| • | By doing so, you will be able to more evenly and fairly Assess Late Fees for late payers. |

| • | The Late Fee assessment process may be run any number of times throughout the month, but each individual Late Fee Group may only be processed once each month. |

| • | The Late Fee Group of Subscribers being charged those Late Fees can then be based on when they were billed for their Recurring Revenues (or whatever Late Fee calculation qualification is chosen). |

| • | This is better than assessing Late Fees based on one fixed date such as the last day of the month where the Invoice Due Dates are all different but the Late Fees calculate for all Past Due Invoices (some of which may be past due just a few days and others many weeks - depending on when they were originally billed). |

| □ | To create Late Fee Groups: |

| • | Select the Accounts Receivable sub-menu |

| ► | Note: Be sure to create a generic Sale-Purchase Item named Finance/Late Charges assigning the code F/C. |

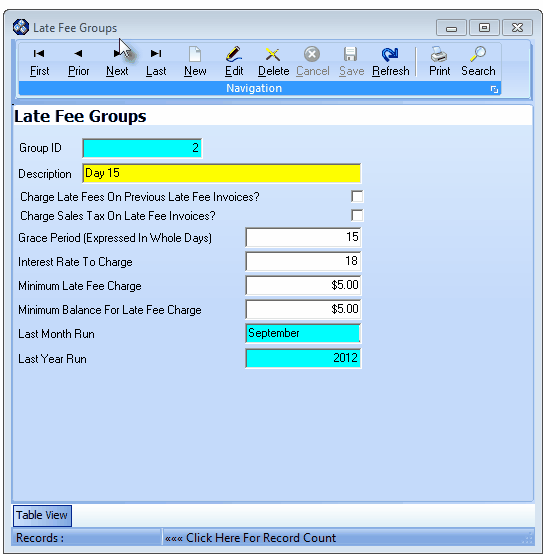

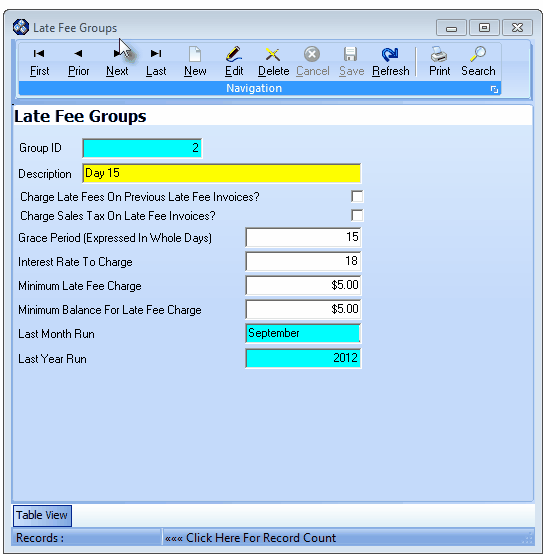

Late Fee Groups Form

| • | This Late Fee Groups Form may be Re-sized by Dragging the Top and/or Bottom up or down, and/or the Right side in or out. |

| • | Navigation Menu - The Navigation Menu is located at the top of the Late Fee Groups Form. |

| • | This Navigation Menu provides the normal Record Movement, New, Edit, Delete, Cancel, Save, and Refresh options; as well as special Print and Search functions. |

| • | Record Editing section - The details of the currently selected record are displayed below the Navigation Menu at the center (Main Body) of the Late Fee Groups Form. |

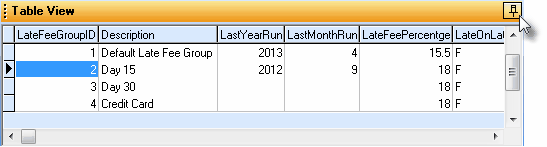

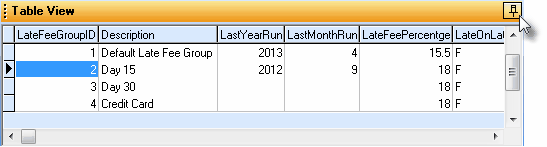

| • | Table View tab - A tabular (spreadsheet style) Table View of the currently defined Late Fee Groups is accessible by Clicking the Table View tab at the bottom of the Late Fee Groups Form. |

| • | This Table View information may be Pinned in Place by Clicking the Pin Icon on the right. |

| • | To display a specific Late Fee Group record in the Record Editing section, Click on that record within the Table View section, or use the Search Icon (see the "Using the Special Functions" section later in this chapter). |

Late Fee Groups Form - with Table View tab Pinned Open

| ▪ | You may Un-Pin this Table View by Clicking the Pin Icon again. |

| ▪ | Click on any listed record to display that information in the center (Main Body) of the Form. |

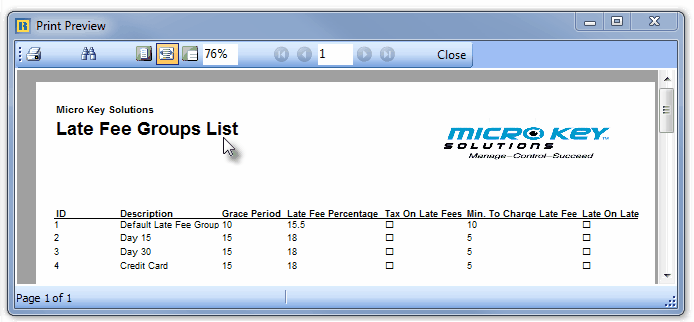

| • | There are ten columns of data in this Late Fee Groups Record Listing: |

| 1) | Late Fee Group ID - The record ID assigned by the system when the entry is originally saved. |

| 2) | Description - The description of the Late Fee. |

| 3) | Late On Late - T/F - Shown as True ("T") if charging Late Fees on Late Fees, and False ("F") if not. |

| 4) | Tax On Late Fees - T/F - Shown as True ("T") if charging Sales Tax on Late Fees, and False ("F") if not. |

| 5) | Grace Period (Expressed in Whole Days) - The days allowed after the Due Date of an Invoice before a Late Fee will be assessed. |

| 6) | Late Fee Percentage - The APR (Annual Percentage Rate) assessed on each Invoice's Past Due Balance. |

| 7) | Min Late Fee - The Minimum Late Fee that will be charged if there is any Past Due Balance. |

| 8) | Min To Charge Late Fee - The Minimum Balance For Late Fee Charge, below which, a Past Due Balance will not be assessed is your Minimum Late Fee. |

| 9) | Last Month Run - System maintained data indicating the Month Late Fees were last assessed. |

| 10) | Last year Run - System maintained data indicating the Year Late Fees were last assessed. |

| • | Each column's Header Name describes the data contained in that column. |

| ▪ | Clicking on a Header Name will set the order in which the Late Fee Groups will be listed. |

| ▪ | Clicking on the same Header Name will set the order in the opposite direction (ascending vs. descending). |

| ▪ | The Header Name that is determining the Order of the list will have an Icon indicating the Order displayed next to that Header Name. |

| • | To define the Late Fee Groups which will be used to calculate Late Fees based on When - within the month - or Why the Invoices were created.: |

| • | Click the  Icon to start the Late Fee Groups entry in the Record Editing section. Icon to start the Late Fee Groups entry in the Record Editing section. |

| ▪ | Group ID - This record number will be assigned after the entry is initially saved. |

| ▪ | Description - Enter a Description of this Late Fee Group |

| o | The Description may up to 40 characters in length and include upper and/or lower case letters, numbers, spaces and normally used punctuation marks. |

| ▪ | Charge Late Fees On Previous Late Fee Invoices - Check this box if Late Fees are to be charged on previously assessed, unpaid Late Fees. |

| ▪ | Charge Sales Tax On Late Fee Invoices - Check this box if the government entity for whom Sales Taxes are collected, requires Sales Tax be assessed on Late Fees. |

| ▪ | Grace Period (Expressed in Whole Days) - Enter the number of days you will allow for a Grace Period (days after the due date before a Late Fee will be assessed). |

| ▪ | Interest Rate To Charge - Enter an A.P.R. (Annual Percentage Rate) to be assessed on each Invoice's Past Due Balance (not to exceed your State's Maximum Permitted Interest Rate). |

| ▪ | Minimum Late Fee Charge - As with most credit providers, a Minimum Late Fee should be established. |

| o | The system will assess the Minimum Late Fee if there is a Past Due Balance that will create an assessment - based on the APR - that would be less than that Minimum Late Fee. |

| ▪ | Minimum Balance For Late Fee Charge - To avoid very small balances triggering a Minimum Late Fee, you may set a Minimum Balance For Late Fee Charge, below which, a Past Due Balance will not be assessed any Minimum Late Fee. |

| ▪ | Last Month Run - A system maintained data indicating the Month Late Fees were last assessed. |

| o | If for some reason you run the Cycles out of the normal sequence (for example, July, before June), the Month (in the example it would be June) of the most recent cycle that was actually processed will be displayed. |

| ▪ | Last Year Run - A system maintained data indicating the Year Late Fees were last assessed. |

| o | As noted above, if a Cycle is run outside of the normal sequence (for example, January 2010, then December 2009), the Year (in the example it would be 2009) of the most recent Cycle that was actually processed will be displayed. |

| • | Click the  Icon to to record this Late Fee Group. Icon to to record this Late Fee Group. |

| • | Any number of additional Late Fee Groups may be created. |

| □ | Using the Special Functions on the Navigation Menu at the top of the Late Fee Groups Form: |

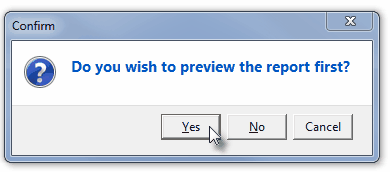

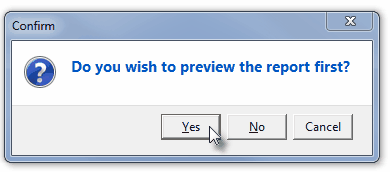

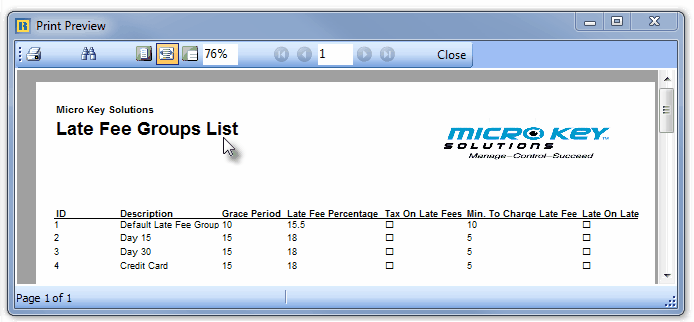

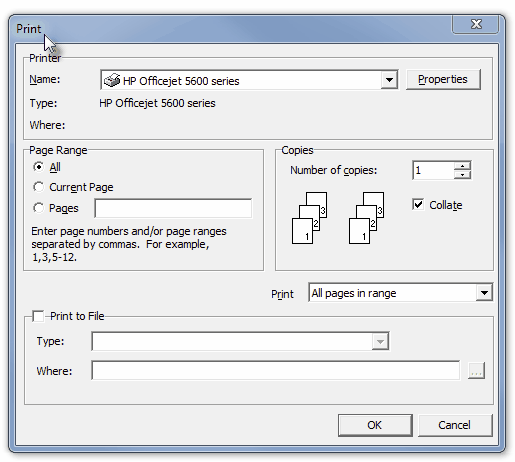

| • | Print - Click the Print Icon to View and/or Print a list of the Late Fee Groups. |

| • | Yes - Click the Yes button to View a copy of the report. |

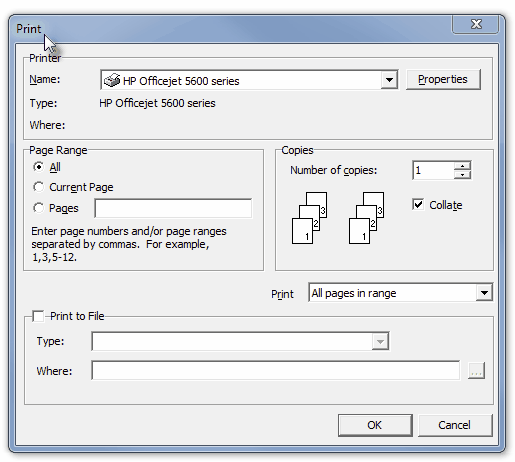

| • | No - Click the No button to open the Windows® Print dialog where a copy of the report may be sent to a selected Printer, or Printed to a File. |

| • | Cancel - Click the Cancel button to close this Print question and return to the Form. |

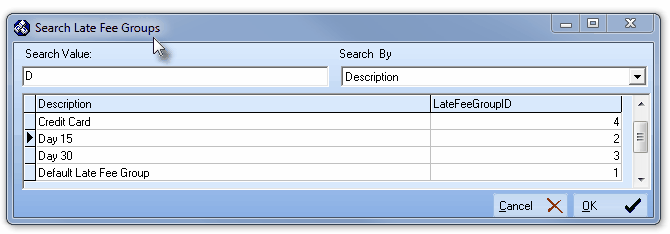

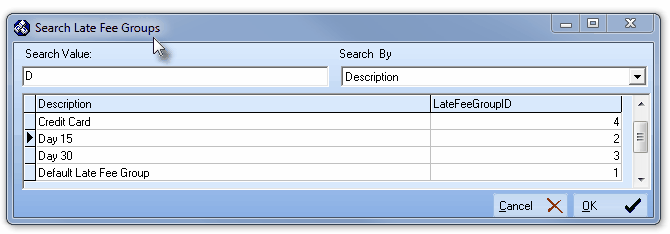

| • | Search - Click the Search Icon to open the Search Late Fee Groups dialog. |

Search dialog

| • | See the "Using the Generic Search dialog" section in the Advanced Search Dialog chapter for more information about this Search dialog. |

![]()

![]()