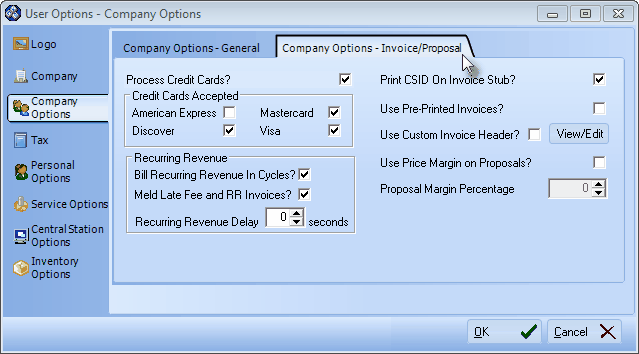

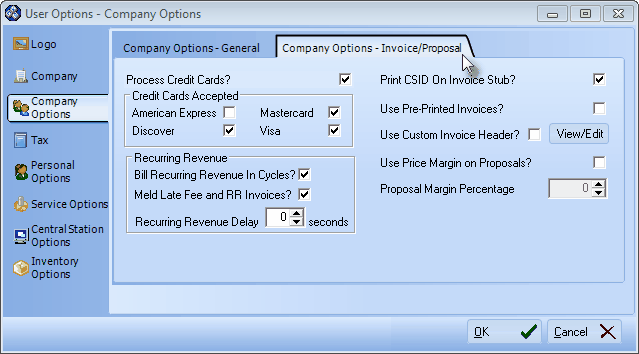

| □ | Company Options - Invoice/Proposal tab |

| • | To access the appropriate User Options, on the Main Menu Select Maintenance, then Choose User Options |

| • | Click the Company Options - Invoice/Proposal tab. |

User Options Form - Company Options - Invoice/Proposal tab

| 1. | Process Credit Cards? - Check the Process Credit Cards box is your Company accepts Credit Cards for Payment of Invoices. |

| • | If you do not accept Credit Cards for Payment of Invoices, do not Check this box. |

| 2. | Credit Cards Accepted - Check the box(es) that represent the Credit Cards that your Company will accept. |

| • | If you do not accept Credit Cards for Payment of Invoices, do not Check any of these boxes. |

| 3. | Recurring Revenue - Set the defaults for certain Recurring Revenue processes: |

| ▪ | For smaller Companies, billing all of your Recurring Revenues for a month will usually be done in one day as a single process. |

| ▪ | However, larger Alarm Companies may find that generating a huge number of Invoices all at once is unmanageable. |

| ▪ | To resolve this problem, MKMS allows you to define any number of Recurring Billing Cycles, and then assign one of those cycles to each Subscriber's Automatic Billing information to identify when (in what Billing Cycle) that Subscriber will be billed. |

| ▪ | Later, as you enter the Recurring Revenue rules for each Subscriber, you will be able to select the specific billing cycle in which that Subscriber is to be billed. |

| o | A specific time within the month when a set of Recurring Revenue charges will be created (e.g., week 1, 2, 3 and 4) |

| o | A special purpose set of Accounts (e.g., those Subscribers automatically paying Recurring Revenue charges with Credit Cards, those Subscribers who represent Multi-location Accounts, those Subscribers paying by E.F.T.) |

| o | Any other designated group of Subscribers - as identified by you - who are to be billed for their Recurring Revenue charges at the same time. |

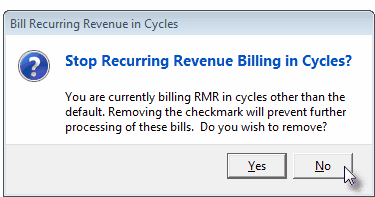

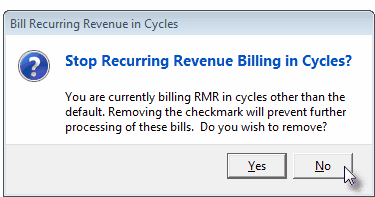

| ► | Note: Once the Bill Recurring Revenue in Cycles feature has been implemented, if the Check is removed from those box, a Warning Message will be displayed and you will be asked to confirm that you do want to stop Cycle Billing. |

Stop Recurring Revenue Billing in Cycles?

| • | Meld Late Fee and RR Invoices? If you plan to bill your Recurring Revenues and Post Late Fees on the same day as most of our Users do, AND you would like both of these charges to appear on the same Invoice, Check this box. |

| • | Recurring Revenue Delay - Note: This option should only be set if your Company is providing Central Station Monitoring for more than 10,000 Accounts. |

| ▪ | If so, contact Micro Key Technical Support for guidance on how to set this option to avoid server performance issues during the Recurring Billing process. |

| ▪ | This Information will be supplied by Technical Support for those needing it. |

| 4. | Other Print Related Options |

| • | Print CSID On Invoice Stub? - Check this box if you want the Subscriber's Primary CSID to be printed on the Remittance stub of their Recurring Revenue Invoice. |

| ► | Note: A Subscriber may have multiple CSIDs assigned to the same Account - and one of the CSIDs must always be designated as the Primary CSID. |

| • | Use Pre-Printed Invoices? - Check this box if you will be using 'Pre-Printed Invoices' for your billing. |

| ► | Note: If this field is Checked, when printing a Statement, if that Statement is being sent via Email, the Name and Address entered in the Company tab of the User Options Form will be used for the return address. |

| • | Use Custom Invoice Header? - Check this box, and Click the View/Edit button, if you are NOT going to use pre-printed Invoice Forms and want to customize the font of the Company's name, address, telephone number, etc. information which is printed as a Company Header on Invoices, Invoice Statements, and regular Statements. |

| ▪ | This Use Custom Invoice Header? option will not be available if the Use Pre-Printed Invoices? option is Checked. |

| ▪ | MKMS will, by default, use the name, address, telephone number, etc. information entered on the Company tab of the User Options Form |

| ▪ | Using this Use Custom Invoice Header? option will override that default Company information. |

| ▪ | View/Edit - When you Check the Use Custom Invoice Header? box, you must then Click the View/Edit button to open a Rich Text Editor dialog to create a Custom Invoice Header. |

| ▪ | Enter the desired name, address, telephone number, etc. information with whatever formatting you deem appropriate. |

| o | Test the result by printing an Invoice. |

| • | Use Price Margin on Proposals? - Check this box to have the Retail Price of Sales-Purchase Items calculated based on a percentage markup. |

| o | Automatically calculated based on a percentage markup of an identified predefined Cost (that you entered in the Sales-Purchase Items Form). |

| o | Automatically calculated based on the Retail Price for that part or service (that you entered in the Sales-Purchase Items Form). |

| • | Proposal Margin Percentage - If you've chosen to have your Proposal's line item pricing automatically calculated based on a percentage markup of a predefined Cost, you must enter enter the mark-up percentage here in the field provided and those Costs in the Sale-Purchase Items Form. |

| ► | Note: The percentage you enter should be a number greater than 1 (and probably greater than 30% or 40%) but it may also be fine-tuned up to two decimal places (e.g., 33.33%, 50.5%), as needed. |