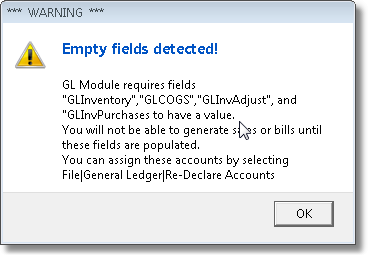

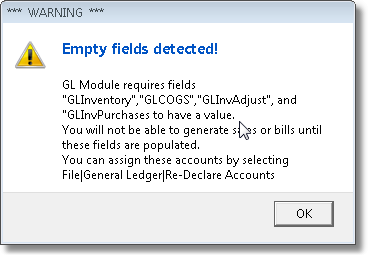

| • | Sometimes, as the result of an Upgrade being installed, you may be asked to define one or more additional Mandatory Accounts. |

Warning - Additional Mandatory General Ledger Accounts Needed

| • | On the Main Menu Select File, Choose the General Ledger sub-menu, then Click Re-Declare Accounts |

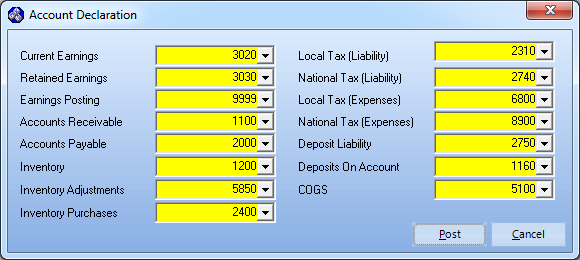

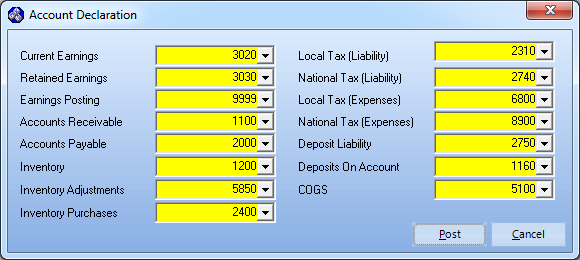

Account Declarations Form

| • | Use the appropriate Drop-Down Selection List to re-assign one or more of the Mandatory Accounts: |

| 1. | Current Earnings - An Equity Account Type numbered between 3000 and 3999. |

| 2. | Retained Earnings - An Equity Account Type numbered between 3000 and 3999. |

| 3. | Earnings Posted - An Expense Account Type numbered 9999. |

| 4. | Accounts Receivable - An Asset Account Type numbered between 1000 and 1999. |

| 5. | Accounts Payable - A Liability Account Type numbered between 2000 and 2999. |

| 6. | Inventory - An Asset Account Type numbered between 1000 and 1999. |

| 7. | Inventory Adjustments - An Expense Account Type numbered between 5000 and 9998 |

| 8. | Inventory Purchases - A Liability Account Type numbered between 2000 and 2999. |

| 9. | Local Tax (Liability) - A Liability Account Type numbered between 2000 and 2999. |

| 10. | National Tax (Liability) - A Liability Account Type numbered between 2000 and 2999 (it may not be the same as the one above, and must be defined). |

| 11. | Local Tax (Expenses) - An Expense Account Type numbered between 5000 and 9998. |

| 12. | National Tax Expenses) - An Expense Account Type numbered between 5000 and 9998 (it may not be the same as the one above, and must be defined). |

| 13. | Deposit Liability - A Liability Account Type numbered between 2000 and 2999. |

| 14. | Deposit On Account - An Asset Account Type numbered between 1000 and 1999. |

| 15. | COGS (Cost of Goods Sold) - An Expense Account Type numbered between 5000 and 9998 (it may not be the same as Inventory Adjustments, and must be defined). |

| • | Click Post to save your changes, or Cancel to abort the process. |

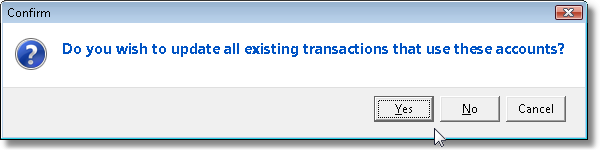

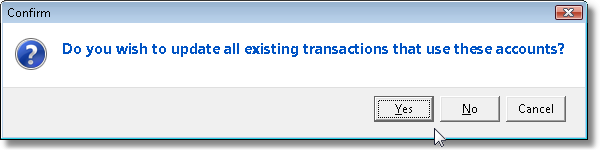

| • | In some, but not all cases, you should update the existing transactions that have been previously posted to the accounts that you changed. |

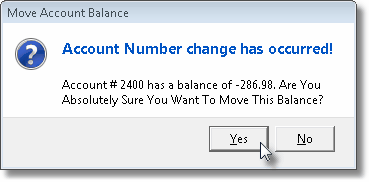

Update Transactions dialog

| • | If you answered Yes, the Net Total of All the existing Transactions, that had been posted to any Mandatory General Ledger Account that has been changed, will be transferred to the newly selected Account number (if any previous transactions in the old account numbers actually exist). |

| • | If you answered No, no transactions will be moved, no transactions will be created, but all future transactions will be posted using newly assigned (re-declared) Account numbers, as appropriate. |

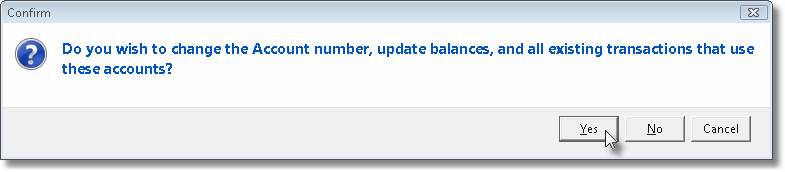

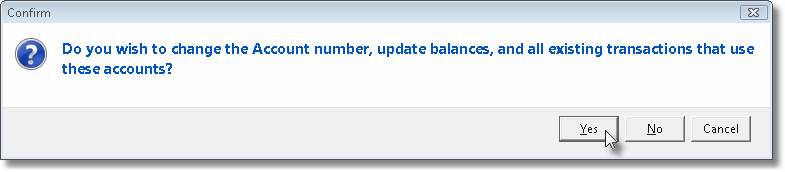

| • | As noted above, when you Re-Declare a Mandatory Account, using the Drop-Down Selection List provided, you may be changing an account that has already been used and so contains an existing balance and transactions associated with that account. |

| • | Click the Yes button to convert the balance, and any existing transactions that used the old account number, to the newly selected account number. |

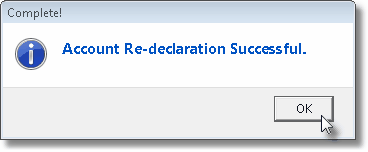

Account Re-declaration Successful!

| • | A Complete! message is displayed |

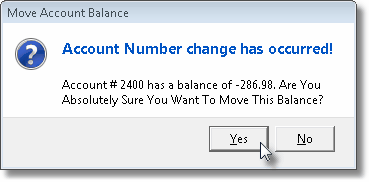

| • | Then, Confirm that you really do want to move the existing Account Balance. |

Move Account Balance confirmation message

| • | Click the Yes button to execute the account balance conversion. |

| • | Another Complete! message will be displayed. |

| • | Click the No button to keep the original set of transactions with the old account number (and just use the new account number for all future transactions). |

| • | Click the Cancel button if you've changes your mind and want to abort the Re-Declaration process. |