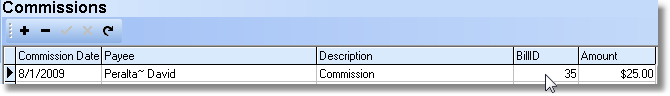

| □ | Commissions - In most cases, if you are doing Job Costing, Sales related Commissions are owed. |

| • | A sales Commissions is usually paid to a Salesperson for selling a Job. |

| • | Commissions are a Job Costing chargeable expense and should be recorded, if paid. |

| □ | To record a Commission expense, on the Main Menu, Select the Maintenance menu and Choose Job Costing. |

| • | Click the Commissions tab. |

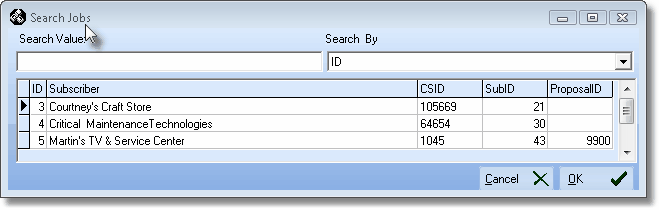

| • | Locate the Job to which you need to record a Commission expense. |

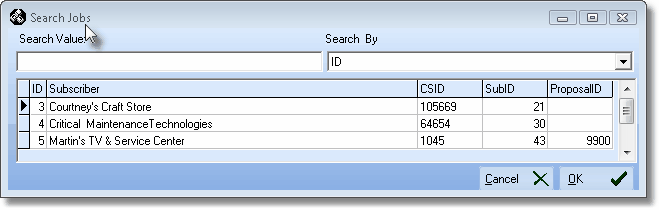

Click the Search icon at the top of the Job Costing Form to open the Search Jobs dialog.

Click the Search icon at the top of the Job Costing Form to open the Search Jobs dialog.

| • | Search By - Use the Drop-Down Selection List to Choose your desired search method. |

| • | Search Value - Enter the characters that will best locate the desired Job. As you enter information, the record pointer4will be continually relocated based on your entry. |

| • | OK - Click OK ü when you have the correct Job located. |

Search Jobs dialog

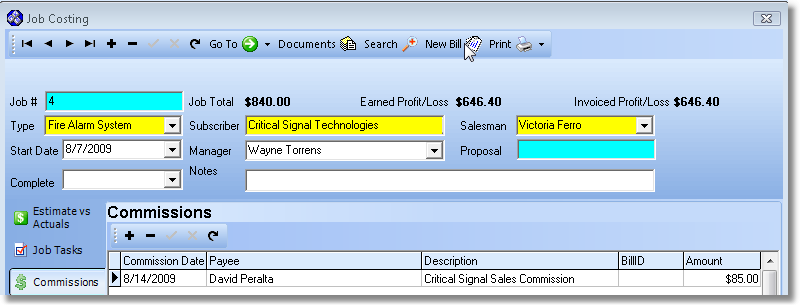

| □ | There are two separate ways to use the Commissions tab to record a Commission expense. |

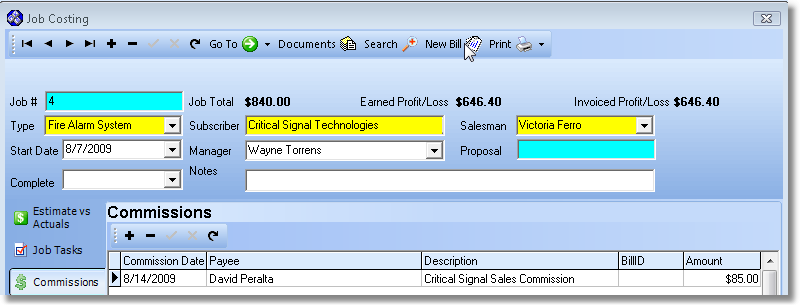

| • | In both cases, you must Select the Commissions tab on the Job Costing Form first. |

Job Costing Form's Commission tab

| 1. | Click Add ("+") and directly input the Commission information. |

| • | This assumes the Commission will be paid as part of the Payroll process for your Company. |

| • | Commission Date - Use the Drop-Down Date Selection Box to enter the Date that this Commission was Paid. |

| • | Payee - Enter the name of the person who received the Commission. |

| ▪ | Multiple Commission entries may be required if this was an Employee Team effort, or both a Commission and a Referral fee are to be Paid. |

| • | Description - Enter a brief explanation of the Commission Payment. |

| • | Bill ID - There will be no Bill ID because this is a direct entry, bypassing the New Bill (see #2 below) procedure. |

| • | Amount - Enter the Amount of the Commission Payment |

| • | Click Save ("ü") to record this Commission expense. |

| • | Repeat this procedure if you need to record multiple Commission payments. |

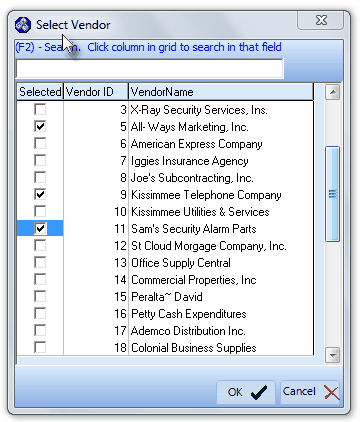

| • | This assumes the Commission will be paid directly to the Salesperson who may be straight commission salesperson (an independent contractor). |

| • | Click the New Bill icon at the top of the Job Costing Form. |

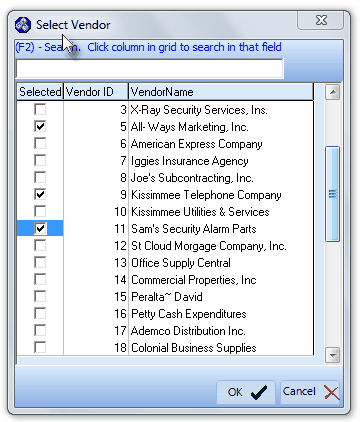

| • | Using the Select Vendor dialog, locate the appropriate Vendor (the individual or organization to which you owe the Commission). |

Select Vendor Dialog

| ▪ | Search By - Using the Drop-Down Selection List to Choose the preferred Search method. You may search by the Vendor Name (the default), or the Vendor ID. |

| ▪ | Search Value - Enter the appropriate Search phrase. As you enter characters, the pointer „ relocates to the most appropriate Vendor record. |

| ▪ | Once the pointer is at the correct record, To Select that Vendor record, Click OK. |

| • | Click Add ("+"), and the appropriate Job Number is inserted. |

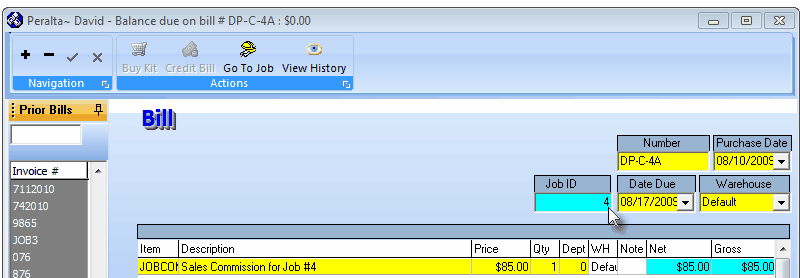

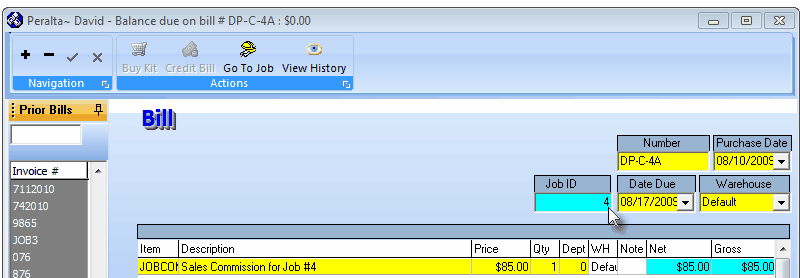

Invoice line item on Bill Form for Commission to be Paid

| • | First, you must enter an Invoice Number. |

| ▪ | Hint: Follow a regular pattern for creating these Vendor Invoice Numbers for Commissions. |

| ▪ | Example: DP-C-4A - This pattern uses the Salesman's initials "DP", followed by "-C-" for commission, and then the Job number "4", and perhaps a letter "A" - so multiple commissions (4B, 4C, 4D, etc.)can be paid as the Job progresses and the Subscriber makes additional payments that are subject to Commissions. |

| ▪ | You may also change the Purchase Date and Due Date, if desired, using the Drop-Down Date Selection Boxes provided. |

| • | Enter a Detail line item for the Commission that is to be paid. |

| ▪ | Description - Modify the default Description entered for this Sale-Purchase Item to include the Job Number (shown in the Job ID field above). |

| ▪ | Price - Enter the amount of the Commission that is to be paid. |

| ▪ | Qty - By default, this should be the number 1. |

| ▪ | Dept - If using the General Ledger module, use the Drop-Down Selection List to Choose the appropriate Department to be charged for this expense. |

| ► | Note - You may want to Double-Click [Memo] in the Note field to enter additional information relating to this Commission Payment. |

| • | Save - Click Save ("ü") to record the Invoice (Bill). |

| • | Repeat this procedure if you need to record multiple Commission payments. |

| • | Close - Click the Close T box to close the Bill Form and return to the Commissions tab. |

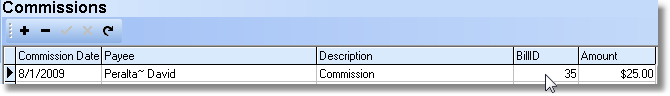

Invoice created Commission entry within the Commissions tab of the Job Costing Form

| • | When you are returned to the Commissions tab on the Job Costing Form, Click the Refresh icon to update this information. |

| • | A Commissions entry will be made which (in addition to the Date, Payee, Description, and Amount) will include the system's internal Bill ID for this new Invoice you've created - thereby indicating that this Commission was successfully entered as a Bill. |

![]() Click the Search icon at the top of the Job Costing Form to open the Search Jobs dialog.

Click the Search icon at the top of the Job Costing Form to open the Search Jobs dialog.