| □ | Preparing for your General Journal Transaction Summarizations: |

| • | However, you may easily create a spreadsheet of the General Ledger Accounts that you've defined. |

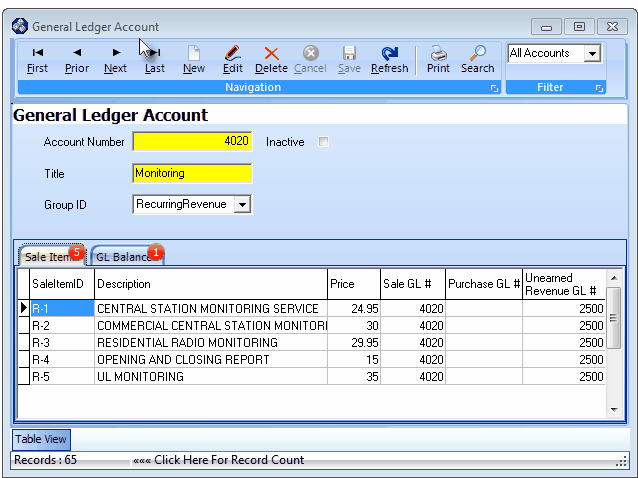

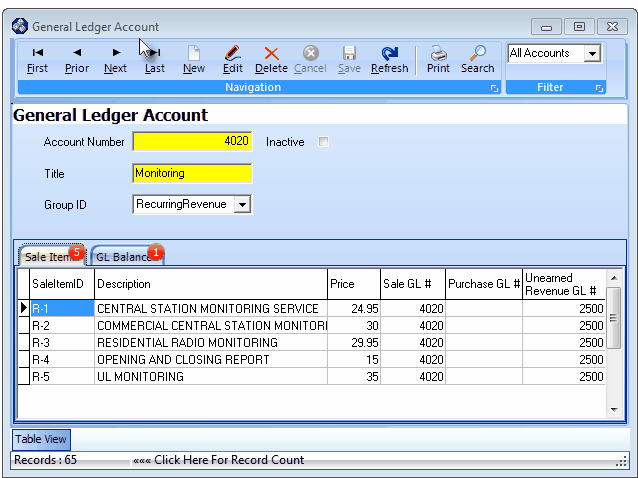

| • | From the Main Menu Select Maintenance and Choose the General Ledger sub menu, then Click Accounts. |

General Ledger Accounts entry Form

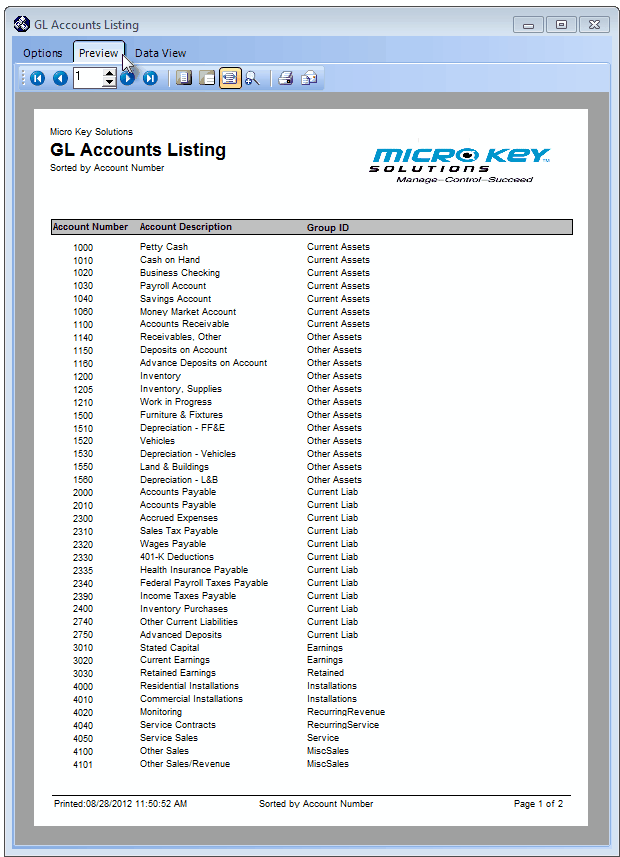

| • | Report Order - Choose the Account Number order option to create your Transaction Summary spreadsheet document. |

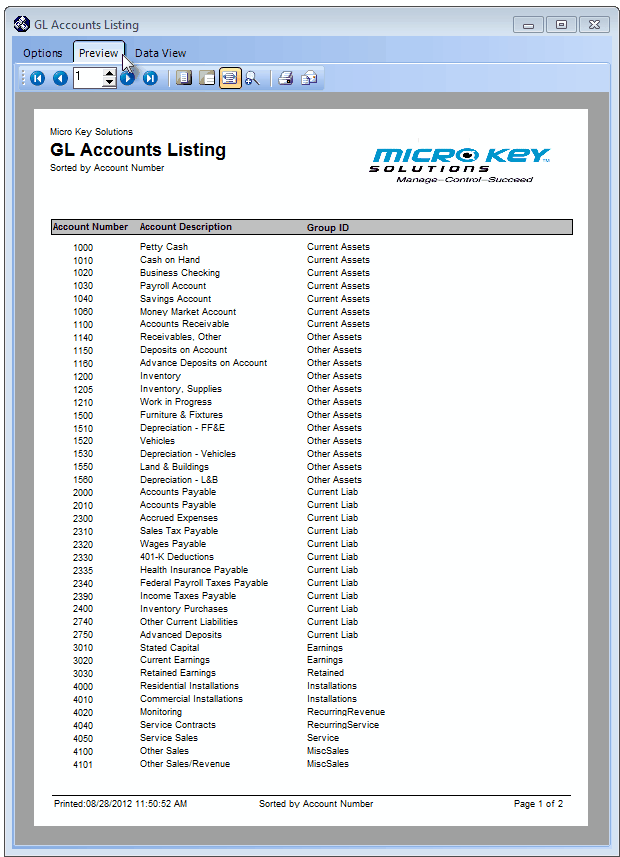

GL Accounts Listing - Preview tab

| • | Select the Data View tab. |

| • | Export - Export the data from this Data View tab: |

| • | Export To Excel - Click this button to export the data to an Excel (.xls) file format. |

| ▪ | Use the standard Windows® Save As... dialog to store this spreadsheet document. |

| ▪ | This file will become your Transaction Summary spreadsheet document. |

| ▪ | Click the Save button to create this document. |

| • | Creating the actual Transaction Summary Worksheets: |

| • | Open this file in Excel® and add two additional columns labeled Debit and Credit. |

| ▪ | Using the Save as option, Save an individual copy of this revised Transaction Summary spreadsheet document for every Closed Month, and one final copy for the Open Period. |

| ▪ | Use a naming convention that is easy to understand (nnnn-nn Transaction Summary) where the numbers (nnnn-nn) represent the Year and Month to be summarized. |

| • | In the Transaction Summarization Procedures section below, there are instructions for locating and then entering the values into the two columns you've added labeled Debit and Credit. |

| • | These Debit and Credit data entries will be used to build a set of Transaction Summary spreadsheets containing the transactions required to properly initialize the MKMS General Ledger System. |

Transaction Summarization Procedures

| • | In this section are the instructions for extracting the required data for the Transaction Summary spreadsheets created above (and will contain the data identified in the Print the Transaction Summary chapter). |

| • | These instruction will also explain how to enter that data (those values) into each the two columns you've added to these Transaction Summary spreadsheet documents created above which were labeled Debit and Credit. |

| • | These Debit and Credit data entries will be used to build the set of Transaction Summary spreadsheets that will contain the transactions (Debit and Credit entries) required later to properly initialize the MKMS General Ledger System when you actually Post these Summarized Transactions. |

| • | Debit the Total Cash Receipts to the appropriate Bank (Cash) account. |

| • | Credit the Total Cash Receipts to your Deposits Liability account. |

| o | Repeat this process for each General Ledger Account representing one of those Banks, entering the transactions noted above on a Batch Number by Batch Number basis, until all the Batches have been recorded. |

| • | In addition, Maintain a List of each month's Total Cash Receipts on a separate paper, noting the Month and Year, and the Amount Paid. |

| ▪ | Be sure to also include the Current Month's Receipts, when you get to that step (see "Summarizing the Current Month for Accounts Receivable Transactions" below). |

| ▪ | When you finally summarize the current month, you will re-distribute these Receipts, to different accounts. |

| ▪ | Deposits for the Current Month, that have not been applied (Allocated), will be entered separately. |

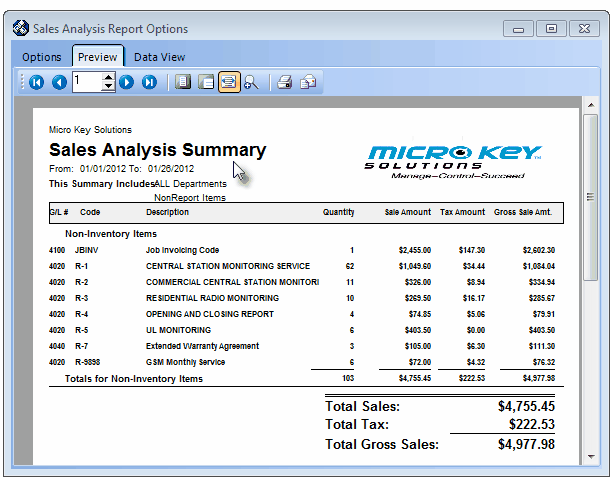

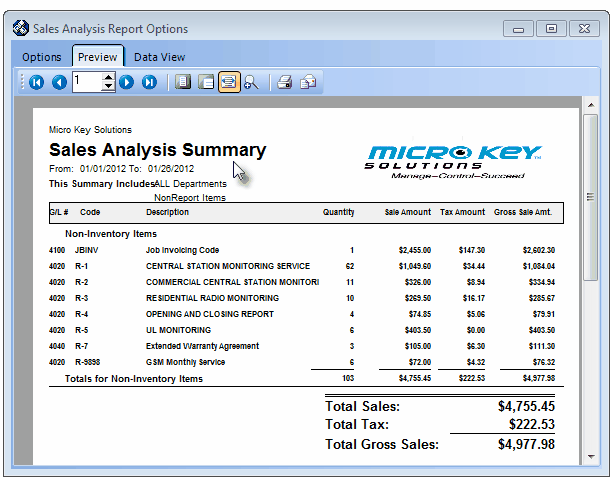

| • | Debit your Accounts Receivable account for the Total Gross Sales (the sum reported at the very end of the report). |

| • | Credit each Tax Amount to the appropriate Sales Tax Liability account. |

| ▪ | When all of these entries are completed, the sum of the Sale Amount totals plus the sum of the Tax Amount totals (the Credit entries) must - and will - equal the Total Gross Sales (Debit entry) in the Accounts Receivable account. |

| • | If you must charge both a Local and a National Sales Tax, as stated above, you will initially apply (see "Credit each Tax Amount" above) all of that Sales Tax to the Local Sales Tax Liability account. |

| ▪ | If you reimburse the Sales Taxing Authorities on an "as Billed" basis, see "Sales Taxes Invoiced Report" below to learn how to appropriately re-distribute the National Sales Tax portion to the National Sales Tax Liability account. |

| ▪ | If you reimburse the Sales Taxing Authorities on an "as Collected" basis, see "Sales Taxes Collected Report" below to learn how to appropriately re-distribute the National Sales Tax portion to the National Sales Tax Liability account. |

Sales Analysis Summary Report - Preview tab

| • | If you only charge a Local (State) Sales Tax, there is nothing more to do. |

| • | If you must charge a Local and a National Sales Tax: |

| ▪ | Initially you entered all of the taxes in the Local Sales Tax Liability account. |

| ▪ | Referring to the Sales Taxes Invoiced Report: |

| o | Debit the Local Sales Tax Liability account for the Amount of the National Sales Tax (GST, VAT, etc.) shown on the Sales Taxes Invoiced Report. |

| o | Credit the National Sales Tax Liability account for the same amount of the National Sales Tax. |

| • | If you only charge a Local (State) Sales Tax, there is nothing more to do. |

| • | If you must charge a Local Sales Tax and a National Sales Tax: |

| ▪ | Initially you entered all the the taxes in the Local Sales Tax Liability account. |

| ▪ | Referring to the Sales Taxes Invoiced Report: |

| o | Debit the Local Sales Tax Liability account for the amount of the National Sales Tax (GST, VAT, etc.) |

| o | Credit the National Sales Tax Liability account for the amount of the National Sales Tax. |

| • | Complete the steps above for the current month's Accounts Receivable related reports. |

| • | Then, for the current month only: |

| ▪ | If you have not done so, reprint the report. |

| • | Re-distribute the Receipts using the following calculation: |

| ▪ | Subtract the remaining unapplied Deposits (not including the value of the Credit Memos) from the Total Cash Receipts (for multiple Bank Account users, this is the sum of the values accumulated on the separate piece of paper for all of the Total Cash Receipts). |

| ▪ | The result will be your "Net Cash Receipts". |

| ▪ | Enter these transactions: |

| o | Debit the Deposits Liability account for the amount of the Net Cash Receipts. |

| o | Credit the Accounts Receivable account for the amount of the Net Cash Receipts. |

| ► | Note 1: Print Checks - Be sure that you have printed all unprinted Checks before attempting to summarize the Accounts Payable transaction information. |

| • | Debit your Accounts Payable account for the sum of all the Checks written and printed (the sum all the items in the Check Register). |

| • | Credit the value of the Checks written and printed to each General Ledger Account representing a Bank Cash account from which those Checks were drawn. |

| ▪ | If you are using multiple Bank accounts for Check based Payments, repeat this transaction process until you have entered the sum of each Bank account's Payments. |

| ▪ | Do not repeat the Debit entry, as that single Debit entry should have encompassed the entire amount of all the Payments. |

| • | Debit each Purchase Category's Purchase Amount to its specific Purchases Expense account |

| • | Credit your Accounts Payable account for the Total Purchases (the sum reported at the very end of the report). |

| • | If you are only charged Local (State) Sales Tax: |

| ▪ | Debit the total amount of the Sales Taxes that were billed to the Sales Tax Expense account |

| ▪ | Credit the total amount of the Sales Taxes that were billed to the Accounts Payable account. |

| • | If you were charged a Local and a National Sales Tax: |

| ▪ | Debit the Grand Total for the Local Tax Sales Taxes that were billed to the Local Sales Tax Expense account. |

| ▪ | Debit the Grand Total for the National Tax Sales Taxes that were billed to the National Sales Tax Expense account. |

| ▪ | Credit the sum of both the Local and National Grand Total Sale Tax amounts billed to your Accounts Payable account. |

| • | Complete the steps outlined above for the current month's Accounts Payable related reports. |

| • | Then, for the Current Month only: |

| • | Unallocated Payments/Credits - |

| ▪ | Credit the amount in the Total Payments column from that Bank's General Ledger Account from which the Checks were drawn. |

| • | Ignore the Total Credits column as these amounts are taken into consideration in the Purchases Analysis Report (see "Purchase Analysis Report" above). |