|

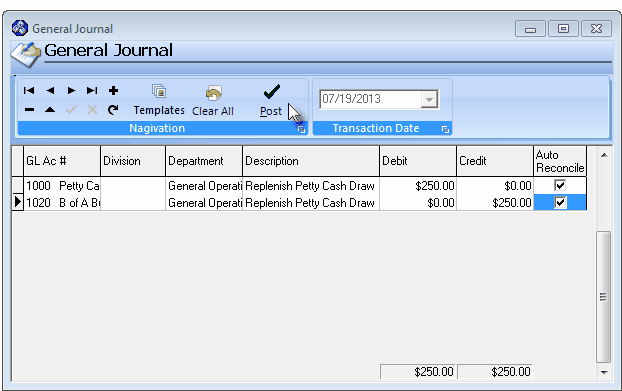

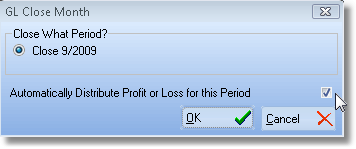

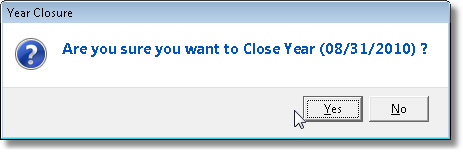

General Ledger Startup Transaction Entries This Help File Page was last Modified on 11/08/2013 |

|

|

|

|

General Ledger Startup Transaction Entries This Help File Page was last Modified on 11/08/2013 |

|

|