| □ | Understanding Accounting Terms and the Various Types of General Ledger related Reports - There are certain terms that, if you understand them, will make starting this General Ledger System much easier: |

| 1. | Account Types - There are five types (Classifications) of General Ledger Accounts which represent the the kinds of Financial Transactions that are posted to them, and so define the values (Balances) they hold (see the "Types of Transaction Accounts" section below). |

| 2. | Chart of Accounts - This is a list of those "Accounts" identified by an Account Name (called its Title), and a Number (the Account Number) that will show the sum total of the dollar values (referred to as the Account's Balance) posted to them. |

| 4. | Trial Balance - This report provides a comparison of the sum of all Debit and Credit Financial Transactions, posted to all of the Debit and Credit Accounts, and so determines whether your General Ledger is, or is not in balance. |

| 5. | Profit & Loss Statement provides a comparison between the posted Revenue and the posted Expenses, reporting the net difference as the Profit (or Loss, if the Expenses are greater than the Revenue). |

| 6. | Balance Sheet - This report provides, on a month by month or annualized basis, the value of the Company's Assets, Liabilities and net Equity. |

| □ | Types of Transaction Accounts - There are five Transaction Types (sometimes referred to as Account Divisions, although Divisions may also have a very different meaning so we use Transaction Types) into which General Ledger Accounts are divided. |

| • | Each Type of Account - which contains its designated set of General Ledger Accounts - is assigned a specific Account Numbering Range, that is pre-determined by the system, based upon generally accepted accounting practices. |

| • | The Type of Account, their Account Numbering Range, and whether they are a Debit or a Credit Account (see the "Understanding Debits & Credits" chapter for detailed information), are listed here: |

| 1. | Asset Accounts 1000 - 1999 - Debit - An Asset Account identifies items that have an actual cash value or can reasonably be converted to cash and are generally sub-divided into these categories: |

| a) | Actual Cash Assets (like real money in a Petty Cash box, and the money in a Bank or Money Market account). |

| b) | Current Assets (things of value that the Company owns or is entitled to) like monies other people or businesses owe your Company (Accounts Receivable) |

| c) | Other Assets such as your Company's Furniture, Computers, Vehicles, Inventory and/or Real Estate. |

| 2. | Liability Accounts 2000 - 2999 - Credit - Each Liability Account identifies some portion of what the Company owes, or in some other manner is obligated to pay to others. |

| a) | Current Liabilities would include Short Term Liabilities such as the Accounts Payable balances owed to Vendors, Inventory Purchases (a temporary holding account for users of the Inventory Tracking System) and things like Payroll Taxes and Credit Card debt that generally must be paid within the current fiscal year. |

| b) | Long Term Liabilities would be items such as amortized business loans and mortgages that are generally repaid over an extended period of years. |

| 3. | Equity Accounts 3000 - 3999 - Credit - The Equity Accounts identify the net value of the business. |

| a) | Start Up Capital records the original investment in the business and any additional Capital that may have been contributed to the company afterwards. |

| b) | Earnings which are the business's Current Earnings for this fiscal year. |

| c) | Retained Earnings which are the business's Earnings - that represent Profits from previous years - that have not yet paid out to Shareholders or Partners. |

| 4. | Revenue Accounts 4000 - 4999 - Credit - This identifies the Revenue (Income) from Sales, Interest earned from savings and other investments, and any other miscellaneous Income. |

| a) | Sales which represent any income (Revenue of almost any type) that is earned by your Company in the normal course of business. |

| b) | Other Income for any other type of income you might receive (Interest Earned, Dividends, abandoned Deposits, etc.) |

| 5. | Expense Accounts 5000 - 9989 - Debit - Purchases made to sustain the business, produce product, complete installations and/or provide services. |

| a) | General Expenses including things like Rent, Utilities, Payroll, Health and other type of Insurance, Shipping, Postage, Office Supplies, Interest for Loans, and Taxes. |

| b) | Cost of Goods Sold includes Inventory which has been used for business purposes, and any associated Adjustments (for "shrink" and/or breakage) |

| c) | Sales related Expenses such as Commissions, Costs for Installations, Service related Expenses, etc. |

| ◆ | The General Ledger Account Numbers 9990 - 9998 are used (internally) by the system and therefore should not be defined by the User. |

| • | A Chart of Accounts is simply a list of those "Accounts" identified by an Account Name (its Title), and a Number (the assigned Account Number) that will "hold" the sum total of the dollar values (referred to as the Account's Balance) posted to them. |

| • | These General Ledger Accounts are separated within the Chart of Accounts by the Type of Transactions which are posted to each of those Accounts (see #1 - #5 in the "Types of Transaction Accounts" section immediately above). |

| • | All of this is done to enable the User to precisely understand the Purpose and Functionality of each General Ledger Account within the Chart of Accounts. |

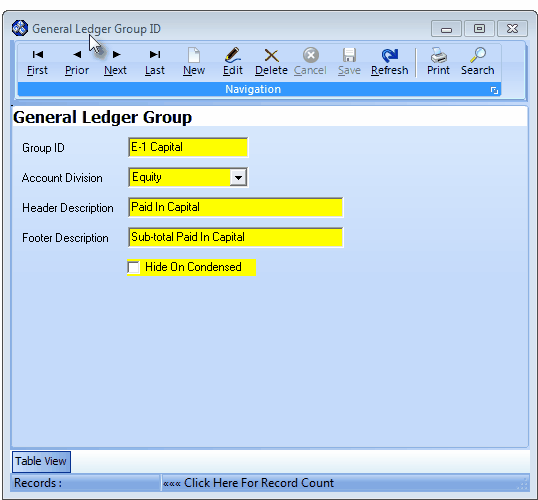

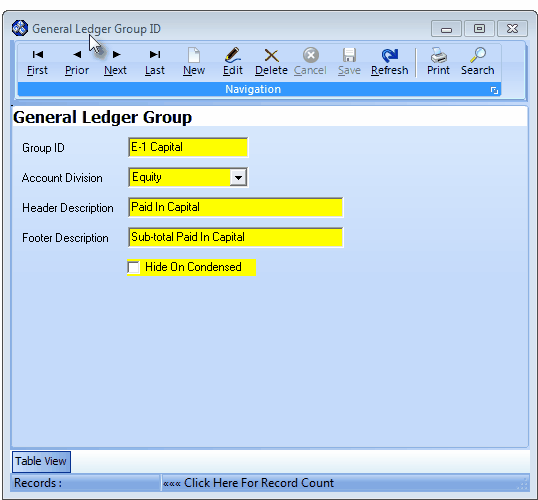

| • | General Ledger Group names (Header Description) will appear as sub-headers - and are shown with their own individual sub-totals - when any Financial Statements are printed or viewed. |

General Ledger Groups Form

| • | Footers for the sub-header (Footer Descriptions) may also be defined and if so, will be inserted next to their associated sub-totals. |

| • | Assigning a Group ID to a specific General Ledger Account ensures that the Account will be grouped with, and will be included in the sub-totals for that Group. |

| • | Optionally, the inclusion of these sub-header Names (and their associated sub-total Names and associated sub-total values) may be determined by the User when reports are printed. |

| • | The Total Values posted to all of the Credit Accounts should equal the Total Values posted to all of the Debit Accounts. |

| • | Because this Trial Balance Report provides a comparison of all of the Debit and Credit transaction entries, which have been posted to all of the Debit and Credit Accounts, it will report whether or not the General Ledger is currently "in balance". |

| □ | Profit & Loss Statement (sometimes referred to as an Income Statement) calculates the Net Profit (Loss) for a designated accounting period. |

| • | It produces a list of the Revenue Accounts with a subtotal, followed by the Expense Accounts with a subtotal, and the net difference between them (if the Revenues are greater than the Expenses, there is a Profit, otherwise there is a Loss). |

| • | This Income Statement is based on a Date Range (usually a selected month or year) and may be produced for a specific accounting period, for a specified Department, and with, or without Graphs or Charts. |

| □ | Balance Sheet lists the balance of each Asset Account with a subtotal, then the balance of each Liability Account with a subtotal, and (what is actually) the net difference between them - which is the Company's (Stockholders') Equity. |

| • | That difference is divided among the Equity Accounts based on why that Equity (from a Profit, Capital invested in the Company, Additional Paid in Capital, etc.) Account has been defined. |

| • | This feature, initially used to establish the starting balances, is most commonly used to post Payroll from an outside service (or separate software application) and is required for making special end-of-period entries. |

| • | It may be used make the adjustment entries required by the Company's Accountant. |