| □ | An Electronic Funds Transfer (EFT) provides an easier method for your Subscribers to pay, and for you to get paid. |

| • | It saves everyone money and time. |

| • | It's cost is nominal for both your Subscriber and your Company. |

| • | Once it is setup, the process is virtually automatic. |

| • | The steps outlined below are meant to provide a quick overview, to give you some general directions. |

| • | Each step is explained in detail elsewhere in the related Help File Chapter Links. |

| □ | The Electronic Funds Transfer Process is setup and executed as follows: |

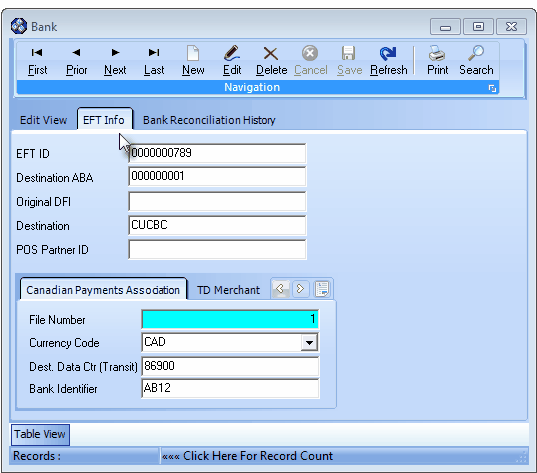

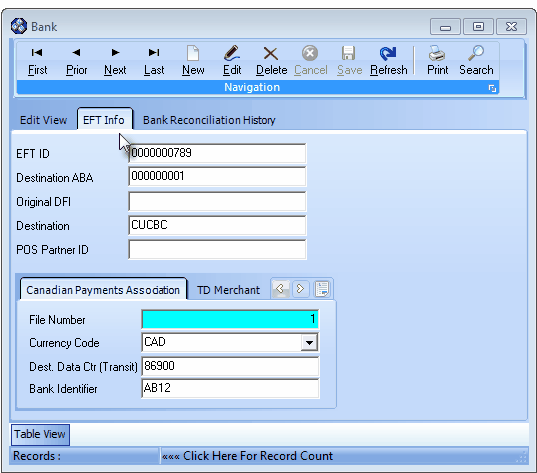

| • | In Bank Maintenance, create a record for the Bank (or other EFT Processing Services) and define the required EFT Information. |

Bank Form - EFT Info tab

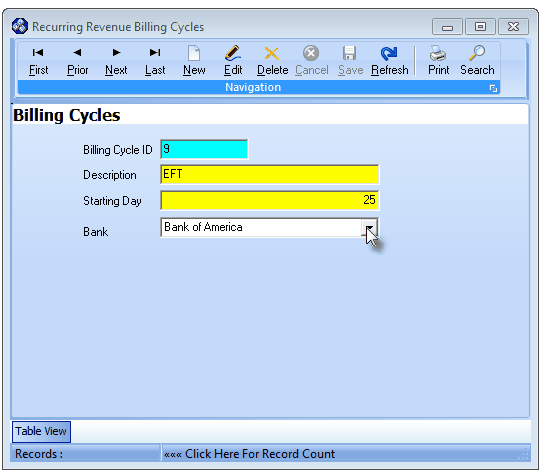

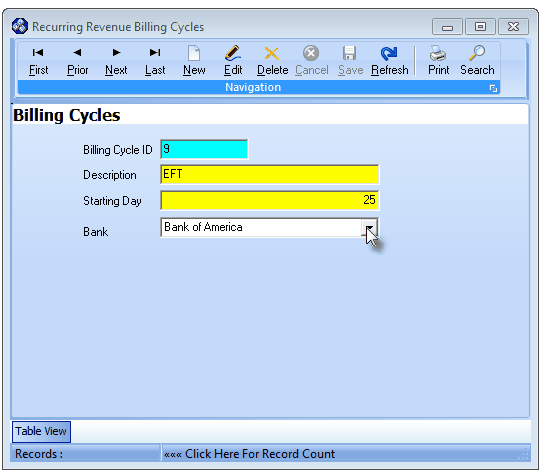

| • | Create at least one Billing Cycle for EFT (Electronics Funds Transfer) processing. |

| • | If you use more than one EFT processor, create a separate Billing Cycle for each. |

| • | Assign the Bank that has the associated EFT Information defined, to the Billing Cycle definition. |

Billing Cycles Form - E.F.T. Billing Cycle - Bank assigned

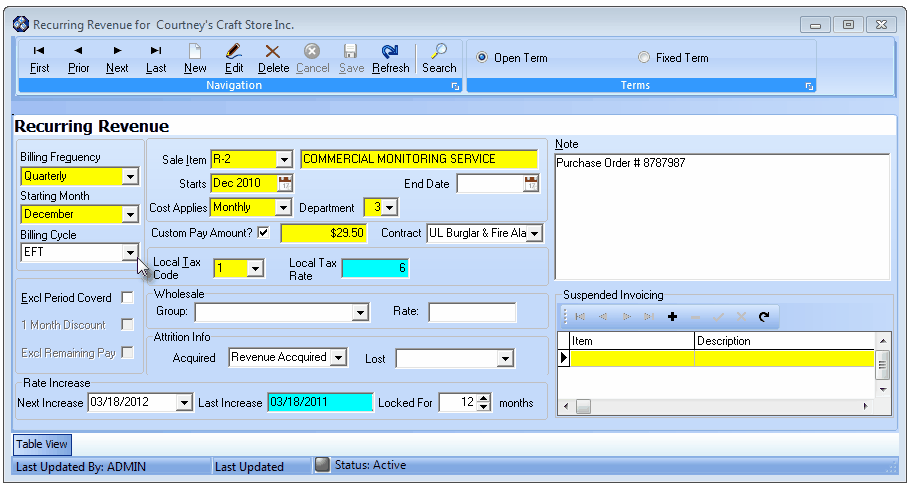

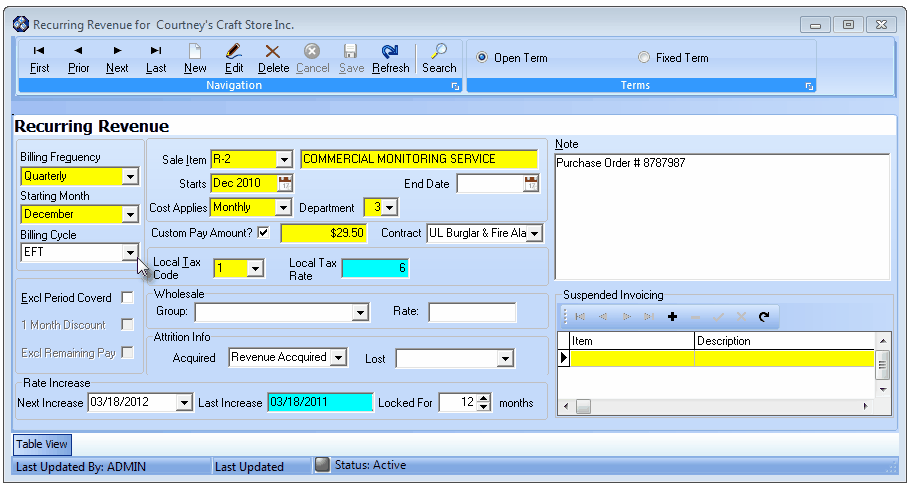

Recurring Revenue Form - With an EFT Billing Cycle assigned

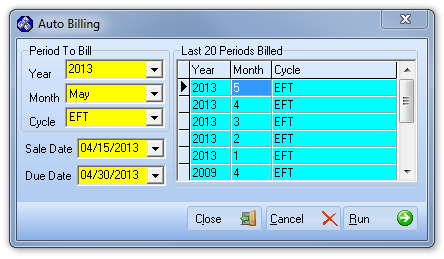

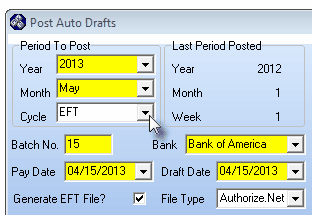

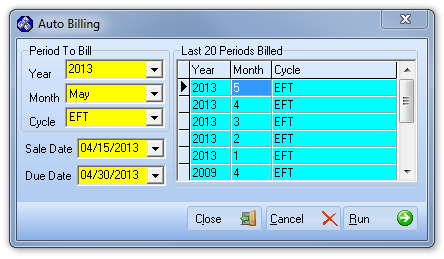

Run the Auto Billing process for EFT Accounts

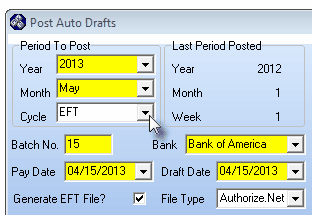

| • | The correct Bank name (which has the associated EFT information) should be inserted automatically. |

| • | Check Generate EFT File? box. |

Post EFT Auto Drafts dialog

| • | The file to be transmitted is created automatically using the name you will be asked to specify. |

| • | Transmit this file to the Bank in the manner they require. |

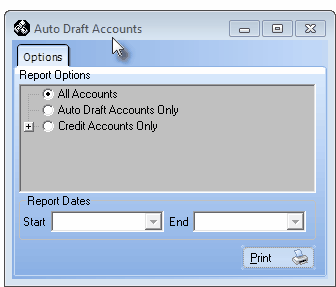

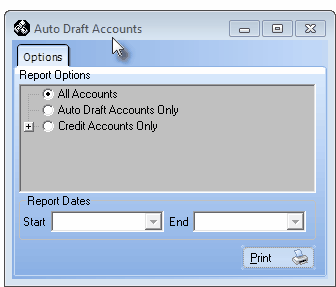

| □ | Periodically, print and review the Auto Draft Accounts Report to ensure the information is up to date, particularly checking each Credit Card's Expiration Dates. |

Auto Draft Accounts Report dialog