| □ | This General Ledger Procedures chapter (and its associated sub-chapters) is provided for the active User(s) of the MKMS General Ledger System module. |

| • | It contains information relating to actively entering, altering, closing and reporting the Financial Transactions contained in the General Ledger System. |

| • | This MKMS General Ledger System is quite flexible, allows multiple months to be open at the same time, and even permits re-closing the most recently closed month again - just in case additional (adjustment) transactions were required for that month. |

| □ | There are two types of Financial Transactions that occur within the MKMS General Ledger System each of which is outlined below, then explained in detail later in this chapter. |

| 1. | Automatically Posted Transactions where the User is not required to enter any of the General Ledger Account Numbers for the transactions as they are posted such as: |

| 2. | Manually entered or initiated Financial Transactions where the User is required to enter the General Ledger Account Numbers such as: |

| a. | Using the General Journal Form (where the user manually enters a combination of Debit and Credit transactions to record an adjustment), post a transaction that is not accommodated in the automatic part of the system, enter accountant directed end-of-month entries, or make start-up entries that establish initial balances within the General Ledger. |

| b. | Using the Payroll Import, or using either the Regulus Import or Custom Import options, to insert a series of Financial Transactions (imported in a specifically designated format), and/or to post a batch of Financial Transactions from an outside service (also imported in a specifically designated format). |

| □ | Automatically Posted Transactions create at least two, but sometimes more, Debit and Credit entries. |

| • | Examples of the General Ledger's automatic Financial Transaction postings from within the Accounts Receivable module are: |

| • | Entering a Sales Invoice - The Invoice is started, a Sale Date, and Invoice Number (among other information) are inserted in the Invoice's header file. |

| ▪ | As Detail Line Items are added, the result of the per unit Amount times the Quantity Billed for each item is a Credit (added) to the Sales Category Code's assigned General Ledger Account Number, along with the Invoice's Sales Transaction Date and Invoice Number for reference. |

| ▪ | The opposing transaction is a Debit (added) for that same Amount and is posted to the Accounts Receivable Account that was identified when the General Ledger Setup Wizard procedure was executed. |

| ▪ | But, if this is a Credit Memo being created, because the Quantity will be a minus value, the Amount posted will be a minus value as well, and so - technically speaking - the Sales Account, which is by definition a Credit Account, will be Debited instead (because when you are subtracting from a Credit Account, the phrase used for reducing a Credit Account is "Debiting a Credit Account"); and therefore the Accounts Receivable Account will be Credited. |

| ▪ | So, until the Receipt is Allocated to an outstanding Invoice (see the "Allocating a Receipt" information immediately below), the "Deposit" transaction is posted (Credited) as a Deposit Liability Account (a Credit Account), and Debited (Added) to your selected Bank Account which has a General Ledger Account assigned to it (a Debit Account). |

| ▪ | The transaction Debits (subtracts the Amount of the "Deposit" from) the Deposit Liability Account (a Credit Account), |

| ▪ | Then, Credits (subtracts the Receipt Amount from) the Accounts Receivable Account (which is a Debit Account). |

| ▪ | The net result is that the monies stay in your Bank Account, and the Accounts Receivable Amount due for that Invoice is removed - because that Invoice was now marked as paid. |

| ▪ | The Trash Can icon is used to delete a Detail Line Item that was entered incorrectly or is not needed. |

| ▪ | Just Drag and Drop the Detail Line Item to be deleted onto the Trash Can Icon. |

| ▪ | By doing so, the system will automatically: |

| o | Credit (subtract the Sales Amount from) the Accounts Receivable (Debit) Account, and |

| o | Debit (subtract the Sales Amount) from the Sales (Credit) Account, for the Amount of that Detail Line Item. |

| • | Examples of the General Ledger's automatic Financial Transaction postings from within the Accounts Payable module are: |

| • | Entering a Purchase - As the Bill is entered, the Purchase Date and Invoice Number (among other information) are inserted in that Invoice's header file. |

| ▪ | As you add Detail Line Items, the Amount of that entry - the result of the per unit Amount (being charged) times the Quantity of each item that was Purchased - is posted to the Purchase Category Code's assigned General Ledger Account Number Expense (Debit) Account, along with the Expense's Transaction Date and Vendor's Invoice Number for reference. |

| o | If this is a Credit Memo being created, because the Quantity will be a minus value, the Amount posted will be a minus value as well, and so - technically speaking - the Expense Account which is by definition a Debit Account will be Credited (because when subtracting from a Debit Account, the phrase used is Crediting a Debit Account). |

| ▪ | The opposing transaction is a Debit for that same Amount posted to the Accounts Payable (Credit) Account identified when you ran the General Ledger Setup Wizard procedure. |

| • | Entering a Payment for a Vendor - When Payments are posted, they are treated as if they were Advance Deposits until they a specifically applied to Invoice(s). |

| ▪ | The Payment is subtracted (Credited) from the Asset Account for that Bank Account (a Debit) Account from which the Check was drawn, and added (Debited) to Deposits on Account (a Debit Account) until an Invoice is selected to which the Payment is to be Applied. |

| ▪ | The net result is that the monies were simply subtracted (Credited) from one Debit Account - the "Bank Account", and added (Debited) to another Debit Account - the "Deposits on Account" - within the same Asset Transaction Type - with no net change in total value of your Assets. |

| ▪ | That Payment Amount is subtracted (Debited) from your Accounts Payable (Liability) Account (a Credit Account), and subtracted (Credited) from Deposits on Account (a Debit Account) because this Deposit is now applied (used up) by paying off a specific Invoice from a Vendor. |

| • | Deleting a Detail Line Item on a Vendor's Invoice - Many times you will need to remove an item from an existing Bill from a Vendor because of an adjustment or an item that was not actually received. |

| ▪ | The Trash Can Icon is used to delete a Detail Line Item which was entered incorrectly or is not needed. |

| ▪ | Just Drag and Drop the Detail Line Item to be deleted onto the Trash Can Icon. |

| o | Debit (subtract the Purchase Amount from) the Accounts Payable (Credit) Account, and |

| o | Credit (subtract the Purchase Amount) from the Expenses (Debit) Account, for the Amount of that Detail Line Item. |

| □ | Manual Transactions are those that a User enters manually, or starts a process that initiates a batch of transactional data entries in the General Ledger System, or simply examines for accuracy. |

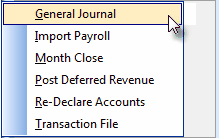

File Menu - General Ledger options

| • | From the Main Menu Select the File Menu and Choose General Ledger to view a list of options which provide the following manual and batch processing features: |

| 1. | General Journal Entries - Except for the start-up process, General Journal entries are generally adjustment entries suggested by your accountant (such as entries for Depreciation and Inventory "shrink", or for posting end-of-year Retained Earnings). |

| ▪ | General Journal Templates - Templates for repetitively posted transactions - entered through the General Journal - may be predefined to ensure that these types of entries are always posted in the same manner. |

| 2. | Payroll Import - A batched transaction that includes all Debit and Credit transactions for a Payroll Period supplied by an outside Payroll service. |

| • | Other procedures which generate a batch of transactions: |

| • | Import Payments - A process whereby a batch of Receipts which were pre-processed by a drop box service may be imported and posted as individual Receipts to each Subscriber's account, automatically. |