|

Post Deferred Revenue This Help File Page was last Modified on 11/12/2013 |

|

|

|

|

Post Deferred Revenue This Help File Page was last Modified on 11/12/2013 |

|

|

Post Deferred Revenue

This Help File Page was last Modified on 11/12/2013

|

Post Deferred Revenue This Help File Page was last Modified on 11/12/2013 |

|

|

|

|

Post Deferred Revenue This Help File Page was last Modified on 11/12/2013 |

|

|

| □ | The Post Deferred Revenue dialog is used to periodically calculate, distribute, and post Deferred and Earned Revenues to the appropriate General Ledger Accounts' balances and the Transaction File. |

| • | During this Post Deferred Revenue procedure: |

| • | The proportional Earned Revenue Amount for each Detail Line Item is Posted (added) to the Detail Line Item's EarnedAmount field |

| • | The Invoice Header of any Invoice with a Recurring Revenue Sale (containing one or more Detail Line Item(s) assigned one of these Recurring Revenue Sale-Purchase Items) will also have the currently calculated Earned Revenue Amount Posted (added) to its EarnedAmount field. |

| • | Therefore, the Invoice Header will contain the most recently updated Total of all of the Earned Revenue for that Invoice. |

| • | In the General Ledger System: |

| • | Any change in the Deferred Recurring Revenue (any newly calculated Earned Recurring Revenue) will be: |

| ▪ | Subtracted (this will be Debit to the Deferred Revenue Liability Credit Account) and |

| ▪ | Added to the Sales Account associated with the Recurring Revenue Sale-Purchase Item (which will be a posted as a Credit - addition - to that Sales Credit Account). |

| • | Viewing the Deferred and Earned Revenue Transactions: |

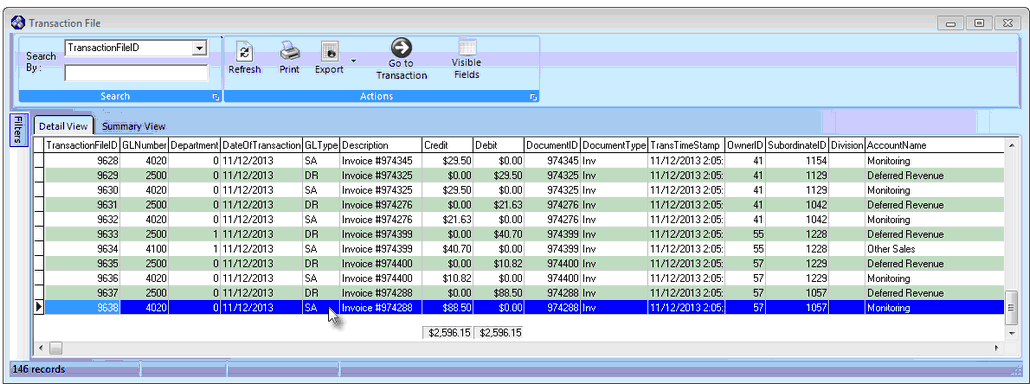

| ▪ | The Transaction File Form will list (as shown below): |

| o | Deferred Revenue as "DR" in the GL Type column for each of these (Deferred Revenue) Credit entries |

| o | Earned Revenue as "SA" (Sales) in the GL Type column for each of these (Earned Revenue) Credit entries |

Transaction File Form - Deferred Revenue and Earned Revenue Transactions

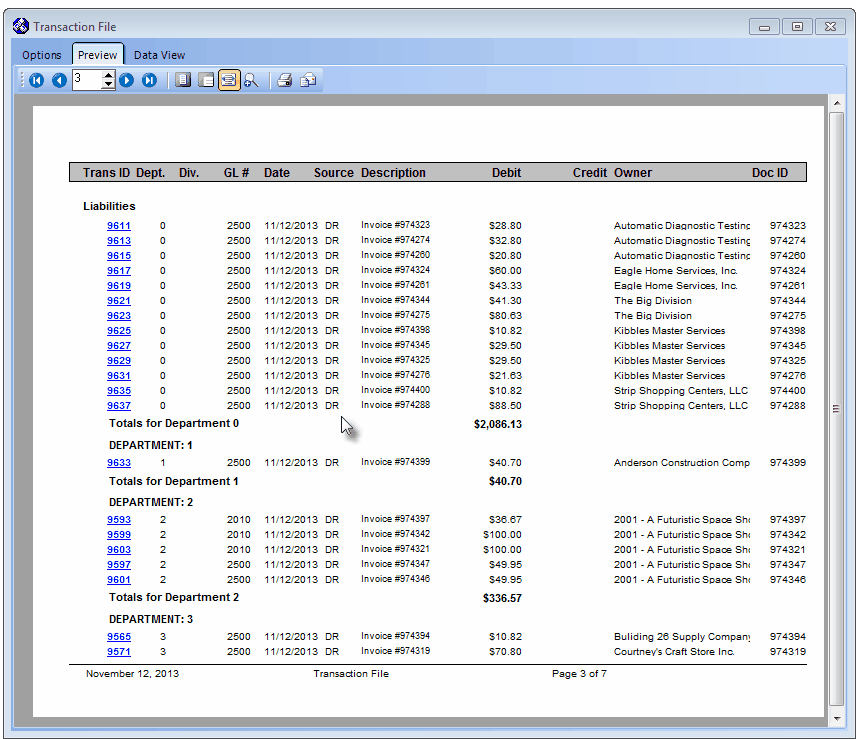

| ▪ | The Transaction File Report will list: |

Transaction File Report - Preview tab - Deferred Revenue entries

| o | Deferred Revenue as "DR" in the Source column for each of these (Deferred Revenue) Credit entries (as shown above) |

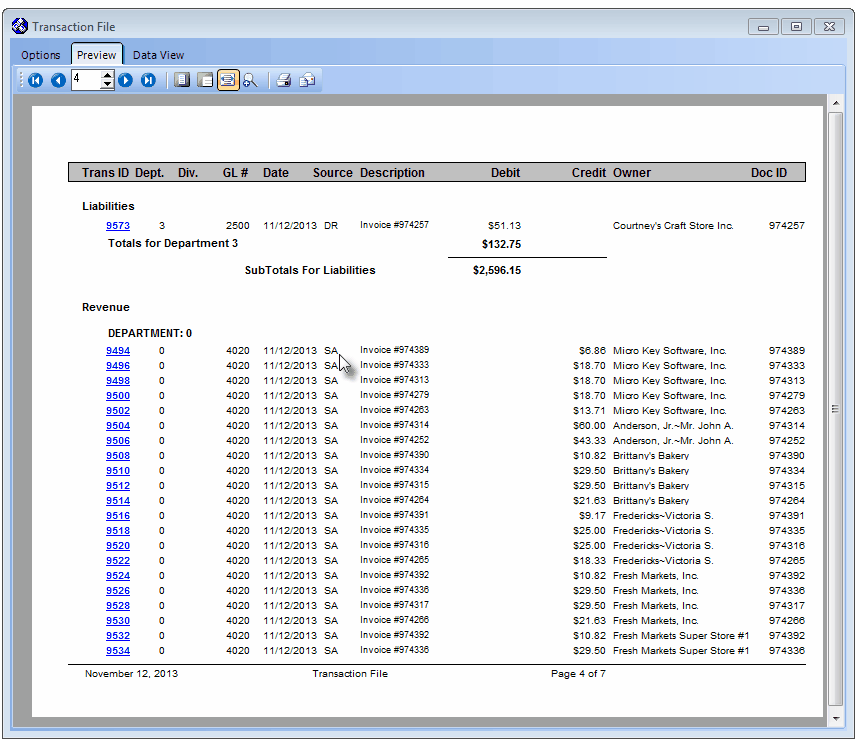

Transaction File Report - Preview tab - Earned Revenue entries

| o | Earned Revenue as "SA" (Sales) in the Source column for each of these (Earned Revenue) Credit entries (as shown above) |

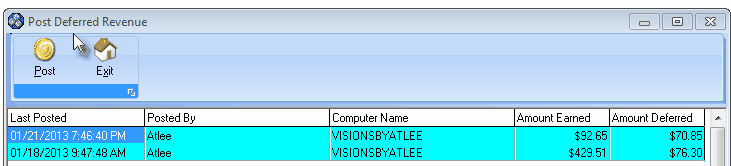

| □ | To Post Deferred Revenue, on the Main Menu Select File and Choose General Ledger, then Select Post Deferred Revenue. |

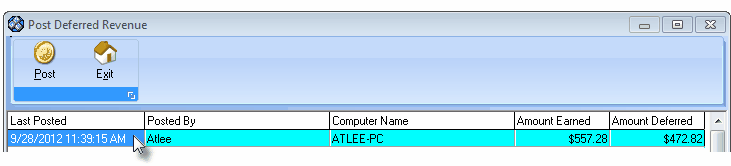

| • | Any previously Posted Deferred Revenue Summary records are listed on the Post Deferred Revenue dialog. |

Post Deferred Revenue dialog

| • | Click the Post option button. |

| • | Confirm that this Post Deferred Revenue process is to be executed. |

| • | The process runs to completion and inserts a Deferred Revenue Summary item in that table. |

| • | A Posted Deferred Revenue Summary table is maintained internally with a summary of the Earned and Deferred Revenues posted during the execution of each Post Deferred Revenue procedure. |

| • | All of the previously Posted Deferred Revenue Summary records are listed on the Post Deferred Revenue dialog. |

| • | Click the Exit option button to Close this Post Deferred Revenue dialog. |