|

Close the Year This Help File Page was last Modified on 08/16/2013 |

|

|

|

|

Close the Year This Help File Page was last Modified on 08/16/2013 |

|

|

Close the Year

This Help File Page was last Modified on 08/16/2013

|

Close the Year This Help File Page was last Modified on 08/16/2013 |

|

|

|

|

Close the Year This Help File Page was last Modified on 08/16/2013 |

|

|

| □ | Preparing to Close the Year in the General Ledger System: |

| 1. | Close the Month - Close the Final month - Period 12 - of the Fiscal Year, requesting that the system Automatically Distribute Profit or Loss for this Period. |

| • | Confirm that the Trial Balance is In Balance. |

| • | Take no further steps until you have received the Year-End Adjustments that your Accountant will invariably require you to make. |

| 2. | General Journal - Once your Accountant has provided the Year-End Adjustments: |

| • | Make these Accountant mandated Adjustments, dating them for the last day of the last period (For example: 12/31/12 if you are on a Calendar based fiscal year and you are closing 2012). |

| • | These adjustment transactions may not be immediately available. |

| • | If not, you must wait for your Accountant to provide them before finalizing your Year. |

| • | However, this does not prevent you from using, or closing future months in the subordinate Accounts Receivable and Accounts Payable modules, as these modules separate each month's transactions automatically and so will not affect the General Ledger's year-end results for what has now become the previous year. |

| 3. | Close the Month - Once you have posted these final transactions to the General Journal, Close the Final month - Period 12 - of the current Fiscal Year, again. |

| • | Unlike before, Do Not request that the system Automatically Distribute Profit or Loss for this Period. |

| 4. | Post Retained Earnings in the General Journal to "finalize" this month: |

| • | To Distribute a net Profit for the Fiscal Year, Debit your Current Earnings account for the Year's Profit and Credit Retained Earnings for that amount. |

| • | To Distribute a net Loss for the Fiscal Year, Credit your Current Earnings account for the Year's Loss and Debit Retained Earnings for that amount. |

| 5. | Re-Close the Month - Re-Close the Final month - Period 12 - of the current Fiscal Year for a final time. |

| • | Assure that the General Ledger is In Balance by Re-Printing the Trial Balance, Profit & Loss Statement and Balance Sheet which should now be your Finalized set of Year-End Reports. |

| • | If Out of Balance, determine - with your Accountant - which General Journal transactions need to be Posted to resolve that issue and properly distribute End of Year Profit, Retained Earnings, etc. |

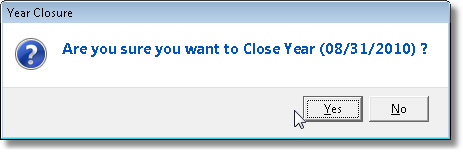

| □ | Close the Year |

| • | On the Main Menu Select File, Choose Close Year. |

| • | Click Yes to Close the Year. |

| • | You are now ready, when the appropriate time comes, to Close Months in the current Fiscal Year following the one you've just closed. |