Setting the Rules for the Collections of Sales Taxes

| □ | The Calculation, Management and Reporting of Sales Taxes will be automatic once you've identified your Company's required Sales Tax Assessment Method(s). |

| • | To access the Tax tab on the User Options Form, on the Main Menu Select Maintenance, then Choose User Options |

| ▪ | You must therefore create (in the Sales Tax Classification Form) a Tax Classification Code of "X" with a Tax Rate of 0.00 and a description of "Tax Exempt". |

| ▪ | When a State Sales Tax must be charged, each Subscriber (who is not Tax Exempt) will be assigned a Tax Classification Code and Sales Tax Rate(s) based on that Subscriber's required Sales Tax obligation. |

| • | Each Subscriber may have more than one Sales Tax Rate they must pay (e.g., a Local (e.g., City, County, School District, State, Provincial), and a National Sales Tax. |

| • | If you have one or more Local Sales Taxing Authorities for which you must collect Sales Taxes, complete a Sales Tax Classification Form (as many as required) for each Local (State or Province) Sales Taxing Authority for which you must collect a Sales Tax. |

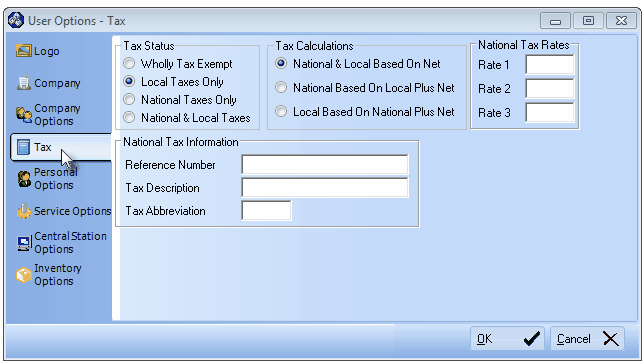

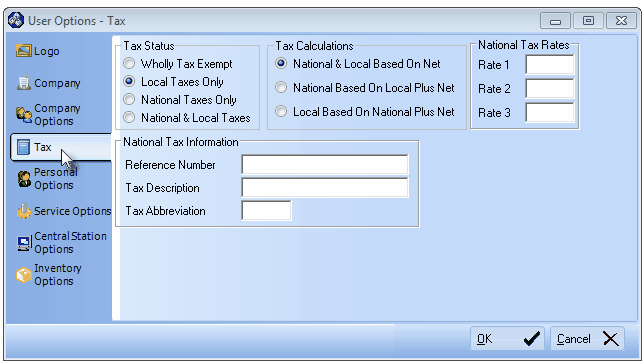

User Options - Tax tab

| a. | Tax Status - Click on the button that represents your Sales Tax obligation(s). |

| ▪ | Wholly Tax Exempt - If there is no Sales Tax charged in the State(s) and Country in which you do business, Click here. |

| ▪ | Local Taxes Only - If there are only a Local (City, County, School District, State or Provincial) Sales Tax, but no National (Federal) Sales Tax - the typical case in the U.S. - Click the Local Taxes Only button and define the Tax Rate(s) in the Sales Tax Classification Form. |

| ▪ | National Taxes Only - If there is only a National Sales Tax, Click this button. |

| ▪ | National & Local Taxes - If there are Local (City, County, School District, State or Provincial) Sales Tax(es), and a National Sales Tax- a typical case in Canada - Click this button. |

| o | Define the National Sales Tax Rates as explained below. |

| b. | Tax Calculations - When there is a National as well as a Local Sales Tax (see National & Local Taxes option above), various Governments may assess Sales Taxes in different ways. To accommodate this, several choices are offered here. Click the appropriate button for how your Local (State or Province) and National Governments calculate their Sales Tax. |

| ▪ | National & Local Based on Net - (The default selection) - National & Local Based on Net is selected when Sales Tax is calculated on the Net Amount of all Taxable Items within an Invoice. This is also the choice if there is no National Sales Tax at all. |

| ▪ | National Based on Local Plus Net - National Based on Local Plus Net is selected when there is a National and a Local Sales Tax and the National Sales Tax is charged on the Gross Amount of all Items within an Invoice PLUS the amount of the Local Sales Tax which has been calculated on the Net Amount of the Invoice's Taxable Items. |

| ▪ | Local Based on National Plus Net - Local Based on National Plus Net is selected when a National Sales Tax is charged on the Gross Amount of an Invoice and then a Local Sales Tax is calculated based on the sum of the Net Amount of all Taxable Items within an Invoice PLUS the amount of the National Sales Tax being charged. |

| c. | National Tax Rates - If different sections of your country are charging different rates, or different products and services are charged at different sales tax percentage rates, you may still select this as your Sales Taxing Method - as long as there are never more than three different percentage rates charged. If you are subject to these multiple National Sales Tax Rates which may vary from Subscriber to Subscriber, enter up to three Tax Rates here. |

| ▪ | Rate 1 - Enter Rate 1 as the regular Sales Tax Percentage Rate normally charged. Enter as a whole number if the Rate is a simple whole number percentage (e.g. 7%, 8%) or followed by a decimal point and the appropriate value if the rate is not an even amount (e.g. 7.25%, 8.375%). |

| ▪ | Rate 2 - If your have multiple Sales Tax Rates based on the type of Part or Service provided, enter those additional rates. Enter as a whole number if the Rate is a simple whole number percentage (e.g. 7%, 8%) or followed by a decimal point and the appropriate value if the rate is not an even amount (e.g. 7.25%, 8.375%). |

| ▪ | Rate 3 - If your have multiple Sales Tax Rates based on the type of Part or Service provided, enter those additional rates. Enter as a whole number if the Rate is a simple whole number percentage (e.g. 7%, 8%) or followed by a decimal point and the appropriate value if the rate is not an even amount (e.g. 7.25%, 8.375%). |

| d. | National Tax Information - Companies that must charge a National Sales Tax, are normally required to have a Tax Account reference number printed on their Invoices along with the "Name" of that tax and it's normal abbreviation. For the typical reporting requirements of a National Sales Tax, enter the information below as required. |

| ▪ | Reference Number - An alpha-numeric field for your National Sales Tax reference number. |

| ▪ | Tax Description - Enter the National Sales Tax's Description as you would want it printed on Invoices and reports (such as "Goods & Services Tax"). |

| ▪ | Tax Abbreviation - Enter an abbreviation for this tax (e.g. GST). |