| □ | L Consistent and Organized approach to a Past Due Accounts Collections process will virtually ensure a much lower rate of past due accounts. |

| • | The best collections scheme performed erratically is worse than none. |

| • | One person, or if a large Company, one supervisor must be "in charge" of the process and accountable for its success. |

| • | The methods outlined below are only a suggestion, an educated one, but a suggestion none the less. |

| I. | Contact Past Due Accounts Regularly |

| • | On Day 1 print the report for Accounts that are 1 to 30 days past due; on Day 2 print for 31 - 60 days past due; and on Day 3 print for 61 - 90 days past due. |

| • | Once each week, review all past 90 days Accounts for submitting them to an outside collections service. |

| • | Making Collection Calls may not be everyone's favorite past time, but regular, staged, follow-up with Subscribers having Past Due Invoices is the most effective method of getting those payments. |

| • | To make this easier, use the Reminders function coupled with the Call button to help manage who should be called (and called back). |

| • | Make clear notes in the Subscriber's Comments section. |

| • | Confirm any payment promise made by a Subscriber with a follow-up letter using the Word Merge feature, and if available an e-mail message. |

| • | Set a new Reminder to check and/or follow-up the conversation or promise to pay. |

| II. | Have a Written Plan that is executed even when the primary person is away on leave. |

| • | On Day 1 print the report for Accounts that are 1 to 30 days past due; on Day 2 print for 31 - 60 days past due; and on Day 3 print for 61 - 90 days past due. |

| • | Once each week, review all past 90 days Accounts for submitting them to an outside collections service. |

| • | Call each Past Due Account listed on the reports and ask for Payment, gently at first than with increasing emphasis if they become more past due. |

| • | Confirm the Call, and particularly any promise to pay, with an E-mail. If no E-mail contact information, send a letter immediately after the contact. |

| • | Record the contact in the Subscribers Comment section. |

| • | Set a Reminder for the proper method and time to recontact the Account. |

| • | Service Requests - When a Subscriber calls for service, be sure that they are referred to the Accounts Receivable Department if they have a past due balance (the Service Department will be reminded automatically when they attempt to enter the Work Order. |

| • | Telephone Contacts - There is no more effective Collections process than a personal telephone call from your Accounts Receivable Department to the Subscriber. |

| • | Ask them their name and if they have received the Invoice - if not - E-mail them a copy immediately. |

| • | Ask if they have a question about this Invoice or if someone else is required to OK the payment. |

| • | Ask when you can expect their payment or a response from the responsible person. |

| • | Based on the results of this Collection Call, set Reminders to alert you to check if they have made the payment as promised, if you received the expected call back, or to schedule a re-call. |

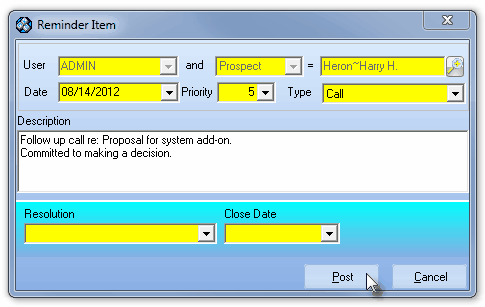

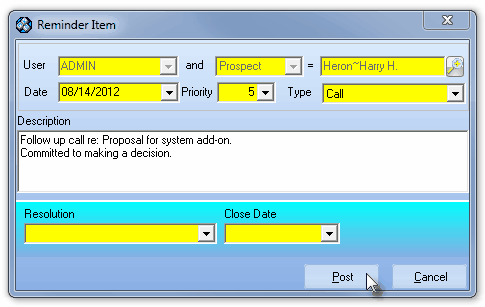

Reminder Item documenting a Collections call Follow-up

| • | Collection Letters - The second most effective Collections process is sending a letter - using the special Word Merge function on the Subscribers Form - to ask for a specific Payment on a specific Invoice. |

| • | E-mail Reminders - The third most effective Collections process is E-mailing the Subscriber to ask for a specific Payment on a specific Invoice by attaching a copy of that Invoice to the E-mail. |

| • | An Invoice may quickly be scanned into a PDF file using almost any all-in-one printer. |

| • | You may also have a Print to a PDF function enabled within your network printers. |

| • | In either case, save that PDF file by its Invoice Number. |

| • | E-mail the Subscriber asking the series of personal telephone call questions outlined above and attaching the scanned Invoice. |

| • | This process may be done multiple times each month for different Late Fee Groups of Subscribers. |

| • | See Assessment of Late Fees below. |

| IV. | Assessment of Late Fees |

| • | For Late Fees to be effective, they must be enforced. |

| • | Generating Late Fee Invoices that are subsequently written off because the Subscriber sends in their payment - eventually - completely undermines the very purpose of assessing late fees. |

| • | Subscribers who pay late affect your cash flow, require more staff time, and so erode the net value of your Sales to them. |

| V. | Consider having the Salesperson contact Subscriber who has not paid for their Installations or any other commission related Sales. |

| • | Then the Salesman can call those who he is still owed commission on, but have not yet received it, because of non-payment. |