A Overview of the Final Start Up Entry Procedures

| □ | Summarizing the Transactions from the Accounts Payable and/or Accounts Receivable module's Reports is a multi-step process where you will post each month's Accounts Payable and Accounts Receivable module's Report's data calculated by using the Summarizing Transactions method (outlined below and described in detail afterwards), posting a summarized set of Financial Transactions one month at a time, until you've finished the process by posting the current month's Financial Transactions. |

| • | An Outline of this process is shown here (a more detailed set of instructions in the "Creating Summarized Transaction Reports" and "Posting the Summarized Transactions" sections is provided later in this chapter). |

| 1. | Create the Summarized Transactions, one month at a time, dating each set the last day of that month (see the "Creating the Summarized Transaction (Reports)" section below). |

| 2. | Post the Summarized Transactions, one month at a time, dating each set the last day of that month, into the General Journal (see the "Posting the Summarized Transactions" section below). |

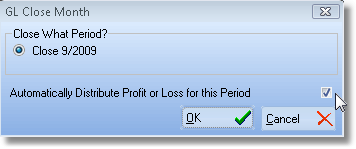

| ▪ | Close the General Ledger one month at a time. |

| ▪ | Request to Automatically Distribute the Profit/Loss for this Period |

| ▪ | If additions and/or corrections are made, Re-close the month. |

| ▪ | Be sure that you request to Automatically Distribute the Profit/Loss for this Period. |

| 6. | You'll record these Summarized Transactions until you've posted them for the current month. |

| 7. | You will not close this (current) month until the month has actually passed. |

Creating the Summarizing Transaction (Reports)

| □ | Print the appropriate Accounts Receivable related summary reports for each month following the Month Ending Date of the initial set of Financial Statements: |

| • | Print the Cash Receipts Summary by Month report identifying the Month and Year (the Date Range covering the month being Summarized) for Each Bank (one Bank at a time), with each Bank specific report covering All Batches and no specified Division. |

| • | Based on the method adopted to Pay the Company's Sales Tax Liability, print either: |

| 1. | The Summary Report Type of the Sales Taxes Invoiced Report specifying the Date Range covering the month being Summarized, for All Divisions or One Division at a time, based on whether Company operational methods makes this the best way to determine how much, and to whom the Sales Tax Liability must be paid. |

| 2. | The Summary Report Type of the Sales Taxes Collected Report specifying the Date Range covering the month being Summarized, for All Divisions or One Division at a time, based on whether Company operational methods makes this the best way to determine how much, and to whom the Sales Tax Liability must be paid, and including All Payment Types. |

| • | Complete the steps above for the current month's Accounts Receivable related reports, but do not Close this month. |

| □ | Print the appropriate Accounts Payable related summary reports for each month following the Month Ending Date of the initial set of Financial Statements: |

| • | Print the Check Register specifying the Date Range covering the month being Summarized, for Each Bank (they can be listed separately) and Payments Only, |

| • | Print the Summary Report format for the Purchase Analysis Report ordered by Purchase Item, specifying the Date Range covering the month being Summarized, and for ALL of the other selection options. |

| • | Print the Summary Report format for the Taxes Billed Report specifying the Taxes Billed Date Range covering the month being Summarized |

| • | Finally, for the Current Month complete the steps outlined above for the current month's Accounts Payable related reports, but do not Close this month. |

Posting the Summarized Transactions

| • | Following the three Steps listed below, you will be able to bring the General Ledger System up the current month and start using it. |

Step 1. Post the Summarized Transaction Reports - one month at a time.

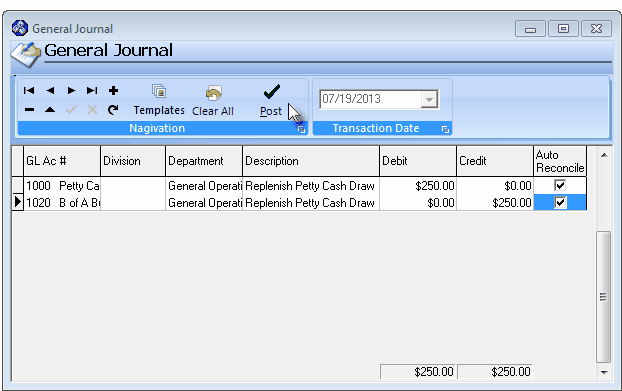

| • | Make your entries dated on the last day of the Month for each Month's Summarized Transactions which are being recorded in the General Journal. |

| • | To start that process, on the Main Menu Select File, Choose the General Ledger sub-menu, then Click General Journal. |

General Journal entries

| • | Completing one month at a time, using the Summarized Transactions Reports, make the appropriate Debit and Credit entries in the General Journal until you have completed all of the General Journal entries for those Summarized Transactions Reports. |

| ► | Note: Saving General Journal Transaction Entries for completion at a later time: |

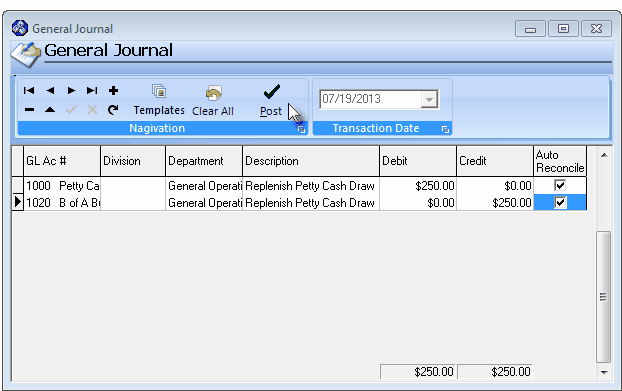

| ▪ | If you have not completed the required General Journal Entries but need to leave this Form temporarily, Close the General Journal Form (but Do Not Click the Postübutton). |

| ▪ | The current set of General Journal Transactions Entry will be saved until you return to this General Journal form (see "Returning to an unfinished General Journal Entry" in the General Journal Entries chapter for more information). |

| □ | Summarizing the Accounts Receivable related Transactions for each Month following the Month Ending Date of the initial set of Financial Statements |

| • | Debit the Total Cash Receipts to the appropriate Bank (Cash) account. |

| • | Credit the Total Cash Receipts to your Deposits Liability account. |

| o | Repeat this process for each General Ledger Account representing one of those Banks, entering the transactions noted above on a Batch Number by Batch Number basis, until all the Batches have been recorded. |

| • | In addition, Maintain a List of each month's Total Cash Receipts on a separate paper, noting the Month and Year, and the Amount Paid. |

| ▪ | Be sure to also include the Current Month's Receipts, when you get to that step (see "Summarizing the Current Month for Accounts Receivable Transactions" below). |

| ▪ | When you finally summarize the current month, you will re-distribute these Receipts, to different accounts. |

| ▪ | Deposits for the Current Month, that have not been applied (Allocated), will be entered separately. |

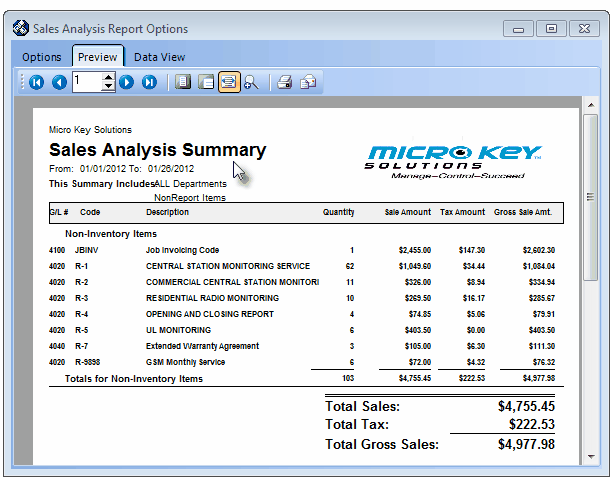

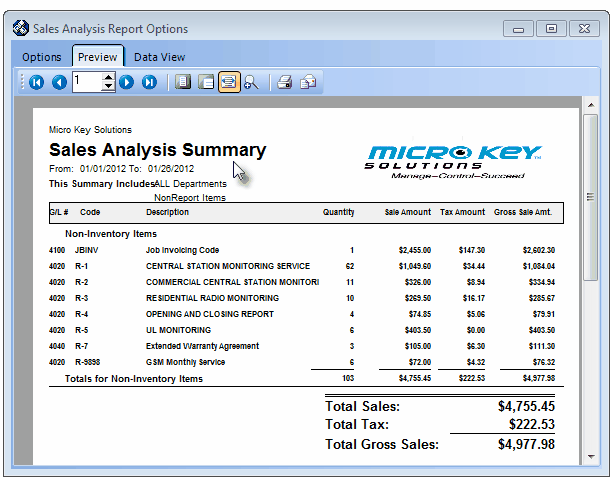

| • | Debit your Accounts Receivable account for the Total Gross Sales (the sum reported at the very end of the report). |

| • | Credit each Tax Amount to the appropriate Sales Tax Liability Account. |

| ▪ | When all of these entries are completed, the sum of the Total Sales plus the sum of the Total Tax (the Credit entries) must - and will - equal the Total Gross Sales (Debit entry) in the Accounts Receivable Account. |

| • | If you must charge both a Local and a National Sales Tax, as stated above, you will initially apply (see "Credit each Tax Amount" above) all of that Sales Tax to the Local Sales Tax Liability account. |

| ▪ | If you reimburse the Sales Taxing Authorities on an "as Billed" basis, see "Sales Taxes Invoiced Report" below to learn how to appropriately re-distribute the National Sales Tax portion to the National Sales Tax Liability account. |

| ▪ | If you reimburse the Sales Taxing Authorities on an "as Collected" basis, see "Sales Taxes Collected Report" below to learn how to appropriately re-distribute the National Sales Tax portion to the National Sales Tax Liability account. |

Sales Analysis Summary Report - Preview tab

| • | If you only charge a Local (State) Sales Tax, there is nothing more to do. |

| • | If you must charge a Local and a National Sales Tax: |

| ▪ | Initially you entered all of the taxes in the Local Sales Tax Liability account. |

| ▪ | Referring to the Sales Taxes Invoiced Report: |

| o | Debit the Local Sales Tax Liability account for the Amount of the National Sales Tax (GST, VAT, etc.) shown on the Sales Taxes Invoiced Report. |

| o | Credit the National Sales Tax Liability account for the same amount of the National Sales Tax. |

| • | If you only charge a Local (State) Sales Tax, there is nothing more to do. |

| • | If you must charge a Local Sales Tax and a National Sales Tax: |

| ▪ | Initially you entered all the the taxes in the Local Sales Tax Liability account. |

| ▪ | Referring to the Sales Taxes Invoiced Report: |

| o | Debit the Local Sales Tax Liability account for the amount of the National Sales Tax (GST, VAT, etc.) |

| o | Credit the National Sales Tax Liability account for the amount of the National Sales Tax. |

| • | Then, for the current month only: |

| • | Re-distribute the Receipts using the following calculation: |

| ▪ | Subtract the remaining unapplied Deposits (not including the value of the Credit Memos) from the Total Cash Receipts (for multiple Bank Account users, this is the sum of the values accumulated on the separate piece of paper for all of the Total Cash Receipts). |

| ▪ | The result will be your "Net Cash Receipts". |

| ▪ | Enter these transactions: |

| o | Debit the Deposits Liability account for the amount of the Net Cash Receipts. |

| o | Credit the Accounts Receivable account for the amount of the Net Cash Receipts. |

| • | Click the Postübutton to save the completed set of ("in-balance") General Journal entries. |

| □ | Summarizing the Accounts Payable related Transactions for each Month following the Month Ending Date of the initial set of Financial Statements |

| ► | Note 1: Print Checks - Be sure that you have printed all unprinted Checks before attempting to summarize the Accounts Payable transaction information. |

| • | Debit your Accounts Payable account for the sum of all the Checks written and printed (the sum all the items in the Check Register). |

| • | Credit the value of the Checks written and printed to each General Ledger Account representing a Bank Cash account from which those Checks were drawn. |

| ▪ | If you are using multiple Bank accounts for Check based Payments, repeat this transaction process until you have entered the sum of each Bank account's Payments. |

| ▪ | Do not repeat the Debit entry, as that single Debit entry should have encompassed the entire amount of all the Payments. |

| • | Debit each Purchase Category's Purchase Amount to its specific Purchases Expense Account |

| • | Credit your Accounts Payable account for the Total Purchases (the sum reported at the very end of the report). |

| • | If you are only charged Local (State) Sales Tax: |

| ▪ | Debit the total amount of the Sales Taxes that were billed to the Sales Tax Expense Account |

| ▪ | Credit the total amount of the Sales Taxes that were billed to the Accounts Payable Account. |

| • | If you were charged a Local and a National Sales Tax: |

| ▪ | Debit the Grand Total for the Local Tax Sales Taxes that were billed to the Local Sales Tax Expense Account. |

| ▪ | Debit the Grand Total for the National Tax Sales Taxes that were billed to the National Sales Tax Expense Account. |

| ▪ | Credit the sum of both the Local and National Grand Total Sale Tax amounts billed to your Accounts Payable Account. |

| • | Complete the steps outlined above for the current month's Accounts Payable related reports. |

| • | Then, for the Current Month only: |

| ▪ | Credit the amount in the Total Payments column from that Bank's General Ledger Account from which the Checks were drawn. |

| • | Ignore the Total Credits column as these amounts are taken into consideration in the Purchases Analysis Report (see "Purchase Analysis Report" above). |

| • | Click the Postübutton to save the completed set of ("in-balance") General Journal entries. |

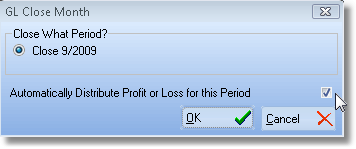

Step 2. Unless this is the Current Month which, during normal operation, will not be Closed until some time has passed after the Month is over, Close the Month that you have just entered in the General Journal.

| • | On the Main Menu Select File, Choose the General Ledger sub-menu, then Click Month Close. |

| • | If this is the first month of the new Fiscal Year, you will only be offered the opportunity to Close that Month. |

| • | However, if you have closed previous months, you will be offered the opportunity to Re-Close a previous Month, or Close the latest Month. |

| • | Choose to Close the latest month |

| • | Check Automatically Distribute Profit or Loss for this Period. |

GL Close Month dialog

Step 3. If this is not the Current Month, Make any Additions or Corrections entries that may be needed using the General Journal.

| • | Check Automatically Distribute Profit or Loss for this Period. |

| • | If this is the Current Month, no additional General Journal entries, or Month Closing Procedures are required beyond what was already done in Step 1. above. |

| □ | Now you must Start using MKMS! |

| • | Start entering accounting information in MKMS again in the normal manner. |