be grouped with others of a similar type on your financial statements, use the Drop-Down Selection List provided to Choose the appropriate Group ID. |

| • | Inactive - Check this box if this General Ledger Account is no longer being used. |

| ▪ | An Account may not be identified as Inactive if any Financial Transaction have been posted to it in an Open Period! |

| ▪ | A Filter (see "Using the Special Functions" below) may be applied whereby All Accounts, only Active Accounts, or only Inactive Accounts may be viewed. |

| • | Click the  Icon to record this General Ledger Account entry. Icon to record this General Ledger Account entry. |

| • | Any number of additional General Ledger Account may be created. |

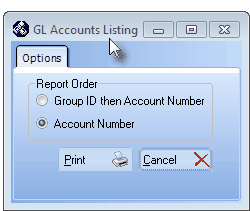

| □ | Using the Special Functions - Located on the Navigation Menu at the top of the General Ledger Account Form: |

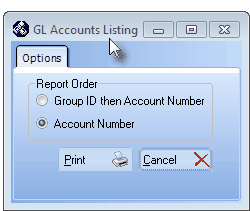

GL Account Listing - Options

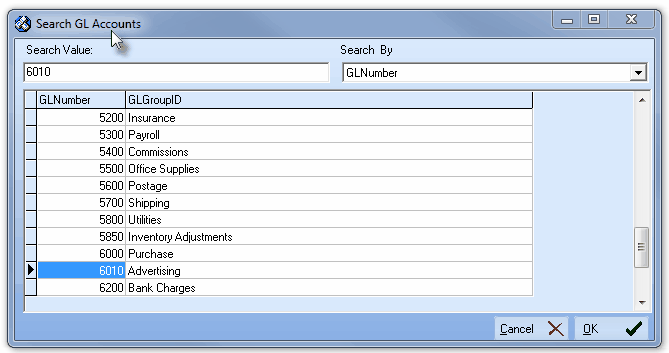

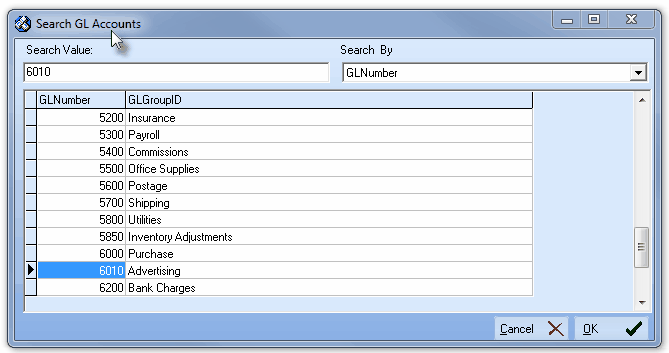

| • | Search - Click the Search Icon to open the Search GL Accounts dialog. |

Search dialog

| • | See the "Using the Generic Search dialog" section in the Advanced Search Dialog chapter for more information about this Search dialog. |

| • | Filter - Because certain Accounts may no longer be used - and have been marked as Inactive (see above) - when viewing this General Ledger Accounts Form the User may specify whether to see All Accounts, only Active Accounts, or only Inactive Accounts, as needed. |

| • | Use the Drop-Down Selection List provided to Choose the desired type of Accounts. |

| • | When you enter a Sale or Purchase, the appropriate General Ledger Account Number for the Sale or Purchase of that item has been identified in that Sale-Purchases Items Form. |

| • | However, the other side of these Financial Transactions (the other Debit or Credit entry required with Double Entry Bookkeeping) have not been specifically identified. |

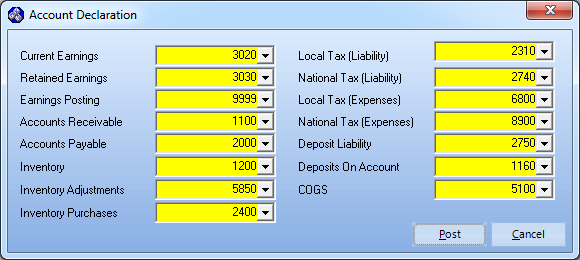

| • | Pre-defining these "other side of the transaction" Accounts allows the General Ledger System to complete the double entry accounting process automatically - without asking the User to identify any Account information at that time. |

| • | Ensure that you have created the associated General Ledger Account for each of these Mandatory Account Numbers (numbers shown are representative only, though they are within the appropriate numbering range) and Titles (titles shown are representative of the purpose, but yours do not have be exactly the same) as part of the process of defining all of your General Ledger Accounts. |

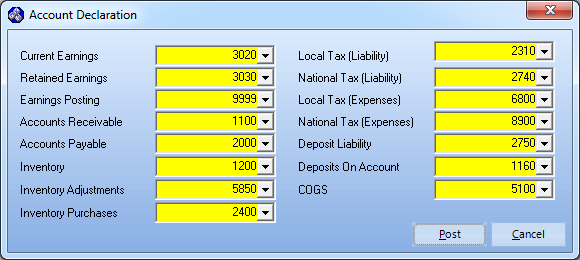

The General Ledger Setup Wizard - Mandatory Account Declaration entries

| • | Current Earnings - An Equity account numbered between 3000 and 3999. |

| • | Retained Earnings - An Equity account numbered between 3000 and 3999. |

| • | Earnings Posted - An Expense account numbered 9999. |

| • | Accounts Receivable - An Asset account numbered between 1000 and 1999. |

| • | Accounts Payable - A Liability accounts numbered between 2000 and 2999. |

| • | Inventory - An Asset account numbered between 1000 and 1999. |

| • | Inventory Adjustments -An Expense account numbered between 5000 and 9998 |

| • | Inventory Purchases - A Liability accounts numbered between 2000 and 2999. |

| • | Local Tax (Liability) - A Liability accounts numbered between 2000 and 2999. |

| • | National Tax (Liability) - A Liability accounts numbered between 2000 and 2999 (it may not be the same as the one above, and must be defined). |

| • | Local Tax (Expenses) - An Expense account numbered between 5000 and 9998. |

| • | National Tax Expenses) - An Expense account numbered between 5000 and 9998 (it may not be the same as the one above, and must be defined). |

| • | Deposit Liability - A Liability accounts numbered between 2000 and 2999. |

| • | Deposit On Account - An Asset account numbered between 1000 and 1999. |

| • | COGS (Cost of Goods Sold) - An Expense account numbered between 5000 and 9998 (it may not be the same as Inventory Adjustments, and must be defined). |

![]()

![]()