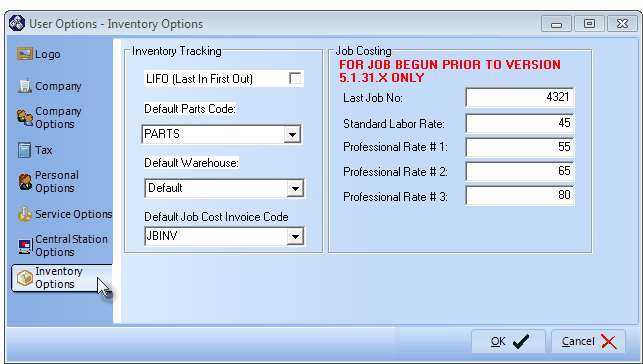

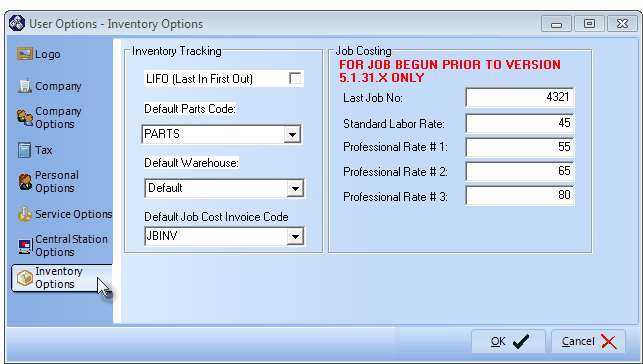

| • | To do so, from the Main Menu Select Maintenance and Choose User Options, then Click the Inventory Options tab. |

User Options Form - Inventory Options tab

| □ | Inventory Valuation Methods - a review: |

| • | LIFO - Used to initiate the Last In - First Out Inventory Valuation Method. |

| • | Average Cost Inventory - Another approach to Inventory Valuation is to use the Average Inventory Cost for the Value that is used in the associated General Ledger System transactions. |

| • | This Inventory Valuation Method will establish and maintain the Value of the Inventory by Averaging the Cost of that Inventory so that all Price (cost) changes of an Inventory Item are taken into consideration whenever the Value of that Inventory Item is reported. |

| ► | Note: When AverageCostInventory is set to True ("T"), if LIFO (Last In/First Out) was the previously selected Inventory Valuation Method, it will be turned off automatically. |

| □ | Inventory Option entries: |

| ▪ | However, from an accounting standpoint, you may want to alter this default behavior by having that Price In Value reset, based on the most recent Cost recorded on an Invoice for the Purchase of this Inventory Item. |

| ▪ | This automatic reset process that is based on the most recent price paid, is called Last In-First Out, or LIFO for short. |

| • | Default Parts Code - Use the Drop-Down Selection List to Choose the default Parts code (which for simplicity should be PARTS). |

| ► | Note: Create a generic Sale-Purchase Item named Parts assigning it the code Parts in the Sale Purchase Items Form. |

| • | Default Warehouse - The default is the predefined Default Warehouse. |

| ▪ | Use the Drop-Down Selection List to Choose a different Warehouse Name, if desired. |

| • | Default Job Cost Invoice Code - To be determined. |

| • | Click OK to save this Inventory Options information. |

| ► | Note: If Legacy Job Costing records exist within the MKMSdefault database, the following fields will be displayed, but may not be modified, otherwise, these fields will not be displayed at all. |

| ▪ | Last Job No. - No longer Used - This was a Legacy Job Costing function where the next Job Number to be assigned could be specified by entering the Last Job Number that was used (or what you wanted to represent as that last number thereby identifying what the next number should be). |

| ► | Note: In Version 2.0.X Job Costing, the system automatically assigns a Record Number for each new Job Costing project, and that number cannot be changed. |

| ▪ | Labor Rates: - No longer Used - This was a Legacy Job Costing function where the Labor Rates defined below would represent the Hourly Rate that is Invoiced to a Subscriber - with those Labor Rates being calculated based on the set of Technician Skills that would be required to complete a specific type of Job Task assignment. |

| o | Standard Labor Rate - Enter the minimum labor rate that will be charged. |

| o | Pro. Labor Rate #1 - Enter the minimum Professional level labor rate that will be charged. |

| o | Pro. Labor Rate #2 - Enter the second level Professional level labor rate that will be charged. |

| o | Pro. Labor Rate #3 - Enter the highest level Professional labor rate that will be charged. |