| □ | As with all the modules within the Micro Key Millennium Series, the General Ledger System has a start-up, step-by-step process that must be followed to ensure accurate Financial Reporting in the future. |

| • | General Ledger Groups - These are used to sub-divide the five basic Financial Transaction Account Types (i.e., Assets, Liabilities, Equity, Sales and Expenses) into more finely defined sub-groups (or segments). |

| ▪ | These General Ledger Groupings also provide Sub-Totals for each of the Sub-Headers that are define. Financial Transaction Account Types (i.e., Assets, Liabilities, Equity, Sales and Expense). |

| 1. | Assets 1000 - 1999 - Create Sub-Headers to separate Current Assets like actual Cash and Accounts Receivable accounts (by using 1000 to 1499), from Other Assets like Furniture & Fixtures or Properties (by using numbers from 1500 to 1999). |

| 2. | Liabilities 2000 - 2999 - In a similar manner, create Sub-Headers to separate Current (Short Term) Liabilities such as Accounts Payable and Credit Card debt from Long Term Liabilities such as business loans and mortgages. |

| 3. | Equity 3000 - 3999 - Create Sub-Headers to separate Capital accounts from Current and Retained Earnings |

| 4. | Revenues 4000 - 4999 - You should also create Sub-Headers to separate various types of Revenue such as Sales Revenues, Recurring Revenues for Monitoring and Service Contracts, and Miscellaneous Revenues such as interest earned. |

| 5. | Expenses 5000 - 9989 - Create Sub-Headers to separate General Expenses from Sales related Expenses (payroll, commissions, advertising, etc.), and other Miscellaneous expenses. |

| ◆ | The General Ledger Account Numbers 9990 - 9998 are used (internally) by the system and therefore should not be defined by the User. |

| • | The Number assigned to an Account identifies which of the five basic Financial Transaction Account Types (i.e., Assets, Liabilities, Equity, Sales and Expense) they will represent (see 1. to 5. above). |

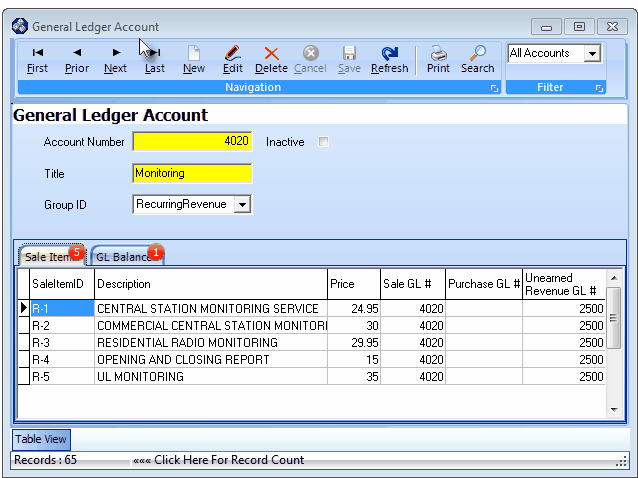

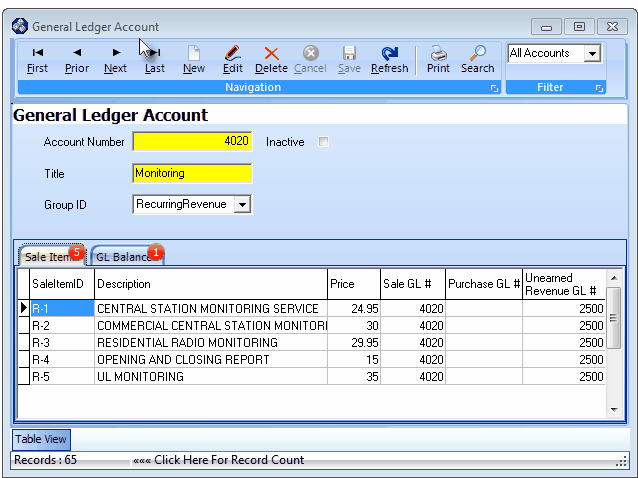

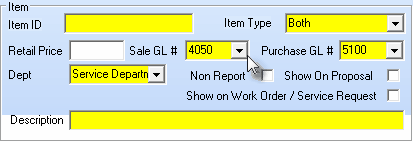

General Ledger Accounts entry Form

| • | A Group ID may be assigned to any Account (see the Understanding General Ledger (sub) Groups section above) thereby further sub-dividing an Account Type into smaller, more finely defined sub-groups. |

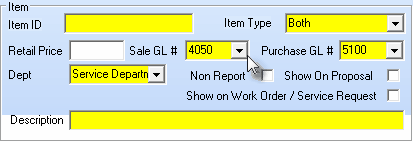

| ▪ | Dept - If you plan to initiate Multi-Departmental Accounting, enter the appropriate Department number using the Drop-Down Selection List provided. |

| ► | Note: These mandatory fields will NOT be highlighted in Yellow until AFTER the General Ledger Setup Wizard is run successfully. Thereafter, they will be highlighted in Yellow. |

| □ | An Overview of the General Ledger Setup Process: |

| • | If you have an existing General Ledger System (whether manual or software driven), the setup process is fairly straightforward because you'll already have a usable Chart of Accounts, a Trial Balance, a Balance Sheet, and a Profit & Loss Statement available. |

| ▪ | If you do not have an existing General Ledger System, arrange for your accountant to prepare a Chart of Accounts, plus a Trial Balance, Profit and Loss (Income) Statement, and Balance Sheet - for a specific point in time (at the end of a financial reporting period - reporting either the end of a month or the end of a fiscal year). |

| ▪ | These Maintenance Entries may be done at any time prior to beginning the actual setup process. |

| • | It is always easier to start this module at the end of a financial reporting period (end of month or end of year), and prior to posting any financial transactions for the following period. |

| • | However, this is not mandatory, as you may start the General Ledger Setup Process at any time. |

| • | Just keep in mind that you should start this process at the beginning of the day because, once started, all transactions thereafter are immediately posted - in real time - into the MKMS General Ledger System. |

| ◆ | Monitoring operations are unaffected by this General Ledger Setup Process, and should continue normally. |

| • | Execute these Steps of the General Ledger Setup Process which are outlined below, and explained in much more detail within the associated chapters: |

| 5. | Finally, Post the Summarized Transactions for the financial transactions that occurred after the accounting period for which that Trial Balance - provided by your accountant - was created. |

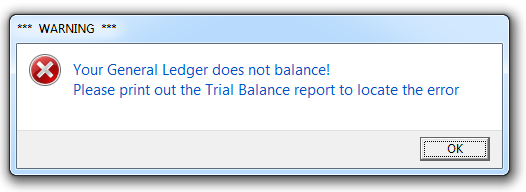

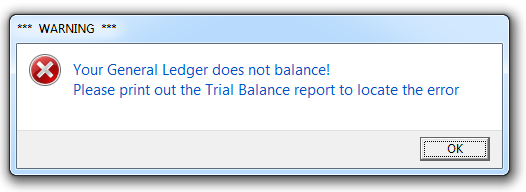

| ◆ | Once the General Ledger System is operational, if - for whatever reason - the Trial Balance becomes "Out of Balance", a Warning Message will be displayed at Login when the User who has Logged In is either an Administrator (Admin) or has been granted the Super User Authority. |

| • | Execute the Five Steps of the General Ledger Setup Process outlined below, and explained in much more detail within their associated chapters: |

| 5. | Finally, Post the Summarized Transactions for the financial transactions that occurred after the accounting period for which that Trial Balance - provided by your accountant - was created. |