| □ | The Trial Balance Report provides a comparison of all of your Debit and Credit transaction entries, made to all of your Debit and Credit accounts, and determines whether your General Ledger is in balance. |

| • | On the Main Menu, Select Reports and Choose the General Ledger sub-menu, then Click Trial Balance. |

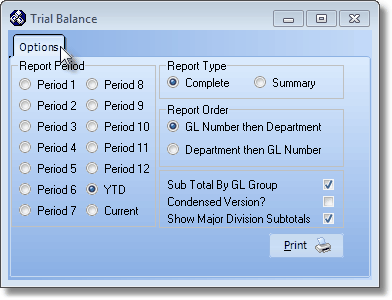

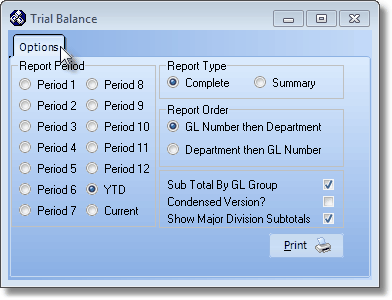

| □ | Trial Balance Report tabs - There are three tabs on the Trial Balance dialog. |

| • | Options - Initially only the Options tab is shown (until you make your Options selections and Select Print). |

| • | Not all options are available with all choices. |

Trial Balance Report - Options tab

| • | Report Period - Specify the accounting period to be reported. |

| • | Period 1 ... Period 12 - The status of your Trial Balance based on the Financial Transactions that occurred during the select accounting period. |

| • | YTD - By default, the status of your Trial Balance based all of the Financial Transactions posted, up to and including the most recently closed period, but excluding any un-closed month(s). |

| • | Current - The status of your Trial Balance based on current period representing all dates that fall within the un-closed month(s). |

| • | Report Type - Choose the complexity of the report format. |

| • | Complete - By default, all Groups, Departments and Accounts will be listed. |

| • | Summary - A condensed format summarizing any separate Departmental entries into its master account number. |

| • | Report Order - Select the sequence in which the information will be listed. |

| • | GL Number then Department - By default, Report by General Ledger Account Number and then show the Departmental balances for each account. |

| • | Department then GL Number - Report on a Department by Department basis, with all the accounts within each department included in that departments section. |

| • | Sub-Total by GL Group - By default, all General Ledger Accounts assigned to a Group, and whose assigned accounts have active balances, will be listed along with the Group's name and a Sub-Total for each Group's balance. |

| • | Uncheck this box to have only the sub-totals for the five general ledger account types (Assets, Liabilities, Equity, Sales and Expenses). |

| • | Condensed Version - Uncheck Sub-Total by GL Group and Uncheck Show Major Division Sub-Totals the Check this box to eliminate Groups information, show the Departmental information, and show sub-totals for the five general ledger account types (Assets, Liabilities, Equity, Sales and Expenses). |

| • | Show Major Division Sub-Totals - By default, the sub-totals will be for the five general ledger account types (Assets, Liabilities, Equity, Sales and Expenses) will be included. |

| • | Uncheck this box to have only the Grand Total of Debits and Credits shown. |

| • | Print - Click the Print button  to Preview and optionally Print (to a File or a Printer) this Trial Balance Report. to Preview and optionally Print (to a File or a Printer) this Trial Balance Report. |

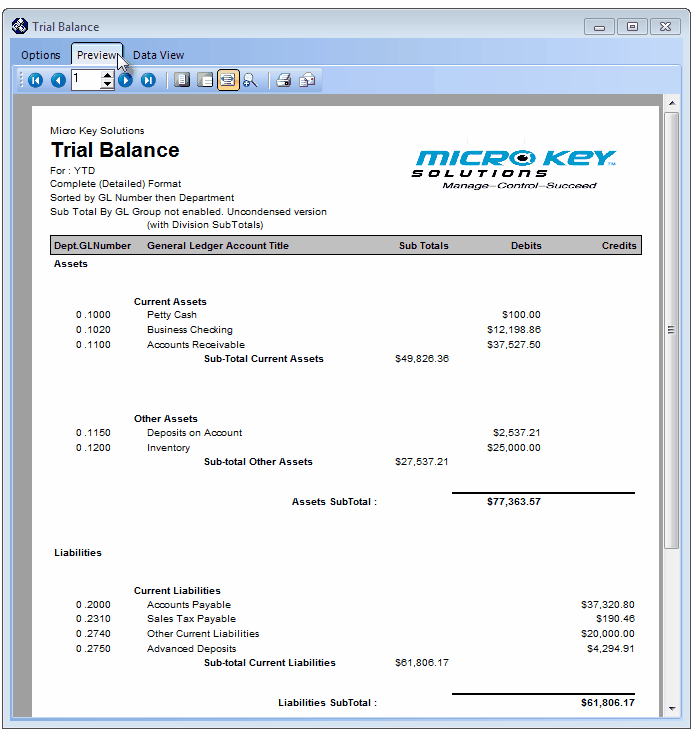

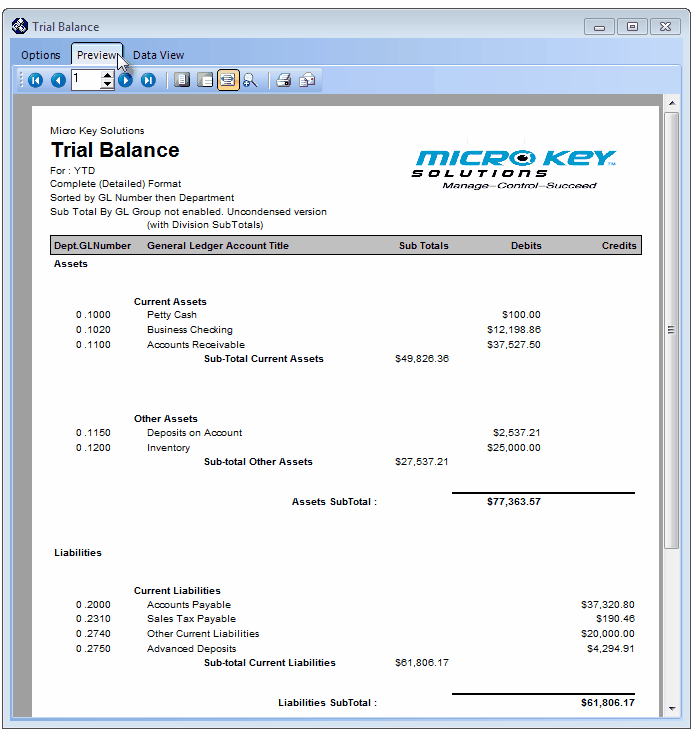

| □ | The Preview tab presents the report which resulted from the Options you've selected. |

| • | Trans ID - The Transaction Number for each entry is underlined and printed in Blue. |

| • | While Previewing the Transaction File, you may Click on any Trans ID's number to open the related Form (Receipt, Sale, Bill, Payment, etc.) which created the Transaction. |

| • | Up Arrow/Down Arrow - hi - Moves the report one line up, or one line line down, respectively. |

| • | Page Up/Page Down - Moves the report to the previous or next page, respectively. |

Trial Balance - Preview tab

| • | Arrows - The arrows allow you to move back and forth, from page to page. |

| • | Number - Indicates the page number you are viewing. |

| • | You may also type in a specific page number, Press 8 Enter and that page will be displayed immediately. |

| • | If you enter an invalid page number, it will be ignored. |

| • | Fit To Page - Click the first button after the arrows to size a full page of the report to fit the screen. |

| • | Zoom To 100% - Click the second button after the arrows to display the page at 100% (of the printed view). |

| • | Fit To Page Width - Click the third button after the arrows to size the page of the report to fit the full width of the screen. |

| • | Zoom To Percentage - Click the fourth button after the arrows to re-size the page of the report by percentage. |

| • | When you Click the Zoom To Percentage button, the Percentage selector will be displayed. |

| • | You may then Click the Up or Down ‚ arrows to set the exact amount of Zoom you want. |

| • | Print - Click the Print button to Print (to a File or a Printer)  the displayed Profit & Loss Statement, and may also be converted to a PDF or various other types of documents, or into an Excel® Spreadsheet file the displayed Profit & Loss Statement, and may also be converted to a PDF or various other types of documents, or into an Excel® Spreadsheet file |

| • | Email - Click the Email button  to send the Report to an Email Address of your choosing. to send the Report to an Email Address of your choosing. |

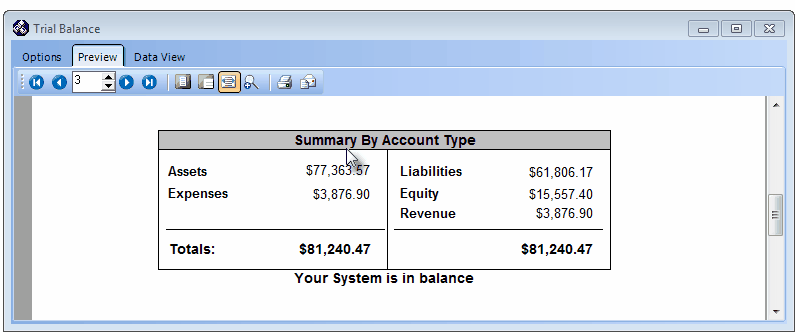

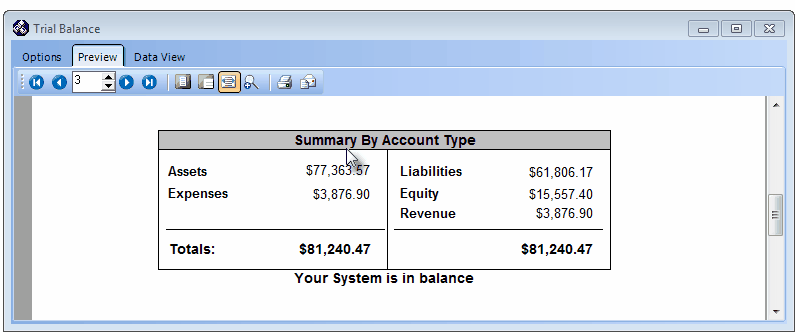

| □ | Checking the In-Balance status: |

| • | At the end of the Trial Balance Report, the Debit (Assets and Expenses) and Credit (Liabilities, Equity and Revenue) account types are compared to ensure that your system is in balance. |

Trial Balance Report - Summary By Account Type sample

| • | In the illustration above, the Trial Balance is In-Balance but the Revenue total does not equal the Expenses total. |

| • | A few words about the Trial Balance and its importance in relation to reporting for a closed month: |

| • | Carefully examine the last page of your Trial Balance. |

| ▪ | The Assets plus the Expenses account totals should equal the sum of the Liabilities, Equity and Revenue account totals. |

| ▪ | But the Expenses total should equal Revenue total. |

| • | If this is not the case, you have probably forgotten to Check the Automatically Distribute Profit or Loss for this Period box when this month was closed. |

| ▪ | Simply Re-Close the same month and be sure to Check the Automatically Distribute Profit or Loss for this Period box. |

| ▪ | Check the results on the last page (as outlined above). |

| • | If these still do not balance as noted, you almost certainly have forgotten to post Profit & Loss for a previous month. |

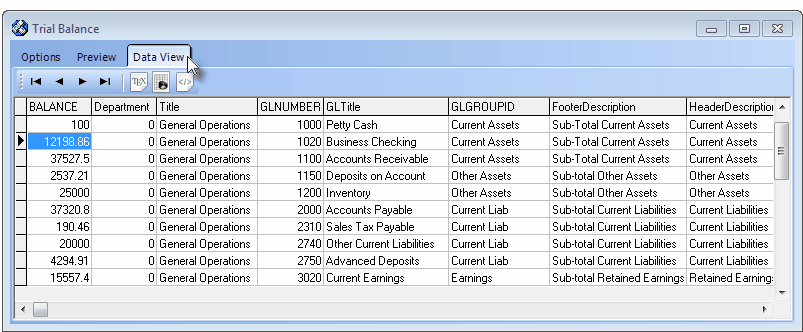

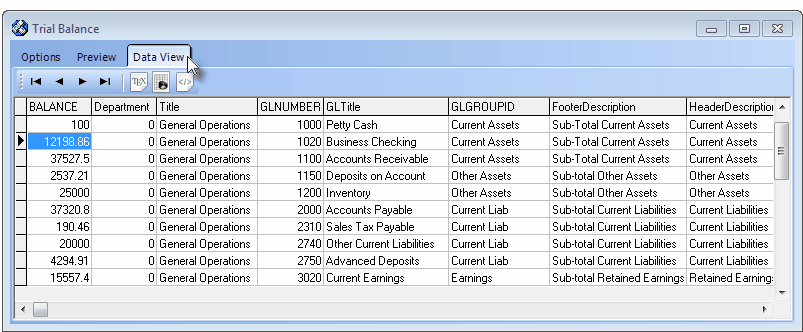

| □ | Data View - This view provides a tabular (spreadsheet style) presentation of the selected data. |

Trial Balance - Data View tab

| • | Arrows - Click the arrows to move through the record. |

| • | Export - Exporting the data from this Data View Form (note the "fly-over" help available on these buttons): |

| • | Export to CSV - Click the first button after the arrows to export the data to a Comma Separated Values (CSV) file format. |

| • | Export To Excel - Click the second button after the arrows to export the data to an Excel (.xls) file format. |

| • | Export To Html - Click the third button after the arrows to export the data to an HTML formatted file. |

| • | Exit the Form by Clicking the Close button x on the right at the top of the Form. |

![]()