Running the General Ledger Setup Wizard

| ► | Note: If you have not yet done so: |

You should now Stop entering financial transaction into the MKMS Accounts Receivable and Accounts Payable modules at this time.

Central Station Monitoring operations are unaffected, and should continue.

| □ | On the Main Menu Select File and Choose General Ledger Setup. |

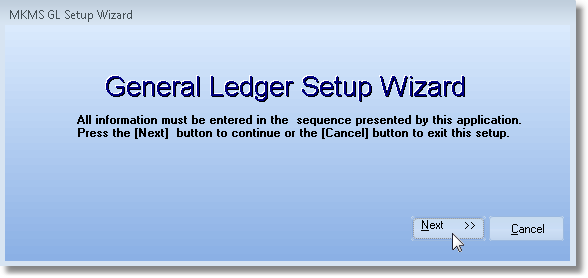

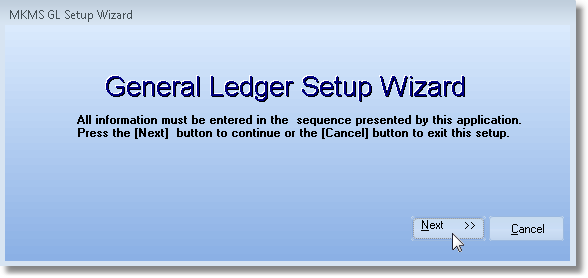

| • | The General Ledger Setup Wizard dialog will appear prompting you to Click the Next >> button. |

General Ledger Setup Wizard dialog

| • | All information must be entered in the sequence presented by the Setup Wizard and, at the completion of each step in the process, you will be asked to Click Next >>. |

| • | You may also Click Back << to return to the previous screen. |

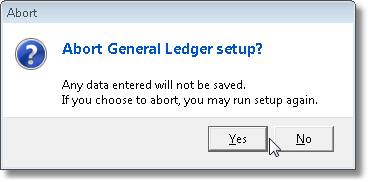

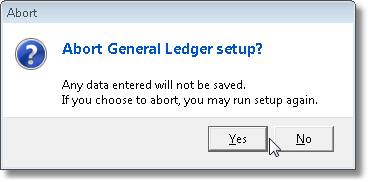

Abort General Ledger Setup?

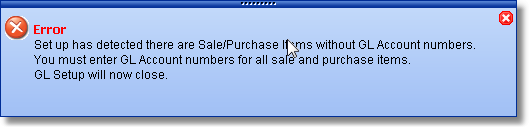

| • | If you want to abort the process at any time (because you need to supply information, or make an entry, that is required to continue as in the Error message example below), Click the Cancel button. |

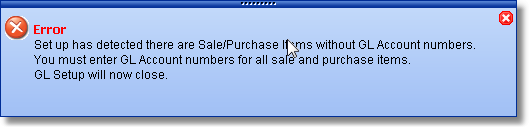

Typical error dialog box that might appear while running the Setup Wizard

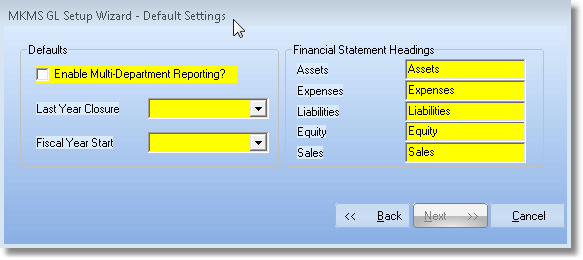

| • | Once the Setup Wizard assures that all Sale-Purchase Item have the proper accounts assigned, it displays the Default Settings Form: |

| □ | Completing the Setup Wizard |

| • | Entering your Default Settings: |

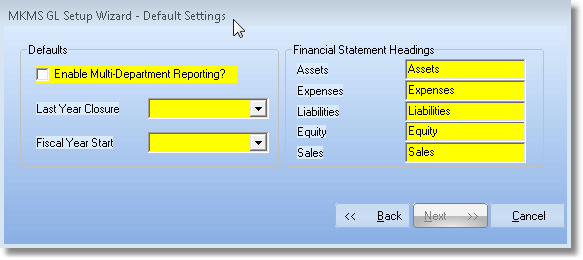

General Ledger Setup Wizard - Default Settings

| ▪ | Enable Multiple Department Reporting? - Check this box to enable the Multi-Departmental Accounting tracking feature. |

| o | Using Departments to separate financial transactions into separate Work Groups or Profit-Centers can often provide you a better, more comprehensive view of your Company's finances. |

| o | But doing so will require, that in most cases, you must enter a Department number as you enter normal transactions. |

| ▪ | Last Year Closure - Using the Drop-Down Date Selection Box provided, enter the year end date as one of either of these two options: |

| 1. | The year previous to the last year that your financial statements were not finalized for the last fiscal year. |

| ◆ | Why enter the year previous to the actual year end date? |

| ◆ | The last fiscal year has not yet been finalized in you existing General Ledger. |

| ◆ | You may have entered transactions for the current year but the previous year has not been closed. |

| ◆ | You may still have to enter transactions for the previous year in order to complete entries for the last fiscal year. |

| ◆ | When making your initial start up entries, some transactions must be dated using the previous fiscal year end date, or dates prior to what that year end date would be. |

| ◆ | So, if you identify the Last Closure Date as the real year end date, no transactions can be entered for those previous dates (if you said that fiscal year was closed). |

| ◆ | Therefore, we "trick" the system, temporarily, while running the Setup Wizard. |

| ◆ | Then you "fix" it when you make the initial entries. |

| ◆ | After making whatever entries are required for the unclosed fiscal year, using the real year end date, you will eventually close that fiscal year. |

| 2. | The actual year end date that your financial statements were finalized. |

| ◆ | Why enter the actual year end date? |

| ◆ | Your most recently closed month is within the current fiscal year. |

| ◆ | All transactions for the previous year have been completed. |

| ◆ | That year has been closed. |

| ◆ | Transactions for additional months within the current year have been entered. |

| ◆ | Therefore, unlike the case in #1 above, No transactions will be required that would have to be dated prior to, or on that year end date. |

| ▪ | Fiscal Year Start - Using the Drop-Down Selection List, Choose the Month in which your fiscal year begins. |

| • | Financial Statement Headings: Although you may change the wording, the essential meaning must remain! |

| ▪ | Assets - You may modify the Default Heading, if required. |

| ▪ | Expenses - You may modify the Default Heading, if required. |

| ▪ | Liabilities - You may modify the Default Heading, if required. |

| ▪ | Equity - You may modify the Default Heading, if required. |

| ▪ | Sales - You may modify the Default Heading, if required. |

| ▪ | When you have completed these entries, Click Next >>. |

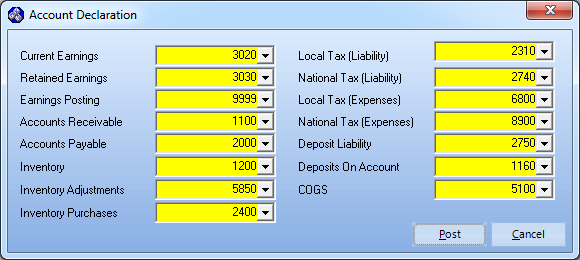

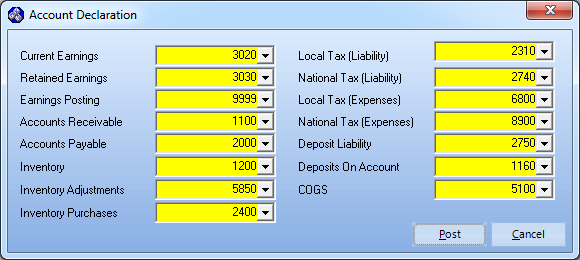

| • | Entering your Mandatory Account Declarations: |

General Ledger Setup Wizard - Mandatory Account Declaration

| • | Current Earnings - Use the Drop-Down Selection List and Choose your General Ledger Account for Current Earnings. |

| • | Retained Earnings - Use the Drop-Down Selection List and Choose your General Ledger Account for Retained Earnings. |

| • | Earnings Posted - Use the Drop-Down Selection List and Choose your General Ledger Account for Earnings Posted. |

| • | Accounts Receivable - Use the Drop-Down Selection List and Choose your General Ledger Account for Accounts Receivable. |

| • | Accounts Payable - Use the Drop-Down Selection List and Choose your General Ledger Account for Accounts Payable. |

| • | Inventory - An Asset account numbered between 1000 and 1999. |

| • | Inventory Adjustments -An Expense account numbered between 5000 and 9998 |

| • | Inventory Purchases - A Liability accounts numbered between 2000 and 2999. |

| • | Local Tax (Liability) - Use the Drop-Down Selection List and Choose your General Ledger Account for Local Sales Tax Liability. |

| • | National Tax (Liability) - Use the Drop-Down Selection List and Choose your General Ledger Account for National Sales Tax Liability. |

| • | Local Tax (Expenses) - Use the Drop-Down Selection List and Choose your General Ledger Account for Local Sales Tax Expense. |

| • | National tax Expenses) - Use the Drop-Down Selection List and Choose your General Ledger Account for National Sales Tax Expense. |

| • | Deposit Liability - Use the Drop-Down Selection List and Choose your General Ledger Account for an Advance Deposit Liability. |

| • | Deposit On Account - An Asset account numbered between 1000 and 1999. |

| • | COGS (Cost of Goods Sold) - An Expense account numbered between 5000 and 9998 (it may not be the same as Inventory Adjustments, and must be defined). |

| ► | Note: Once the Mandatory Account Declaration Form is completed (properly) the Next >> button will again become available. If not, check the following: |

| 1. | Every account number selected must be different than any other account number that has been previously selected, or you will not be able to proceed. |

| 2. | Even if you do not need the requested account (For example, if you do not collect National Sales Tax), and it currently does not apply to your style of operation, you still must enter an account number in the field (or you may use a generic Liability and/or Expense account if in your case these are unnecessary fields). |

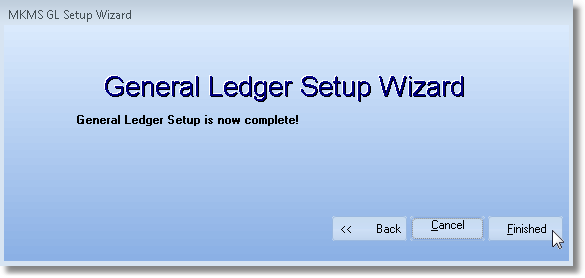

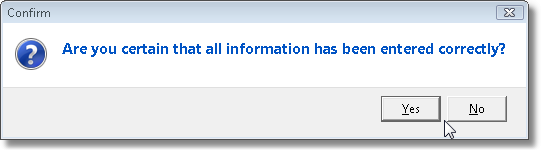

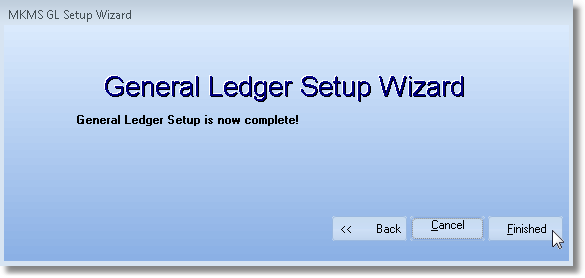

| • | Click Next >> and you will be told that you've completed the Setup Wizard successfully. |

General Ledger Setup Wizard - completion message

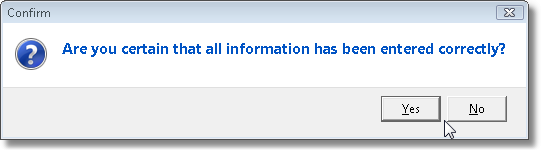

| • | Confirm that you want to save the entries (you believe they are correct and want to save them permanently) by Clicking the Yes button. |

| • | You're finished with the Setup Wizard. |

| • | Once you exit the MKMS application and return to it, the new General Ledger related sub-menus will be included in the Files and Reports menus. |

| □ | How to proceed from here: |

| • | Any future Finance Transaction, entered through either the Accounts Receivable or Accounts Payable modules, will be posted automatically - in the background - while using those modules in the normal manner. |

| • | Only the previous Finance Transactions which existed prior to running the Setup Wizard need to be posted manually. |

| • | There are basically two options for posting the manual Finance Transactions: |

| i. | Previous Year End Summary. |

| ii. | Summary of each of the Closed Months within the Current Year. |

| iii. | Summary of the transactions entered after the most recently closed month (no closing required until the month is actually completed) but before the Setup Wizard was run. |

| ▪ | It provides the most detailed General Ledger history for future reference within MKMS. |

| o | The current month's Summary of the transactions must still be posted as recommended regardless of which option is chosen. |

| 2. | Lump Sum Posting - Use the various reports outlined in the Summarizing the Startup Transactions chapter, but summarize All Transactions for all of the Closed Months (by entering the appropriate Date Range) and only post those combined summary values. |

| ▪ | Three sets of Journal Entries would be entered: |

| i. | Previous Year End Summary. |

| ii. | Summary of all Closed Months for the Current Year. |

| iii. | Summary of the transactions entered after the most recently closed month. |

| ▪ | This is the method will only provide Financial Statements as a summary of the all the transactions for the Closed Months. |

| ▪ | It provides a basic summarized history for future reference within MKMS. |

| o | The current month's Summary of the transactions must still be posted as recommended regardless of which option is chosen. |

| • | When must this Posting be done? The timetable for completing these entries - whichever method you choose - is not as "immediate" as you might think. |

| • | Once the Setup Wizard is successfully run, all future financial transactions will be posted to the General Ledger System immediately. |

| • | This means that whether you make all of these "startup entries" before you continue using the Accounts Receivable and Accounts Payable financial modules, or make them in an "as time allows" process makes no difference. |

| • | As long as you have your Transaction Summary spreadsheet documents which contain all of the needed itemized Month End Summarized Transactions (as detailed in the "Summarizing the Startup Transactions" chapter), the actual posting of these transactions may be done at any time in the future. |

| • | But, the sooner the better! |