An Overview of Earned & Deferred Revenues

| □ | Earned and Deferred Revenue Tracking is a somewhat complex accounting concept (one of many that are designed to ensure full employment for accountants). |

| • | Within the context of the accounting procedures that most of us are familiar, every Sales Invoice that is issued would normally be considered "earned" when it is created (i.e., you're billing someone or some company for something they've purchased and, in most cases, have already received from your Company such as a Work Order, or a new System Installation). |

| • | This is because the Sales Invoices for Recurring Services (e.g., Monitoring Fees, Service Contracts, Opening & Closing Reports) are almost always printed and mailed a month (or a least a week or so) in advance of when the period of service (for which they are being billed) actually begins. |

| • | So technically, if the Receipts for those Recurring Revenue Invoices - are posted before the entire period of service (for which they were Invoiced) has passed: |

| ▪ | The required Recurring Services that was paid with those Receipts has not yet been provided (or not provided completely). |

| ▪ | Therefore, from an accounting standpoint, the income which you received for those Recurring Services (or at least a portion of that income), could - and probably should - be considered unearned when you received it. |

| • | Obviously, once you have fully provided those Recurring Services, all of those Recurring Revenues associated Receipts are earned. |

| • | In summary, Revenue billed is not fully Earned until the service - for which the Subscriber was billed - has been fully provided. |

| • | Therefore, the Company's "books" should reflect in some manner, that the Revenues Received for those Services are Deferred (not recognized as Earnings), until the Period of Time your Company is required to provide those Services, has expired. |

| □ | An example of tracking Deferred - and subsequently Earned - Revenue |

| • | A Subscriber is billed "Quarterly" on the 15th of the month preceding the beginning of their (billed for) service period. |

| • | They pay on time - remember this is only an example, so stop laughing. |

| • | Therefore, by paying on time they have actually paid "in advance" for the full service period that was billed for those services. |

| • | So, the Company has billed for, and received payment for, services which the Company has not yet provided. |

| • | This means that this Revenue should - for accounting purposes - be Deferred (i.e., not recognized as a Sale) until it has actually been Earned. |

| • | Until the three months (the "Quarterly" service period for which they were billed for services) has passed, the money received for those services may already be (and in reality probably has been) spent - without fully providing those required (billed for) services. |

| • | In fact, you are only earning one month of their prepayment at the end of each month within the service period for which they were billed. |

| • | So, at the end of each month, one month's worth of that prepayment Revenue is Earned, and this continues until the service period - for which the Subscriber has paid in advance - has been provided. |

| • | At that point, the "billed for" service period has been fully provided by the Company (and consumed completely by the Subscriber) so all of that prepayment Revenue is now Earned.. |

| □ | Why did we put you through this exercise? (Who - except Einstein - likes this kind of "thought experiment" anyway?) |

| • | Growing companies - by the nature of that growth - enjoy increasing revenues month over month, and year over year. |

| • | If some (and often much) of this revenue is from Recurring Services (e.g., Monitoring, Service Contracts, Opening & Closing Reports), and most - if not all of these services - are billed in advance as Recurring Revenues, you may be able to "defer" some of this unearned income (for the portion of the service period that is not yet Earned) until the following tax year. |

| • | Generally, this is a good thing because the value of money declines over time, and in the meantime, you may actually be using, and/or earning interest on that Recurring Revenue. |

| • | Plus, when any Revenue is able to be Deferred into the following tax year, you don't have to pay taxes on that Revenue on the current year's tax return. |

| ► | Important Note: This is actually legal - ask your accountant! |

| □ | The Problem (Why doesn't every one do this?) |

| • | Earned and Deferred Revenue Tracking can be very difficult, and extremely time-consuming to calculate! |

| • | If you have not automated this process, it would probably cost you as much to accurately calculate your Earned and Deferred Revenues as you would save in Taxes. |

| □ | The Solution - Set up properly, MKMS will calculate the Earned & Deferred Revenue as part of its Recurring Revenue Billing and subsequent Post Deferred Revenue processes - with virtually no additional effort required on your part. |

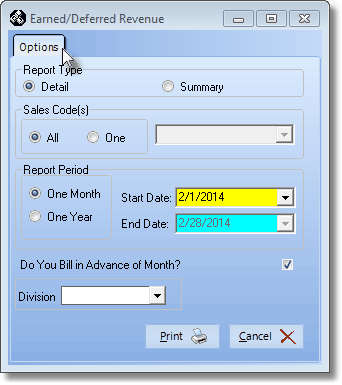

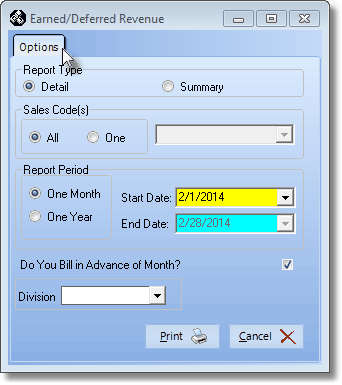

Earned/Deferred Revenue Options dialog

| • | If you are manually posting Earned and Deferred Revenue to an "outside" General Ledger, the Earned/Deferred Revenue Report (see illustration above) provides you with the Earned and Deferred Revenue Tracking results. |

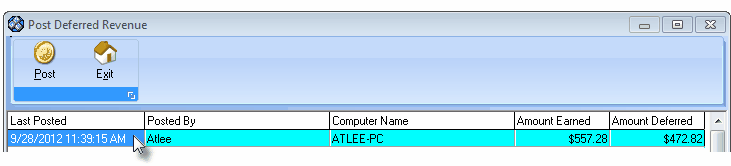

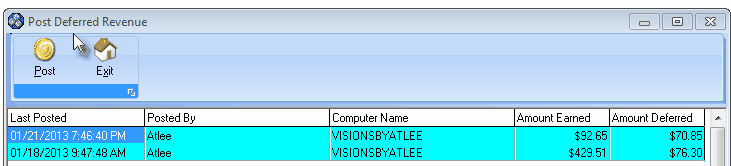

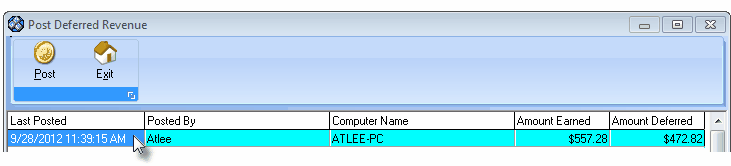

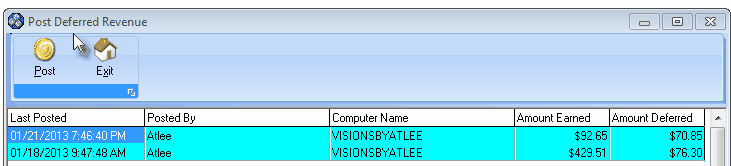

Post Deferred Revenue dialog

Automating the Earned & Deferred Revenue Tracking Process

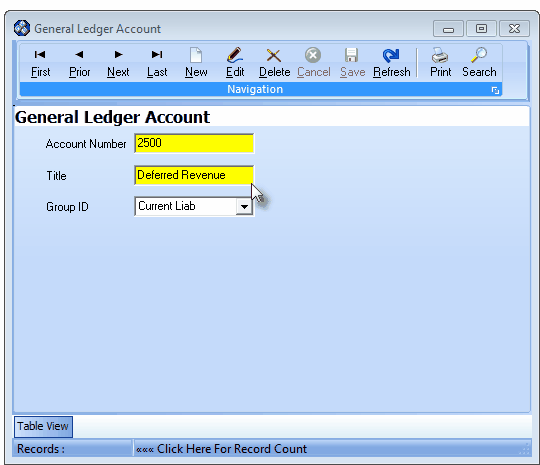

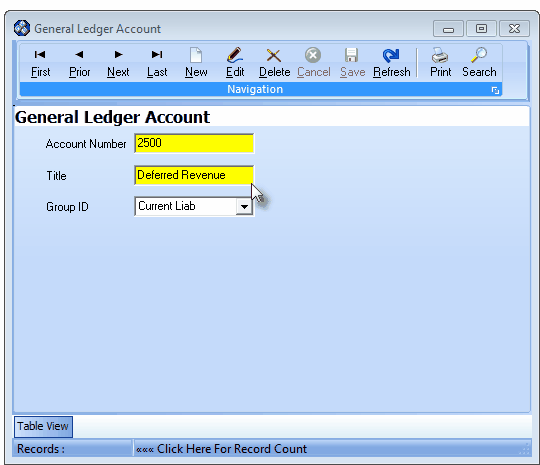

General Ledger Account Form - Deferred Revenue Account

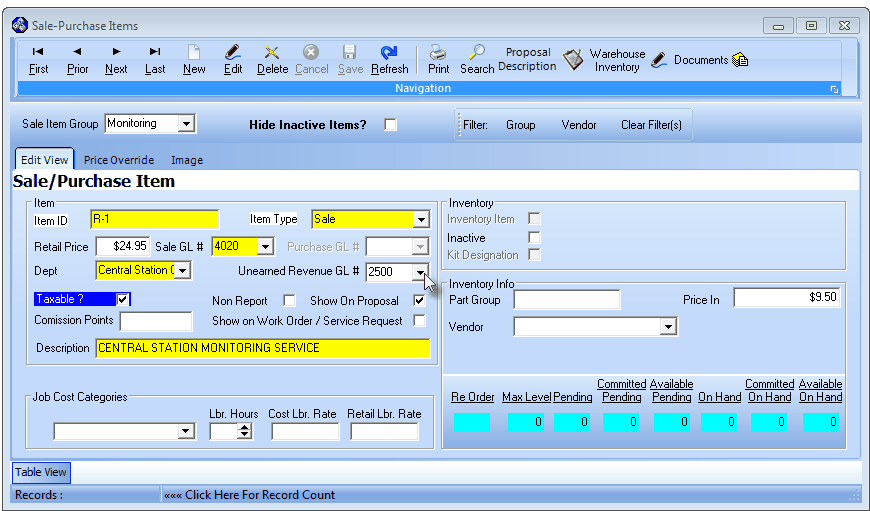

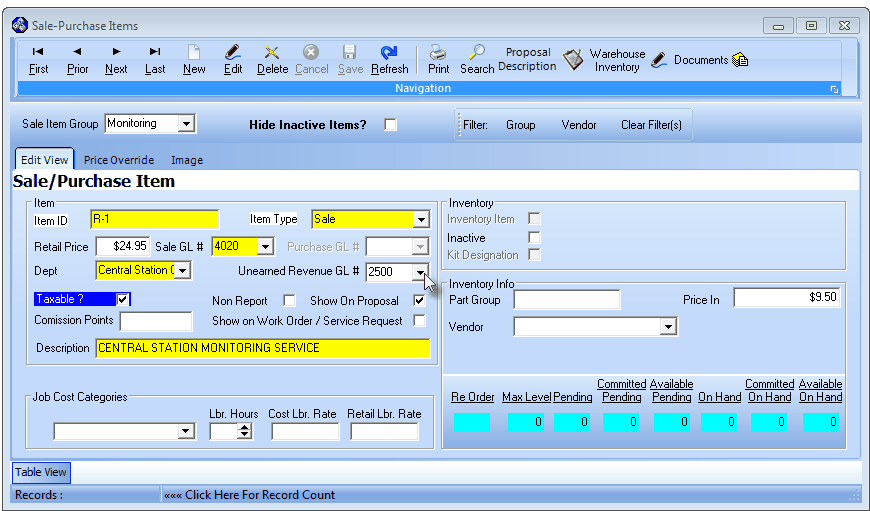

Sale-Purchase Item Form - Unearned Revenue GL# field

| • | The Gross Total Value (Total Value = [the (Detail Line Item's Sales Value which is Quantity * Price) + (Sales Tax Rate * that Detail Line Item's Sales Value)] of each Detail Line Item is posted (added) to the General Ledger System's Accounts Receivable Account. |

| • | The Sales Value (Quantity * Price) of each of those Detail Line Items will be posted (added) to the Deferred Revenue General Ledger Account instead of the General Ledger Sales Account - that Deferred Revenue Account Balance will be increased (a Credit will be posted to the designated Deferred Revenue Liability Account) for the Value of each of those Detail Line Items. |

| • | The Sales Tax Value (Sales Tax Rate * that Detail Line Item's Sales Value) is added to the Sales Tax Payable Liability Account. |

| • | The Value of the Detail Line Item's internal Earned Revenue field is initially set to $0.00. |

| □ | Deferred/Earned Revenue Processing: |

Post Deferred Revenue dialog

| ▪ | The proportioned Earned Revenue Amount for each Detail Line Item is Posted (added) to the Detail Line Item's internal Earned Revenue field's balance. |

| ▪ | The Invoice Header of any Invoice with a Recurring Revenue Sale (i.e., containing one or more Detail Line Item(s) assigned one of these Recurring Revenue Sale-Purchase Items) will also have the currently calculated Earned Revenue Amount Posted (added) to its internal Earned Amount field. |

| ▪ | So, the Invoice Header will contain (internally) the updated Total of all of the Earned Revenue for that Invoice. |

| • | Any change in the Deferred Recurring Revenue (meaning any newly calculated Earned Recurring Revenue) will be: |

| • | Subtracted (this will be Debit to the Deferred Revenue Liability Account) and |

| • | Added to the Sales Account associated with the Recurring Revenue Sale-Purchase Item (which will be a Credit to that Sales Account). |

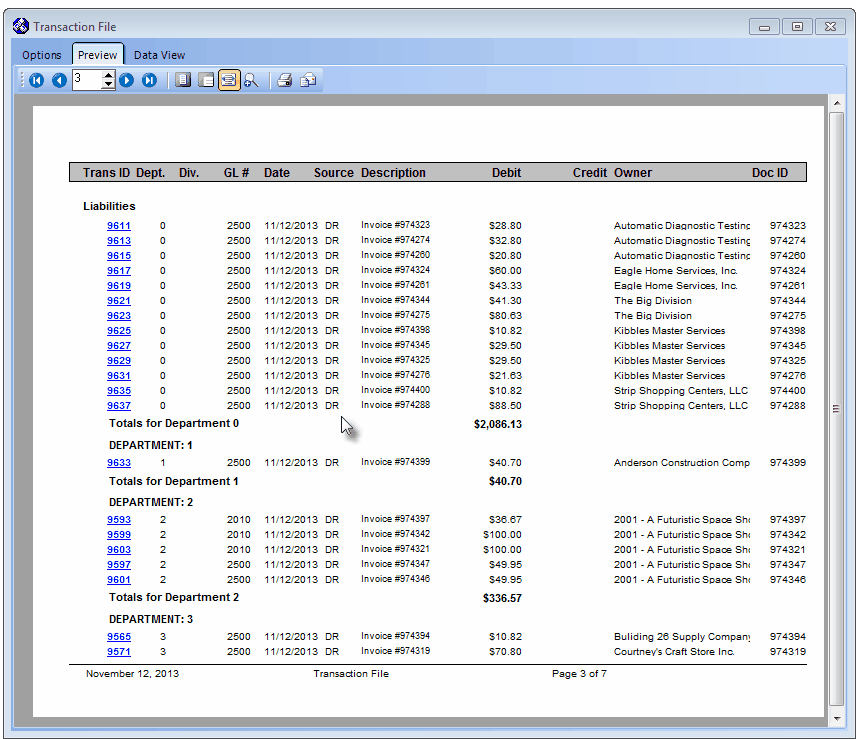

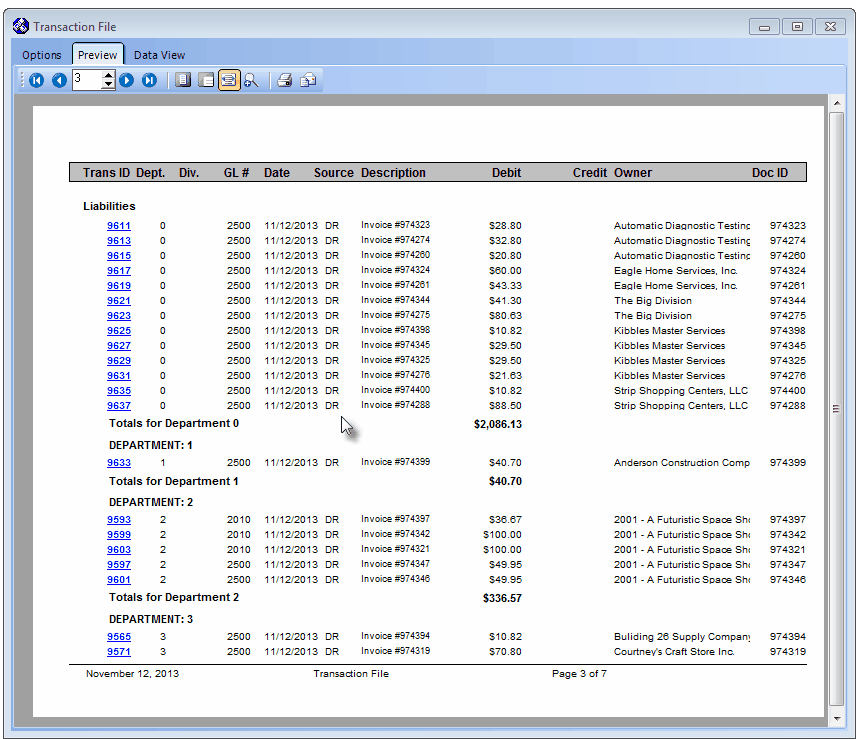

Transaction File Report - Preview tab - Deferred Revenue entries

| o | Deferred Revenue as "DR" in the Source column for each of these (Deferred Revenue) Credit entries (as shown above) |

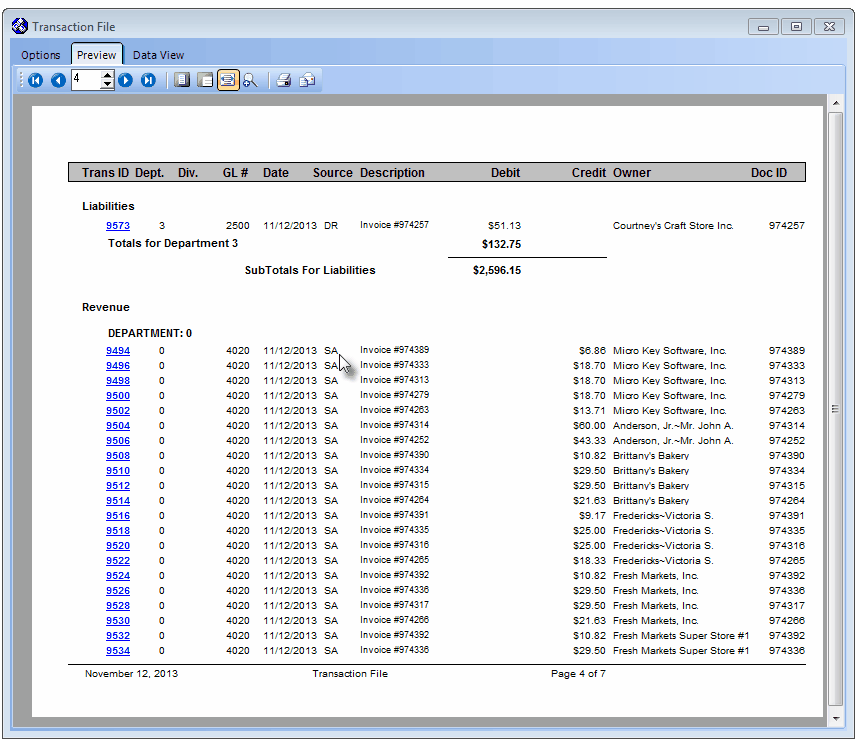

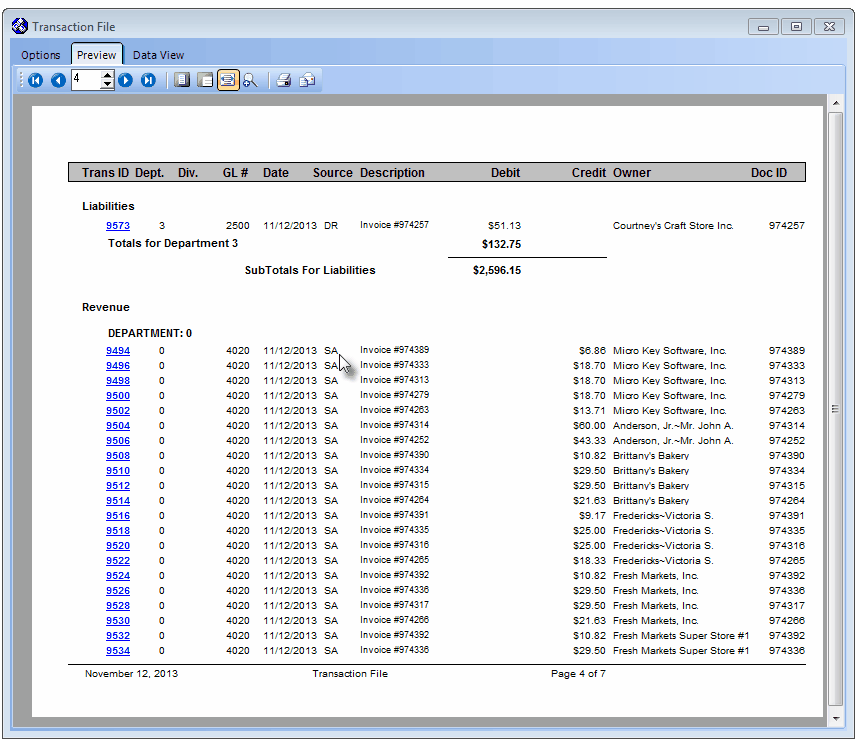

Transaction File Report - Preview tab - Earned Revenue entries

| o | Earned Revenue as "SA" (Sales) in the Source column for each of these (Earned Revenue) Credit entries (as shown above) |

| • | A Posted Deferred Revenue Summary table is maintained internally with a summary of the Earned and Deferred Revenues posted during the execution of each Post Deferred Revenue procedure and those previous Posted Deferred Revenue Summary records are listed on the Post Deferred Revenue dialog. |