| □ | The Late Fee Invoice Generation method (rate, grace period, minimum charge, etc.) used to assess Late Fees is defined in Late Fee Groups. |

| • | Note: Be sure to create a generic Sale-Purchase Item named Finance/Late Charges assigning it the code F/C. |

| □ | To assess Late Fees, from the Main Menu Click the File menu, Select Accounts Receivable, then Click Run Late Fee Generation |

| • | The Late Fee Invoice Generation dialog will open. |

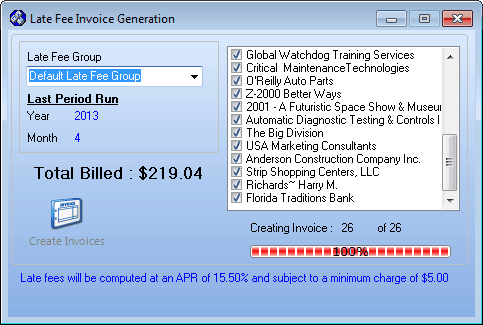

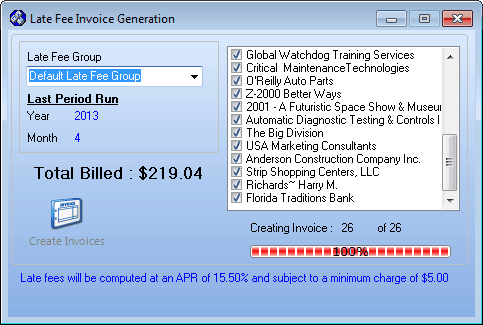

Late Fee Invoice generation dialog

| • | Choose the Late Fee Group to which you want to assess Late Fees using the Drop-Down Selection List . |

| • | Click the Create Invoices button. |

| • | The process runs automatically and when finished, displays to whom, and how much, each Subscriber was charged a Late Fee. |

| • | Click Close (S) to exit the form. |

| □ | Repeat this procedure at the appropriate time in the month for each of your Late Fee Groups. |

| □ | Late Fee Invoices assessments are based on the Total Past Due Amount owed by the Subscriber, and calculated using the information you entered for the selected Late Fee Groups. |

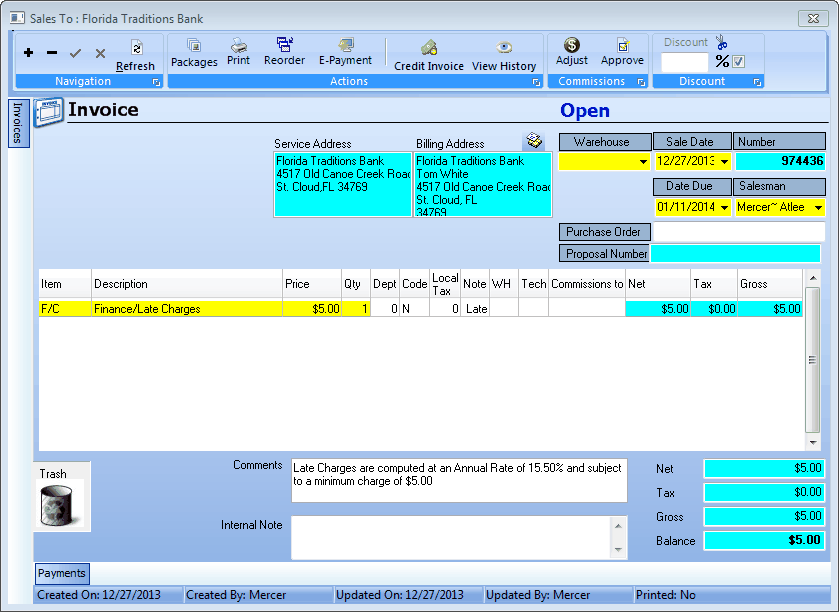

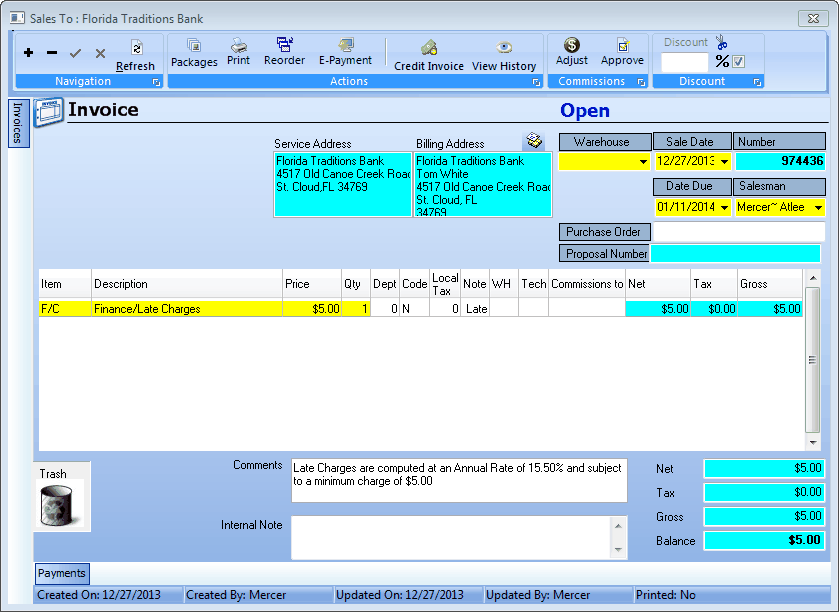

| • | Each Invoice is created with the Sale-Purchase Item "F/C", its Description, the Finance Charge Price, a Quantity of 1, and the Total. |

| • | The Comments section is automatically inserted based on the rules set for this Late Fee Group. |

Body of Late Fee Invoice showing Item, Description, Total and automatically created Comments