| □ | If the Vendor charges Sales Tax on your Purchases, Check the Charges Tax? box on the General Information tab to open this Vendor Tax Information Tab. |

| • | If no Sales Tax is ever charged by this Vendor, do not Check the Charges Tax? box and you will not need to enter anything on this tab. |

| ▪ | Once the Vendor's Sales Tax information is defined, the Vendor Tax Information Tab may also be accessed by Pressing the Alternate key together with the Underlined Letter in the tab's Title (Alt+T). |

| • | As you enter your Purchases, each Line Item on a Bill may be Taxable or Non-Taxable, based on the tax rules of your location. |

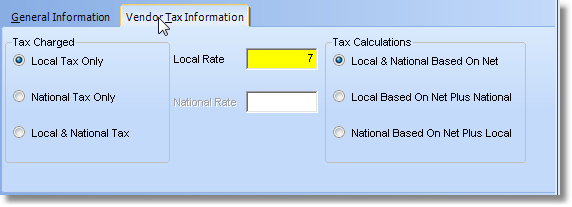

Vendor Tax Information tab on the Vendor Information Form

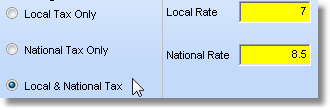

| • | Local Tax Only - If there is only a Local (State) Sales Tax, Click this button and enter the Local Percentage Rate. |

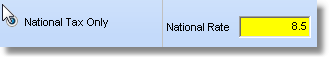

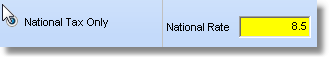

| • | National Tax Only - If there is only a National (Federal level) Sales Tax, Click this button and enter the National Percentage Rate |

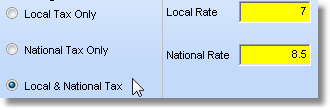

| • | Local & National Tax - If there is both a Local (State or Provincial) and a National (Federal level) Sales Tax, Click this button and enter the Local and the National Percentage Rates. |

| • | (Sales) Tax Calculations - When there is a National as well as a Local Sales Tax, various Governments may assess Sales Taxes in different ways. To accommodate this, several choices are offered here. Click the appropriate button for how your Local (State or Province) and National Governments calculate their Sales Tax. (Local & National Based on Net is the default if there is only a Local Tax charged.) |

| • | Local & National Based on Net - Selected when each category of Sales Tax is calculated on the Net Amount of all Taxable Items within an Invoice. |

| • | Local Based on Net Plus National - Selected when a National Sales Tax is charged on the Gross Amount of an Invoice and then a Local Sales Tax is calculated based on the sum of the Net Amount of all Taxable Items within an Invoice PLUS the amount of the National Sales Tax being charged. |

| • | National Based on Net Plus Local - Selected when there is a National and a Local Sales Tax and the National Sales Tax is charged on the Gross Amount of all Items within an Invoice PLUS the amount of the Local Sales Tax which has been calculated on the Net Amount of the Invoice's Taxable Items. |

| • | Click the Save ("ü") to record the Vendor Tax Information entry. |